Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain how the after tax salvage from the asset being sold at $5 instead is $5.96 please show work for a better understanding, thank

Please explain how the after tax salvage from the asset being sold at $5 instead is $5.96 please show work for a better understanding, thank you

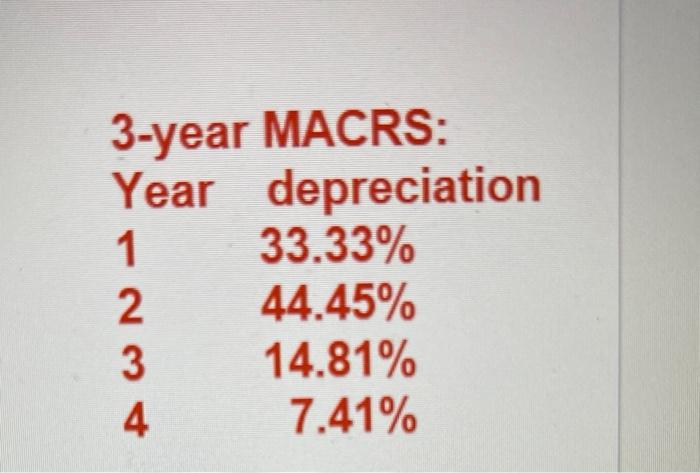

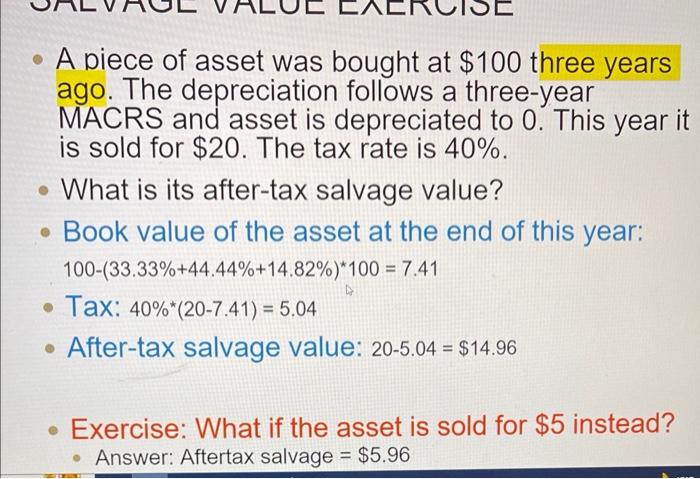

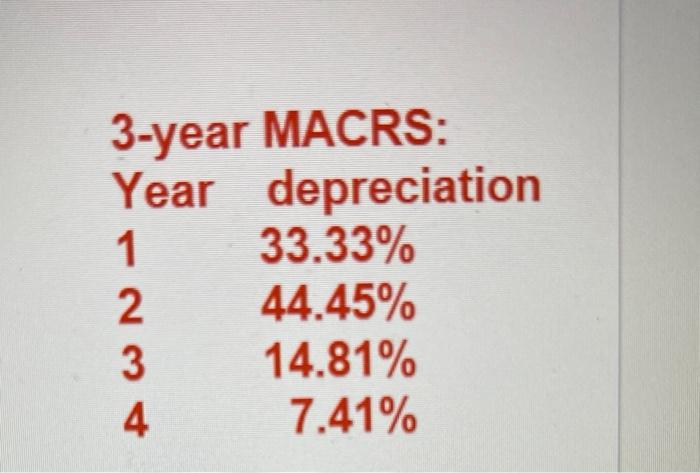

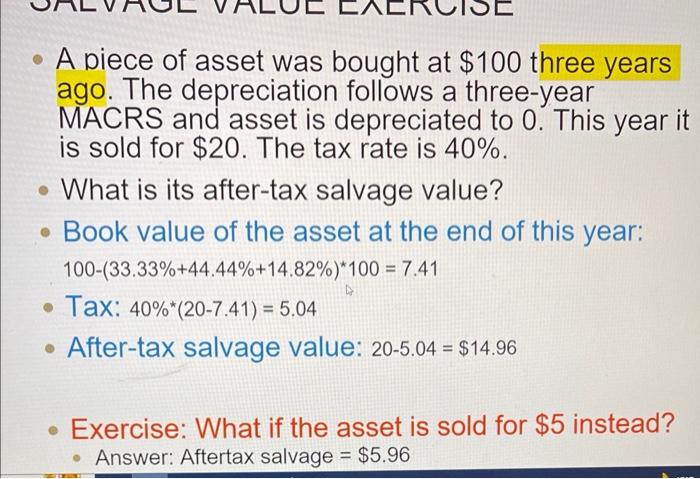

3-year MACRS: Year depreciation 123433.33%44.45%14.81%7.41% A piece of asset was bought at $100 three years ago. The depreciation follows a three-year MACRS and asset is depreciated to 0 . This year it is sold for $20. The tax rate is 40%. - What is its after-tax salvage value? Book value of the asset at the end of this year: 100(33.33%+44.44%+14.82%)100=7.41 Tax: 40%(207.41)=5.04 After-tax salvage value: 205.04=$14.96 Exercise: What if the asset is sold for $5 instead? - Answer: Aftertax salvage =$5.96

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started