Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Explain Financial ratios: Financial leverage. The financial statements for Tyler Toys, Inc. are shown in the popup window: . Calculate the debt ratio, times

Please Explain

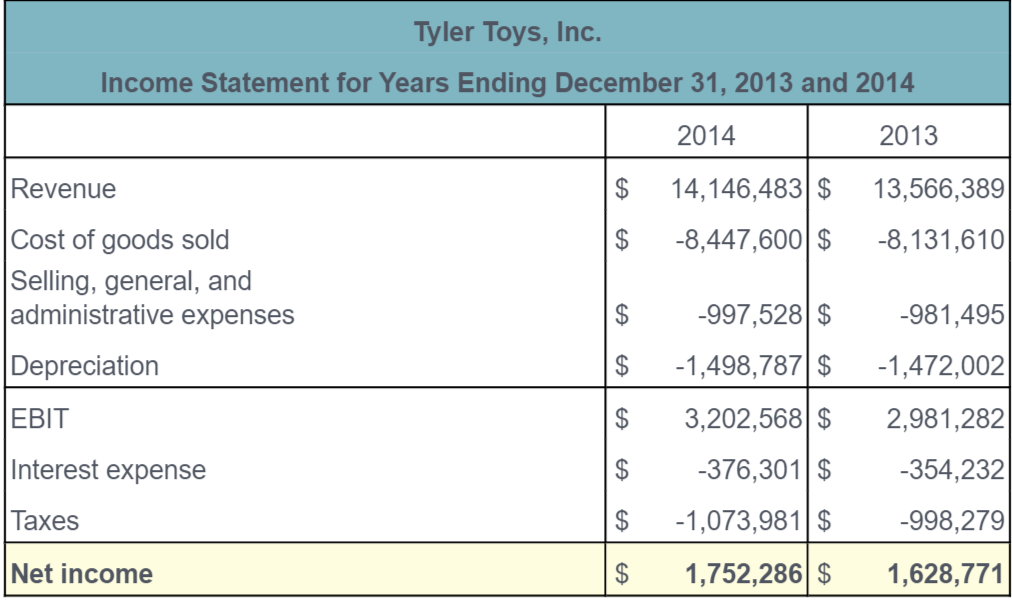

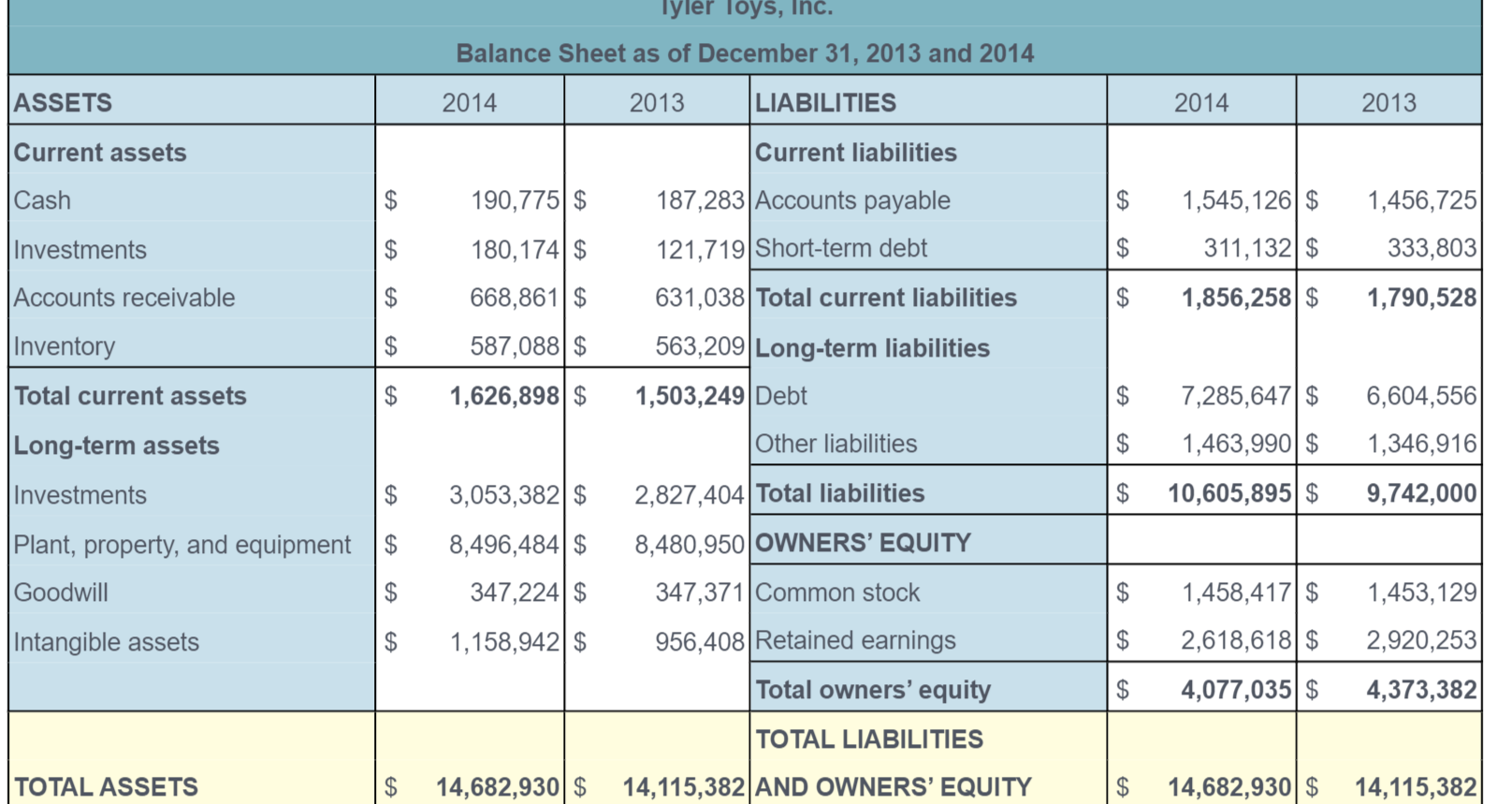

Financial ratios: Financial leverage. The financial statements for Tyler Toys, Inc. are shown in the popup window: . Calculate the debt ratio, times interest earned ratio, and cash coverage ratio for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 \begin{tabular}{|l|lr|lr|} \hline & \multicolumn{1}{|c|}{2014} & \multicolumn{2}{c|}{2013} \\ \hline Revenue & $ & 14,146,483 & $ & 13,566,389 \\ Cost of goods sold & $ & 8,447,600 & $ & 8,131,610 \\ Selling, general, and \\ administrative expenses & $ & 997,528 & $ & 981,495 \\ Depreciation & $ & 1,498,787 & $ & 1,472,002 \\ \hline EBIT & $ & 3,202,568 & $ & 2,981,282 \\ Interest expense & $ & 376,301 & $ & 354,232 \\ Taxes & $ & 1,073,981 & $ & 998,279 \\ \hline Net income & $ & 1,752,286 & $ & 1,628,771 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started