Question

PLEASE EXPLAIN HOW TO CALCULATE THIS ANSWER. WITHOUT EXCEL. THANK YOU! Presented below are two independent situations. Harris Cosmetics acquired 20% of the 300,000 shares

PLEASE EXPLAIN HOW TO CALCULATE THIS ANSWER. WITHOUT EXCEL. THANK YOU!

Presented below are two independent situations.

Harris Cosmetics acquired 20% of the 300,000 shares of common stock of Sia Collective at a total cost of

$16 per share on July 18, 2020. On September 30, Sia Collective declared and paid a $40,000 dividend. On December 31, Sia Collective reported net income of $160,000 for the year. At December 31, the market price of Sia Collective Fashion was $20 per share. The stock is classified as available-for-sale.

West, Inc., obtained significant influence over Cudi Corporation by buying 30% of Cudi's 50,000 outstanding shares of common stock at a total cost of $8 per share on March 1, 2020. On August 15, Cudi declared and paid a cash dividend of $70,000. On December 31, Cudi reported a net income of $110,000 for the year.

INSTRUCTIONS:

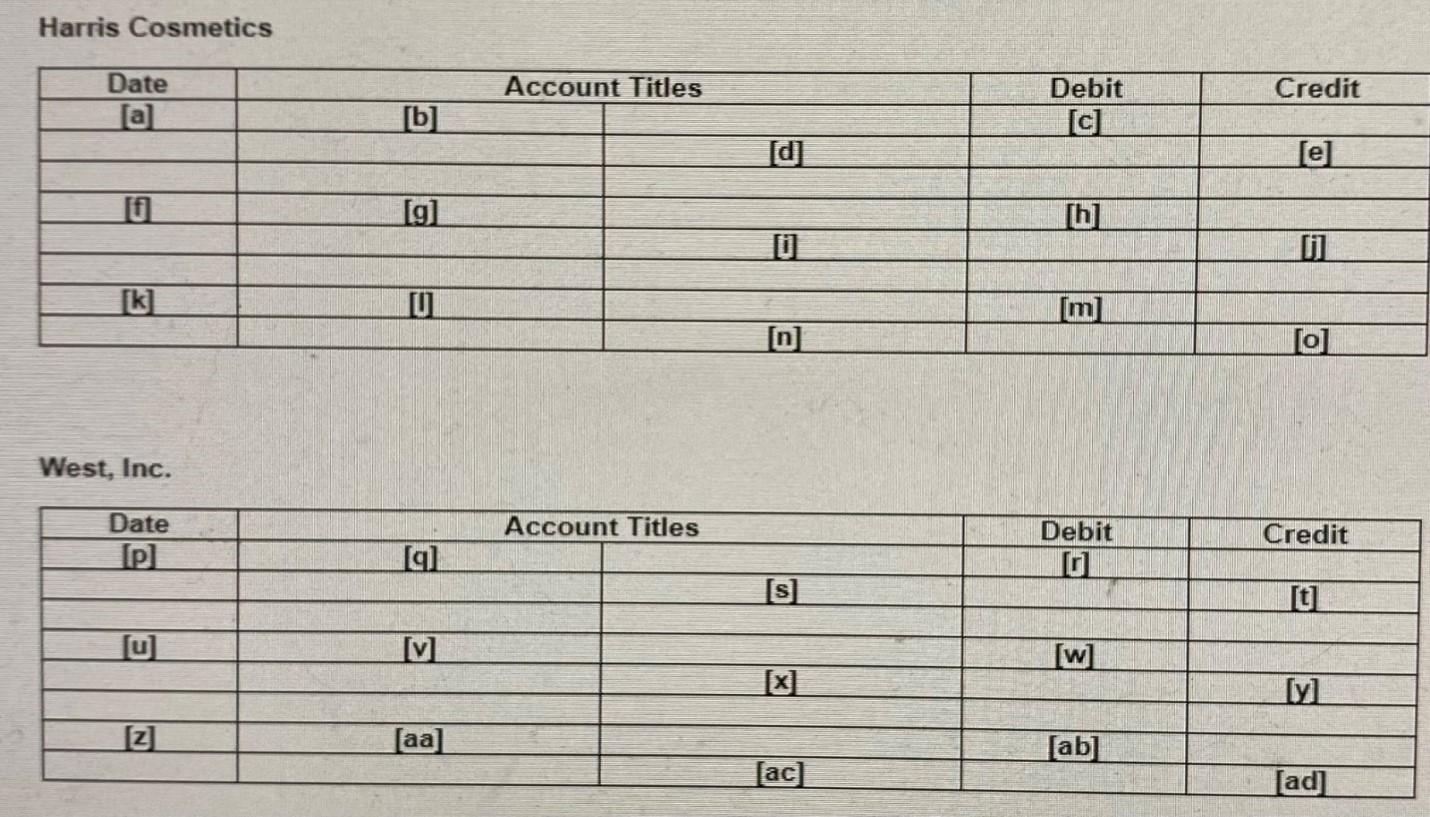

a) Prepare journal entries for the books of Harris Cosmetics.

b) Prepare journal entries for the books of West, Inc.

Dates should be keyed as (ex. Month DD). Account titles must be appropriate and spelled correctly to receive any credit. Refer to the provided word bank for assistance. Amounts must be written using commas (ex. 12,000).

- July 18

- Stock Investments

- 960,000

- Cash

- 960,000

- September 30

- Cash

- 8,000

- Dividend Revenue

- 8,000

- December 31

- Fair Value Adjustment-AFSN

- 240,000

- Unrealized Gain or Loss-Equity

- 240,000

- March 1

- Stock Investments

- 120,000

- Cash

- 120,000

- August 15

- Cash

- 21,000

- X.Stock Investments

- 21,000

- December 31

- Stock Investments

- 33,000

- Revenue from Stock Investments

- 33,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started