Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain computations on ROA. I do not get the same answers as the solution in the bottom Please explain computations on ROA. I do

Please explain computations on ROA. I do not get the same answers as the solution in the bottom

Please explain computations on ROA. I do not get the same answers as the solution in the bottom!

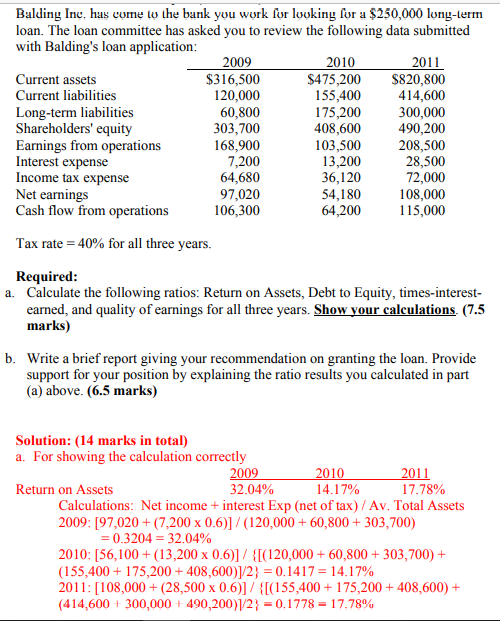

Balding Inc. has come to the bank you work for looking for a $250,000 long-term loan. The loan committee has asked you to review the following data submitted with Balding's loan application: 2009 2010 2011 Current assets $316,500 $475,200 $820,800 Current liabilities 120,000 155,400 414,600 Long-term liabilities 60,800 175,200 300,000 Shareholders' equity 303,700 408,600 490,200 Earnings from operations 168,900 103,500 208,500 Interest expense 7,200 13,200 28,500 Income tax expense 64,680 36,120 72,000 Net earnings 97,020 54,180 108,000 Cash flow from operations 106,300 64,200 115,000 Tax rate = 40% for all three years. Required: a. Calculate the following ratios: Return on Assets, Debt to Equity, times-interest- earned, and quality of earnings for all three years. Show your calculations. (7.5 marks) b. Write a brief report giving your recommendation on granting the loan. Provide support for your position by explaining the ratio results you calculated in part (a) above. (6.5 marks) 2009 Solution: (14 marks in total) a. For showing the calculation correctly 2010 2011 Return on Assets 32.04% 14.17% 17.78% Calculations: Net income + interest Exp (net of tax) / Av. Total Assets 2009: [97,020 + (7,200 x 0.6)]/(120,000 + 60,800 + 303,700) = 0.3204 = 32.04% 2010: [56,100 + (13,200 x 0.6)]/{[(120,000 + 60,800 + 303,700) + (155,400 + 175,200 + 408,600)}2} = 0.1417 = 14.17% 2011: [108,000 + (28,500 x 0.6)]/{[(155,400 + 175,200 + 408,600) + (414,600 + 300,000 + 490,200)/2) = 0.1778 = 17.78%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started