Question

Download the Vita-Joy Exercise spreadsheet below Download the Vita-Joy Exercise spreadsheet and use it to complete the following scenario: You are the product manager for

Download the Vita-Joy Exercise spreadsheet below Download the Vita-Joy Exercise spreadsheet and use it to complete the following scenario:

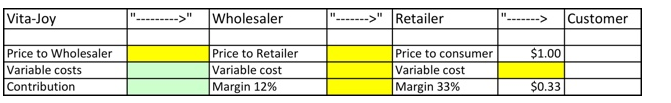

You are the product manager for Vita-Joy, a consumer product with a retail price of $1.00. Retail margins on the product are 33%, while wholesalers take a 12% margin. Using the indicated supply chain, fill in the yellow boxes with dollar amounts. (Hint: Variable costs at one link of the chain become the price at a previous link in the chain. Begin your Vita-Joy calculations with the customer and move backwards; do not start with the company and move forward).

Variable manufacturing costs for Vita-Joy are $0.09 per unit. Fixed manufacturing costs are $900,000. The advertising budget for Vita-Joy is $500,000. Your salary and expenses total $35,000. Salespeople are paid entirely by a 10% commission. Shipping costs, breakage, insurance, and so forth are $0.02 per unit.

Now answer the following:

- By filling in the yellow and green boxes, determine the contribution per unit for Vita-Joy.

- What is Vita-Joys breakeven point?

Some Hints:

- The variable cost for the retailer is the wholesaler's price to the retailer.

- The wholesaler margin of 33% is applied to the wholesaler price. The wholesaler variable cost can then be calculated.

- Similarly the variable cost for the wholesaler is the Vita-joy price to the wholesaler.

- Vita-Joy Commissions are 10% of the Price to the wholesaler.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started