Answered step by step

Verified Expert Solution

Question

1 Approved Answer

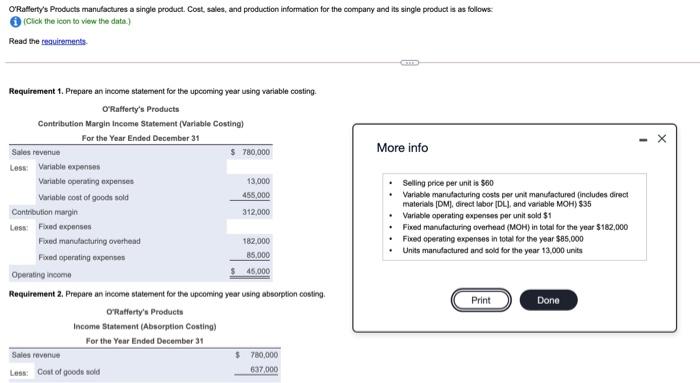

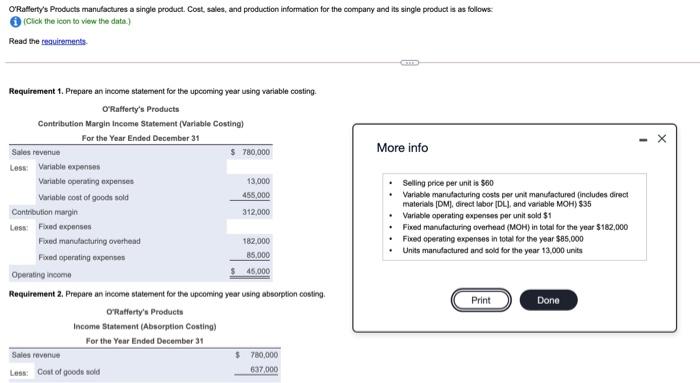

please explain how the last two boxes at the bottom were calculated. (98,000 & 45,000) O'Rafferty's Products manufactures a single product. Cost, sales, and production

please explain how the last two boxes at the bottom were calculated. (98,000 & 45,000)

O'Rafferty's Products manufactures a single product. Cost, sales, and production information for the company and its single product is as follows (Click the icon to view the data) Read the requirements - X More info Requirement 1. Prepare an income statement for the upcoming year using variable costing O'Rafferty's Products Contribution Margin Income Statement (Variable Costing) For the Year Ended December 31 Sales revenue $ 780,000 Less Variable expenses Variable operating expenses 13,000 Variable cost of goods sold 455,000 Contribution margin 312,000 Less Foed expenses Fixed manufacturing overhead 182,000 Foed operating expenses 35.000 Operating income $ 45,000 Requirement 2. Prepare an income statement for the upcoming year using absorption costing O'Rafferty's Products Income Statement (Absorption Conting) For the Year inded December 31 Sales revenue $ 780,000 Less: Cost of goods sold 637,000 Selling price per unit is 560 Variable manufacturing costs per unit manufactured includes direct materials (DM), direct labor (DL), and variable MOH) $35 Variable operating expenses per unit sold $1 Fived manufacturing overhead (MOH) in total for the year $182,000 Fixed operating expenses in total for the year $85,000 Units manufactured and sold for the year 13.000 units Print Done Print Done For the Year Ended December 31 Sales revenue Less: Cost of goods sold Gross profit Less: Operating expenses Operating income $ 780,000 837,000 143,000 98,000 45,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started