Please explain how to calculate this to get an answer like the key above for number 76, 77, 78, 79, 80, 81, 82, and 83

Please explain how to calculate this to get an answer like the key above for number 76, 77, 78, 79, 80, 81, 82, and 83

Chapter : CORPORATIONS: DIVIDENDS, RETAINED EARNINGS, AND INCOME REPORTING

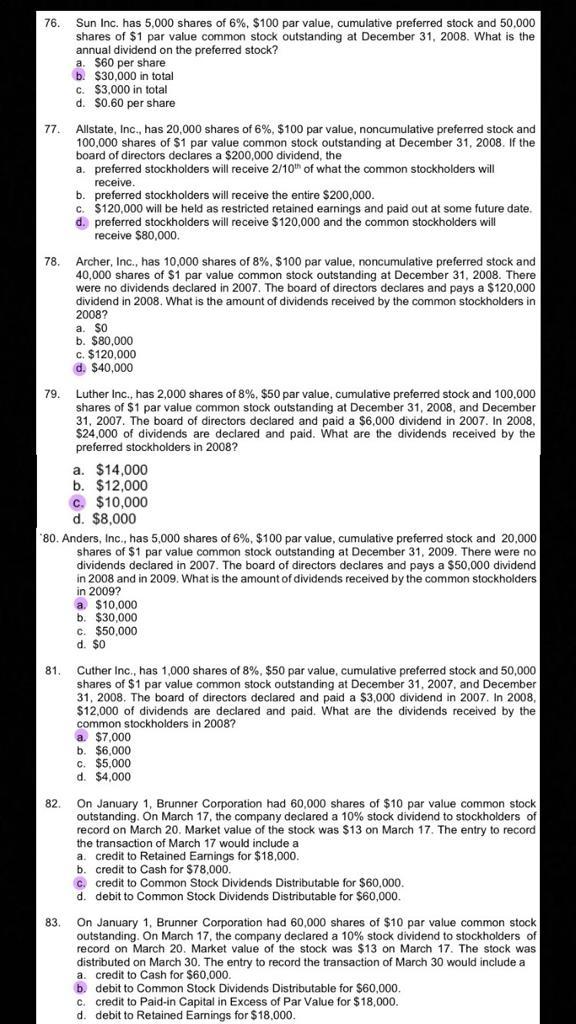

76. Sun Inc. has 5,000 shares of 6%, $100 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2008. What is the annual dividend on the preferred stock?

77. Allstate, Inc., has 20,000 shares of 6%, $100 par value, noncumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2008. If the board of directors declares a $200,000 dividend, the

78. Archer, Inc., has 10,000 shares of 8%, $100 par value, noncumulative preferred stock and 40,000 shares of $1 par value common stock outstanding at December 31, 2008. There were no dividends declared in 2007. The board of directors declares and pays a $120,000 dividend in 2008. What is the amount of dividends received by the common stockholders in 2008?

79. Luther Inc., has 2,000 shares of 8%, $50 par value, cumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2008, and December 31, 2007. The board of directors declared and paid a $6,000 dividend in 2007. In 2008, $24,000 of dividends are declared and paid. What are the dividends received by the preferred stockholders in 2008?

80. Anders, Inc., has 5,000 shares of 6%, $100 par value, cumulative preferred stock and 20,000 shares of $1 par value common stock outstanding at December 31, 2009. There were no dividends declared in 2007. The board of directors declares and pays a $50,000 dividend in 2008 and in 2009. What is the amount of dividends received by the common stockholders in 2009?

81. Cuther Inc., has 1,000 shares of 8%, $50 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2007, and December 31, 2008. The board of directors declared and paid a $3,000 dividend in 2007. In 2008, $12,000 of dividends are declared and paid. What are the dividends received by the common stockholders in 2008?

82. On January 1, Brunner Corporation had 60,000 shares of $10 par value common stock outstanding. On March 17, the company declared a 10% stock dividend to stockholders of record on March 20. Market value of the stock was $13 on March 17. The entry to record the transaction of March 17 would include a

83. On January 1, Brunner Corporation had 60,000 shares of $10 par value common stock outstanding. On March 17, the company declared a 10% stock dividend to stockholders of record on March 20. Market value of the stock was $13 on March 17. The stock was distributed on March 30. The entry to record the transaction of March 30 would include a

76. 77. Sun Inc. has 5,000 shares of 6%, $100 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2008. What is the annual dividend on the preferred stock? a. $60 per share b. $30,000 in total C. $3,000 in total d. $0.60 per share Allstate, Inc., has 20,000 shares of 6%, $100 par value, noncumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2008. If the board of directors declares a $200,000 dividend, the a. preferred stockholders will receive 2/10 of what the common stockholders will receive. b. preferred stockholders will receive the entire $200,000. C. $120,000 will be held as restricted retained earnings and paid out at some future date d. preferred stockholders will receive $120,000 and the common stockholders will receive $80,000 78. Archer, Inc., has 10,000 shares of 8%. $100 par value, noncumulative preferred stock and 40,000 shares of $1 par value common stock outstanding at December 31, 2008. There were no dividends declared in 2007. The board of directors declares and pays a $120,000 dividend in 2008. What is the amount of dividends received by the common stockholders in 2008? a. $0 b. $80,000 c. $120,000 d. $40,000 79. Luther Inc., has 2,000 shares of 8%. $50 par value, cumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2008, and December 31, 2007. The board of directors declared and paid a $6,000 dividend in 2007. In 2008, $24,000 of dividends are declared and paid. What are the dividends received by the preferred stockholders in 2008? a. $14,000 b. $12,000 c. $10.000 d. $8,000 80. Anders, Inc., has 5,000 shares of 6%, $100 par value, cumulative preferred stock and 20,000 shares of $1 par value common stock outstanding at December 31, 2009. There were no dividends declared in 2007. The board of directors declares and pays a $50,000 dividend in 2008 and in 2009. What is the amount of dividends received by the common stockholders in 2009? a $10,000 b. $30,000 C. $50,000 d. $0 81. Cuther Inc., has 1,000 shares of 8%. $50 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2007, and December 31, 2008. The board of directors declared and paid a $3,000 dividend in 2007. In 2008, $12,000 of dividends are declared and paid. What are the dividends received by the common stockholders in 20087 a $7,000 b. $6,000 c. $5,000 d. $4,000 82 On January 1, Brunner Corporation had 60,000 shares of $10 par value common stock outstanding. On March 17, the company declared a 10% stock dividend to stockholders of record on March 20. Market value of the stock was $13 on March 17. The entry to record the transaction of March 17 would include a a. credit to Retained Earings for $18,000. b. credit to Cash for $78,000 C. credit to Common Stock Dividends Distributable for $60,000. d. debit to Common Stock Dividends Distributable for $60,000. On January 1, Brunner Corporation had 60,000 shares of $10 par value common stock outstanding. On March 17, the company declared a 10% stock dividend to stockholders of record on March 20. Market value of the stock was $13 on March 17. The stock was distributed on March 30. The entry to record the transaction of March 30 would include a a. credit to Cash for $60,000 b. debit to Common Stock Dividends Distributable for $60,000. C. credit to Paid-in Capital in Excess of Par Value for $18,000. d. debit to Retained Earnings for $18,000. 83Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started