Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain how to calculate q4-5 The following information relates to Questions 110 Samuel & Sons is a fixed-income specialty firm that offers advisory services

please explain how to calculate q4-5

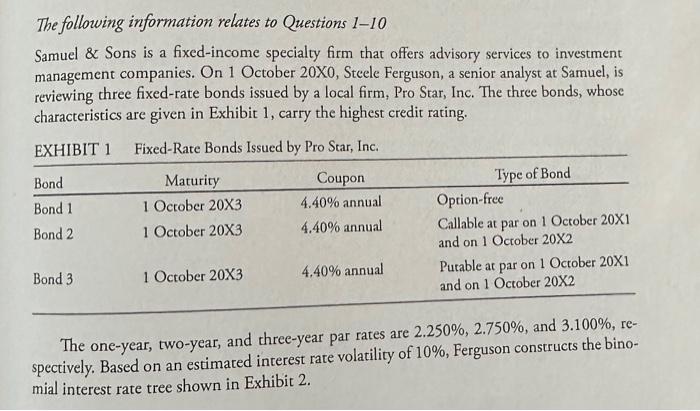

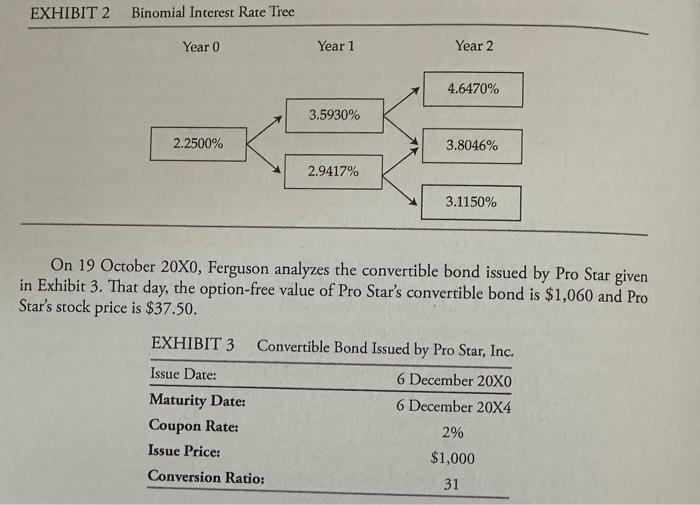

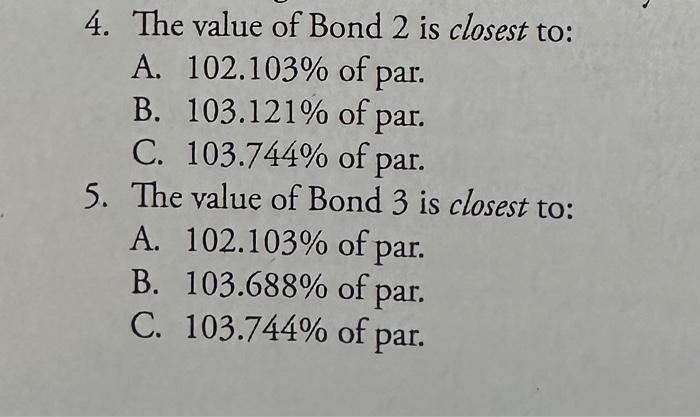

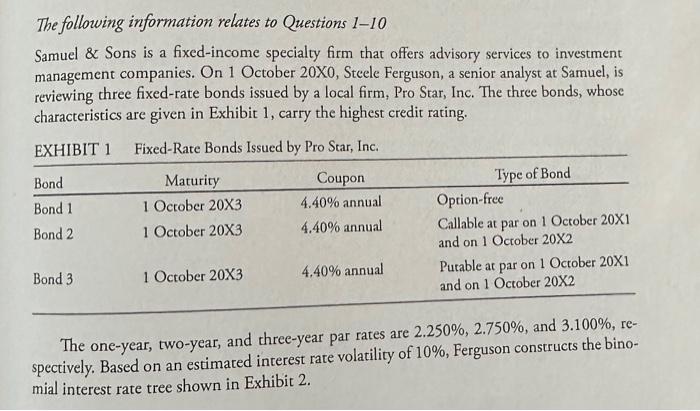

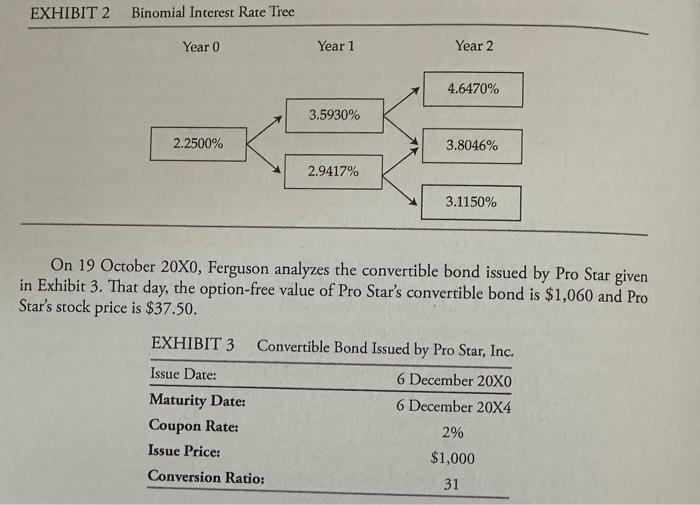

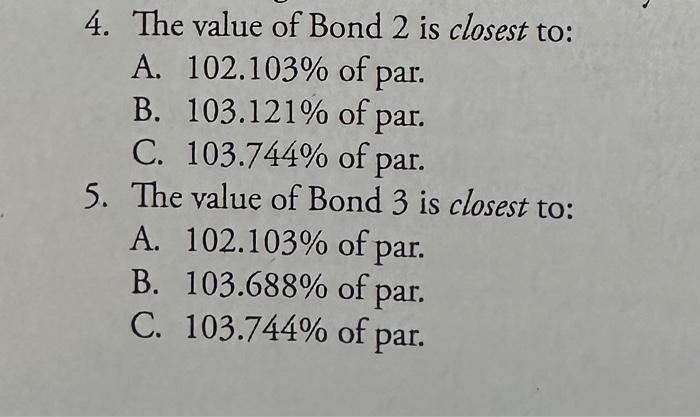

The following information relates to Questions 110 Samuel \& Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating. EVIIRTT 1 Fived-Rare Rnnds Issued bv Pro Star. Inc. The one-year, two-year, and three-year par rates are 2.250%,2.750%, and 3.100%, respectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the binomial interest rate tree shown in Exhibit 2. On 19 October 20X0, Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50. 4. The value of Bond 2 is closest to: A. 102.103% of par. B. 103.121% of par. C. 103.744% of par. 5. The value of Bond 3 is closest to: A. 102.103% of par. B. 103.688% of par. C. 103.744% of par. The following information relates to Questions 110 Samuel \& Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating. EVIIRTT 1 Fived-Rare Rnnds Issued bv Pro Star. Inc. The one-year, two-year, and three-year par rates are 2.250%,2.750%, and 3.100%, respectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the binomial interest rate tree shown in Exhibit 2. On 19 October 20X0, Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50. 4. The value of Bond 2 is closest to: A. 102.103% of par. B. 103.121% of par. C. 103.744% of par. 5. The value of Bond 3 is closest to: A. 102.103% of par. B. 103.688% of par. C. 103.744% of par

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started