Answered step by step

Verified Expert Solution

Question

1 Approved Answer

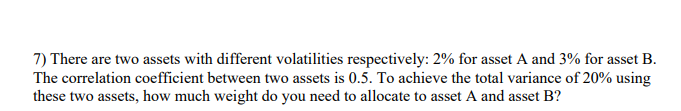

please explain formula and concepts 7) There are two assets with different volatilities respectively: 2% for asset A and 3% for asset B. The correlation

please explain formula and concepts

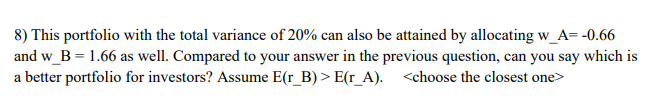

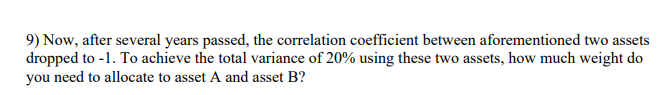

7) There are two assets with different volatilities respectively: 2% for asset A and 3% for asset B. The correlation coefficient between two assets is 0.5 . To achieve the total variance of 20% using these two assets, how much weight do you need to allocate to asset A and asset B? 8) This portfolio with the total variance of 20% can also be attained by allocating w_A A=0.66 and w_B =1.66 as well. Compared to your answer in the previous question, can you say which is a better portfolio for investors? Assume E(r_B) >E(rA). 9) Now, after several years passed, the correlation coefficient between aforementioned two assets dropped to -1 . To achieve the total variance of 20% using these two assets, how much weight do you need to allocate to asset A and asset BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started