Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain. (Highlighted answers are correct) 35. Koon Corporation has the following stock outstanding: 5% Preferred, $100 Par Common Stock, $50 Par $1,200,000 2,000,000 No

Please explain.

(Highlighted answers are correct)

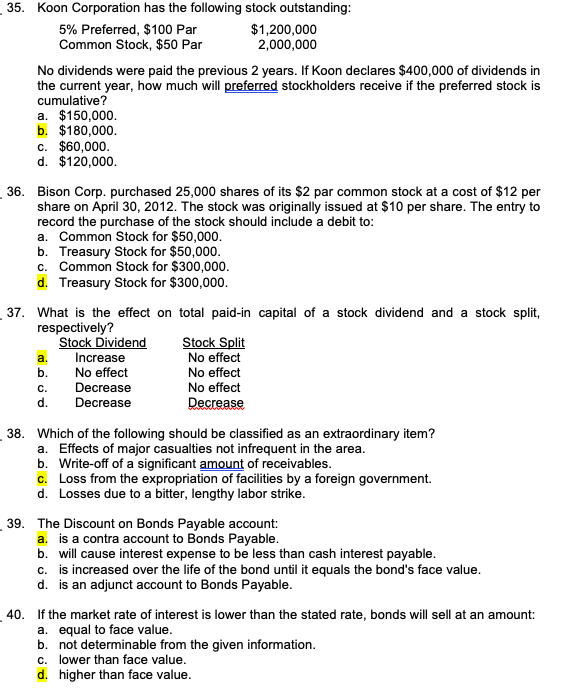

35. Koon Corporation has the following stock outstanding: 5% Preferred, $100 Par Common Stock, $50 Par $1,200,000 2,000,000 No dividends were paid the previous 2 years. If Koon declares $400,000 of dividends in the current year, how much will preferred stockholders receive if the preferred stock is cumulative? $150,000 b. $180,000 c. $60,000 d. $120,000 a. 36. Bison Corp. purchased 25,000 shares of its $2 par common stock at a cost of $12 per share on April 30, 2012. The stock was originally issued at $10 per share. The entry to record the purchase of the stock should include a debit to: a. Common Stock for $50,000. b. Treasury Stock for $50,000 c. Common Stock for $300,000 d. Treasury Stock for $300,000. 37 What is the effect on total paid-in capital of stock dividend and a stock split, a respectively? Stock Dividend Increase No effect Decrease Decrease Stock Split No effect No effect No effect Decrease a. b. C. d. Which of the following should be classified as an Effects of major casualties not infrequent in the area. b. Write-off of a significant amount of receivables. c. Loss from the expropriation of facilities by a foreign government. d. Losses due to a bitter, lengthy labor strike extraordinary item? a. The Discount on Bonds Payable account a. is a contra account to Bonds Payable. b. will cause interest expense to be less than cash interest payable. is increased over the life of the bond until it equals the bond's face value d. is an adjunct account to Bonds Payable. 39. c. If the market rate of interest is lower than the stated rate, bonds will sell at an amount a. equal to face value b. not determinable from the given information lower than face value. d. 40, C. higher than face value. 38Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started