Answered step by step

Verified Expert Solution

Question

1 Approved Answer

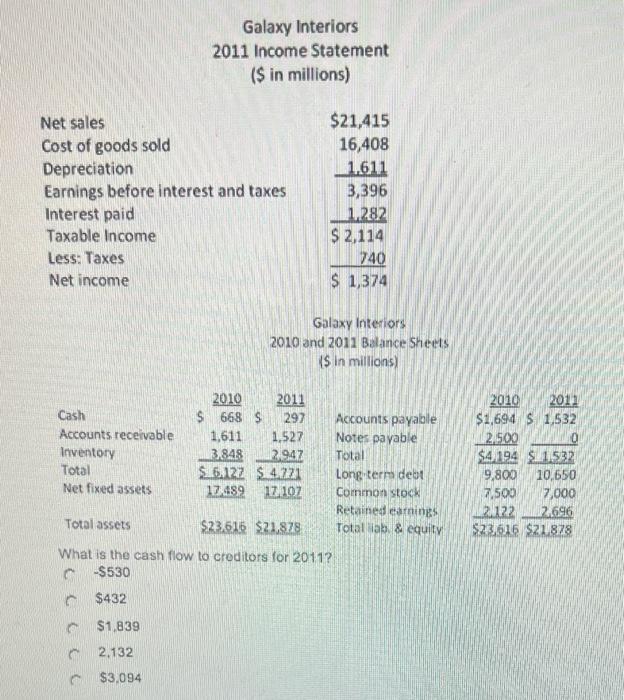

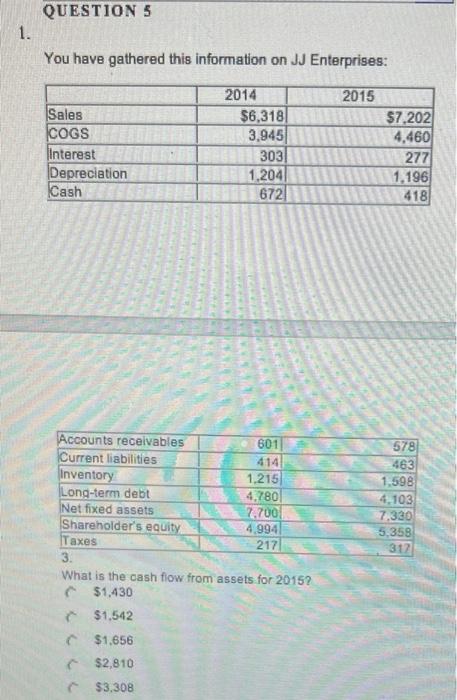

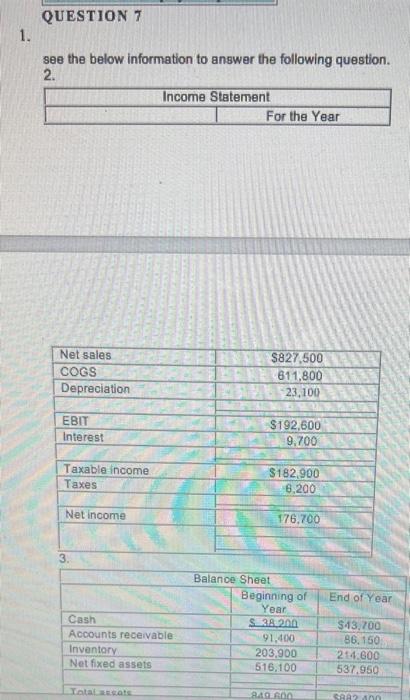

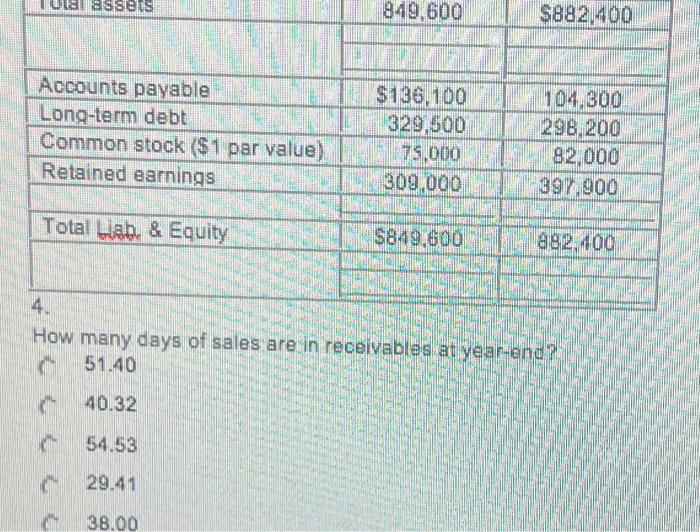

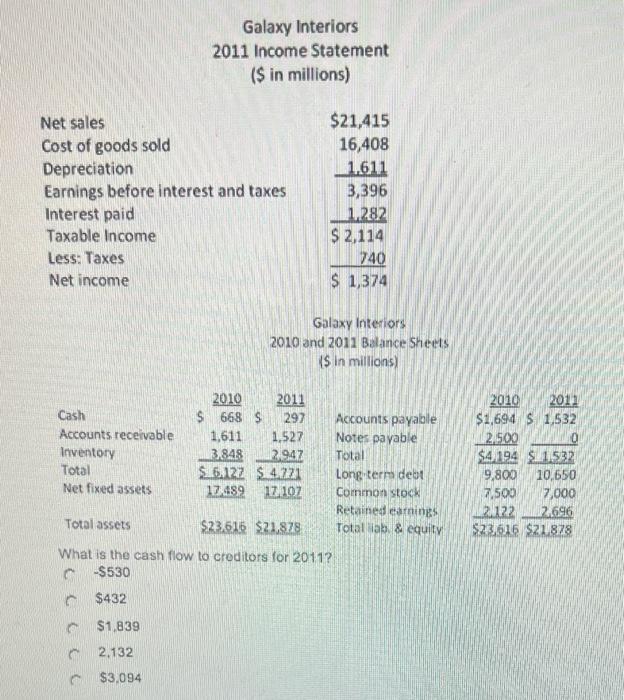

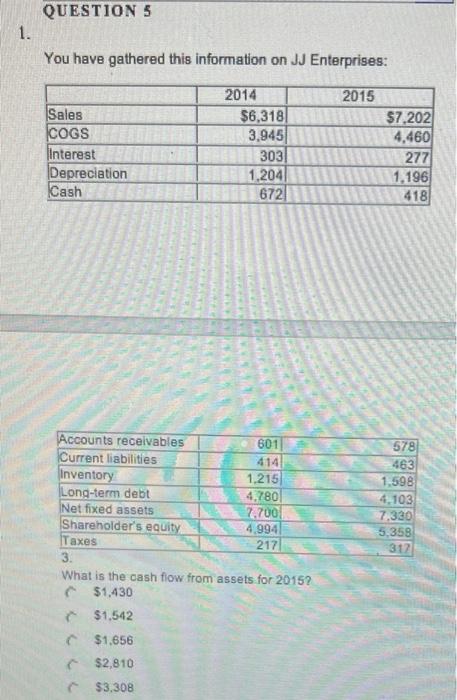

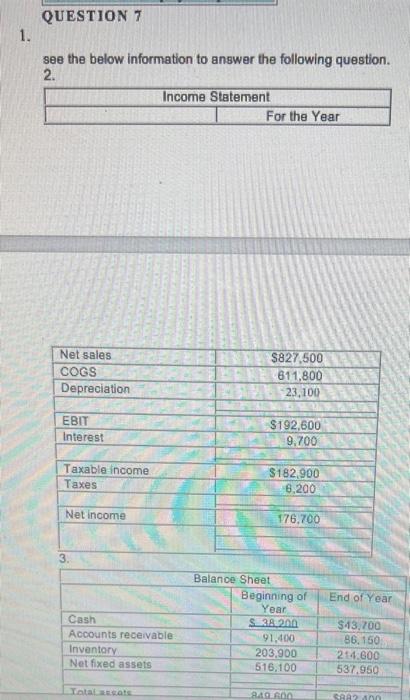

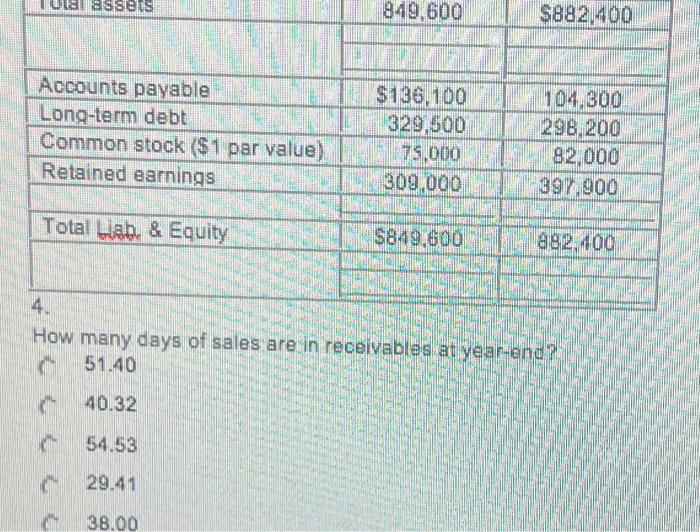

Please explain clearly how to solve these problems, and NOT with excel. Galaxy Interiors 2011 Income Statement ($ in millions) Net sales Cost of goods

Please explain clearly how to solve these problems, and NOT with excel.

Galaxy Interiors 2011 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Less: Taxes Net income $21,415 16,408 1,611 3,396 1.282 $ 2,114 740 $ 1,374 Galaxy Interiors 2010 and 2011 Balance Sheets (S in millions) 2010 2011 Cash $ 668 S 297 Accounts payable Accounts receivable 1,611 1,527 Notes payable Inventory 3.848 2942 Total Total $ 6.122 S 4221 Long-term debt Net fixed assets 17.489 17102 Common stock Retained earnings Total assets $23616 $21,878 Total Tab & equity What is the cash flow to creditors for 2011? -$530 $432 2010 2011 $1,694 S 1,532 2.500 0 $4,194 1.532 9,800 10.550 7,500 7,000 21122 2696 $23,616 $21,878 $1,839 2,132 $3,094 QUESTIONS 1. You have gathered this information on JJ Enterprises: 2015 Sales COGS Interest Depreciation Cash 2014 $6,318 3.945 303 1,2041 672 $7,202 4,460 277 1.196 418 578 463 1,598 4.103 7,320 5,358 317 Accounts receivables 601 Current liabilities 414 Inventory 1.215 Long-term debt 4,780 Net fixed assets 7.700 Shareholder's equity 4.994 Taxes 217 3. What is the cash flow from assets for 2015? $1.430 $1,542 $1.656 $2,810 $3,308 QUESTION 7 1. see the below information to answer the following question. 2. Income Statement For the Year Net sales COGS Depreciation $827,500 611,800 23,100 EBIT Interest S192,600 9,700 Taxable income Taxes S182.900 6.200 Net income 176.700 3. End of Year Cash Accounts receivable Inventory Not fixed assets Balance Sheet Beginning of Year S 38.200 91,400 203,900 516,100 $13,700 86,150 24.600 537.950 Total areats BARDO SAA 2 ann Il assets 849,600 $882,400 Accounts payable Long-term debt Common stock ($1 par value) Retained earnings $ 136,100 329,500 79,000 309,000 104.300 298,200 82,000 397.900 Total Lab & Equity S849,600 882,400 4. How many days of sales are in receivables at year-end? 51.40 40.32 54.53 29.41 38.00 Galaxy Interiors 2011 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Less: Taxes Net income $21,415 16,408 1,611 3,396 1.282 $ 2,114 740 $ 1,374 Galaxy Interiors 2010 and 2011 Balance Sheets (S in millions) 2010 2011 Cash $ 668 S 297 Accounts payable Accounts receivable 1,611 1,527 Notes payable Inventory 3.848 2942 Total Total $ 6.122 S 4221 Long-term debt Net fixed assets 17.489 17102 Common stock Retained earnings Total assets $23616 $21,878 Total Tab & equity What is the cash flow to creditors for 2011? -$530 $432 2010 2011 $1,694 S 1,532 2.500 0 $4,194 1.532 9,800 10.550 7,500 7,000 21122 2696 $23,616 $21,878 $1,839 2,132 $3,094 QUESTIONS 1. You have gathered this information on JJ Enterprises: 2015 Sales COGS Interest Depreciation Cash 2014 $6,318 3.945 303 1,2041 672 $7,202 4,460 277 1.196 418 578 463 1,598 4.103 7,320 5,358 317 Accounts receivables 601 Current liabilities 414 Inventory 1.215 Long-term debt 4,780 Net fixed assets 7.700 Shareholder's equity 4.994 Taxes 217 3. What is the cash flow from assets for 2015? $1.430 $1,542 $1.656 $2,810 $3,308 QUESTION 7 1. see the below information to answer the following question. 2. Income Statement For the Year Net sales COGS Depreciation $827,500 611,800 23,100 EBIT Interest S192,600 9,700 Taxable income Taxes S182.900 6.200 Net income 176.700 3. End of Year Cash Accounts receivable Inventory Not fixed assets Balance Sheet Beginning of Year S 38.200 91,400 203,900 516,100 $13,700 86,150 24.600 537.950 Total areats BARDO SAA 2 ann Il assets 849,600 $882,400 Accounts payable Long-term debt Common stock ($1 par value) Retained earnings $ 136,100 329,500 79,000 309,000 104.300 298,200 82,000 397.900 Total Lab & Equity S849,600 882,400 4. How many days of sales are in receivables at year-end? 51.40 40.32 54.53 29.41 38.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started