Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain clearly. Thank you so much!! QUESTION 6 There is an economy that has only three assets: equity (E), bond (B) and real-estate (R).

Please explain clearly. Thank you so much!!

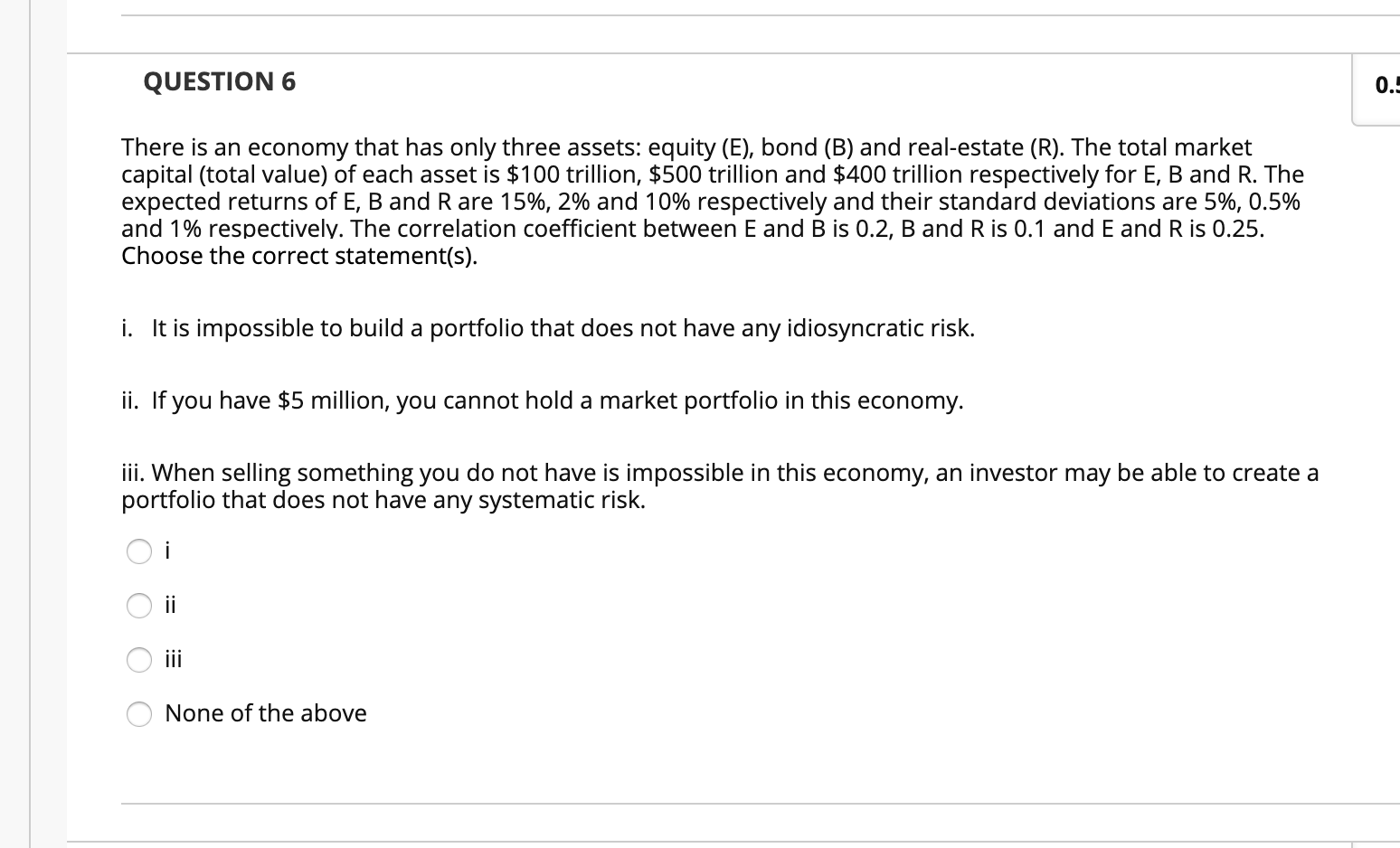

QUESTION 6 There is an economy that has only three assets: equity (E), bond (B) and real-estate (R). The total market capital (total value) of each asset is $100 trillion, $500 trillion and $400 trillion respectively for E, B and R. The expected returns of E, B and Rare 15%, 2% and 10% respectively and their standard deviations are 5%, 0.5% and 1% respectively. The correlation coefficient between E and B is 0.2, B and R is 0.1 and E and R is 0.25. Choose the correct statement(s). i. It is impossible to build a portfolio that does not have any idiosyncratic risk. ii. If you have $5 million, you cannot hold a market portfolio in this economy. iii. When selling something you do not have is impossible in this economy, an investor may be able to create a portfolio that does not have any systematic risk. O i Oiii O None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started