Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain how I get the correct amount for the 2018 section I've tried everything and I cannot figure it out. Take me to the

Please explain how I get the correct amount for the 2018 section I've tried everything and I cannot figure it out.

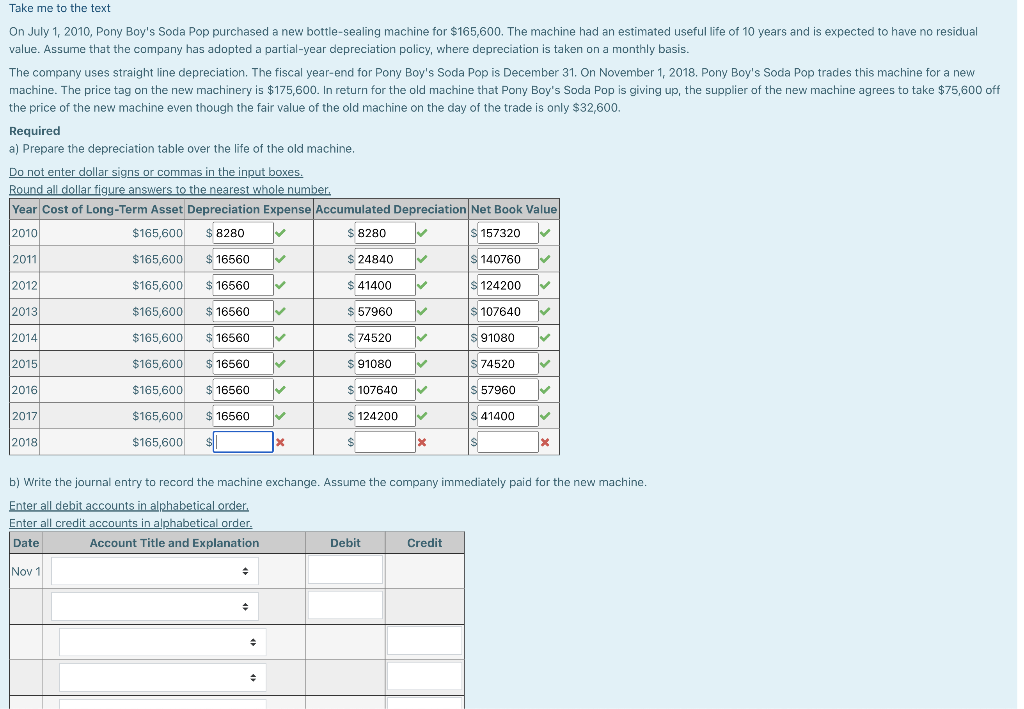

Take me to the text On July 1, 2010, Pony Boy's Soda Pop purchased a new bottle-sealing machine for $165,600. The machine had an estimated useful life of 10 years and is expected to have no residual value. Assume that the company has adopted a partial-year depreciation policy, where depreciation is taken on a monthly basis. The company uses straight line depreciation. The fiscal year-end for Pony Boy's Soda Pop is December 31. On November 1, 2018. Pony Boy's Soda Pop trades this machine for a new machine. The price tag on the new machinery is $175,600. In return for the old machine that Pony Boy's Soda Pop is giving up, the supplier of the new machine agrees to take $75,600 off the price of the new machine even though the fair value of the old machine on the day of the trade is only $32,600. Required a) Prepare the depreciation table over the life of the old machine. Do not enter dollar signs or commas in the input boxes. Round all dollar figure answers to the nearest whole number, Year Cost of Long-Term Asset Depreciation Expense Accumulated Depreciation Net Book Value 2010 $165,600 $ 8280 $ 8280 S 157320 2011 $165,600 $ 16560 $ 24840 S 140760 2012 $165,600 $ 16560 $ 41400 S 124200 2013 $165,600 $ 16560 $ 57960 $ 107640 2014 $165,600 $ 16560 $ 74520 S 91080 2015 $165,600 $ 16560 $ 91080 S 74520 2016 $165,600 $ 16560 $ 107640 S 57960 2017 $165,600 $ 16560 $ 124200 $ 41400 2018 $165,600 X X X b) Write the journal entry to record the machine exchange. Assume the company immediately paid for the new machine. Enter all debit accounts in alphabetical order. . Enter all credit accounts in alphabetical order. Date Account Title and Explanation Debit Credit Nov 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started