Please explain how to create accounting and break even analysis using Goal Seek in excel

Please explain how to create accounting and break even analysis using Goal Seek in excel

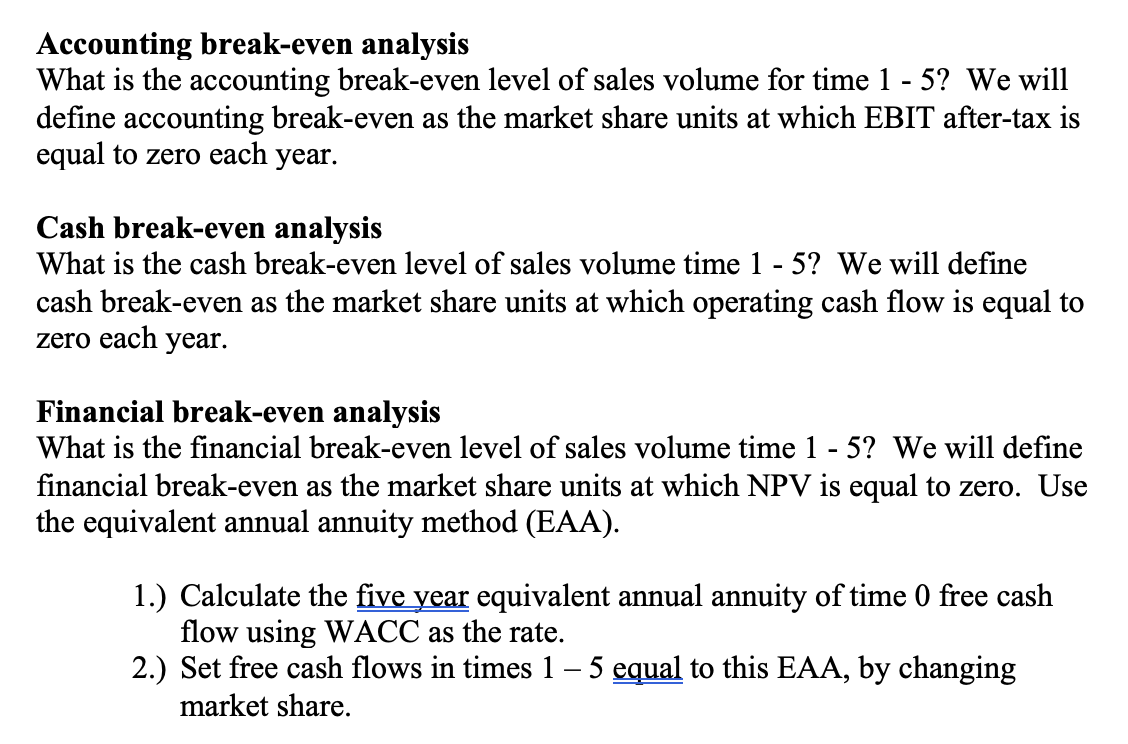

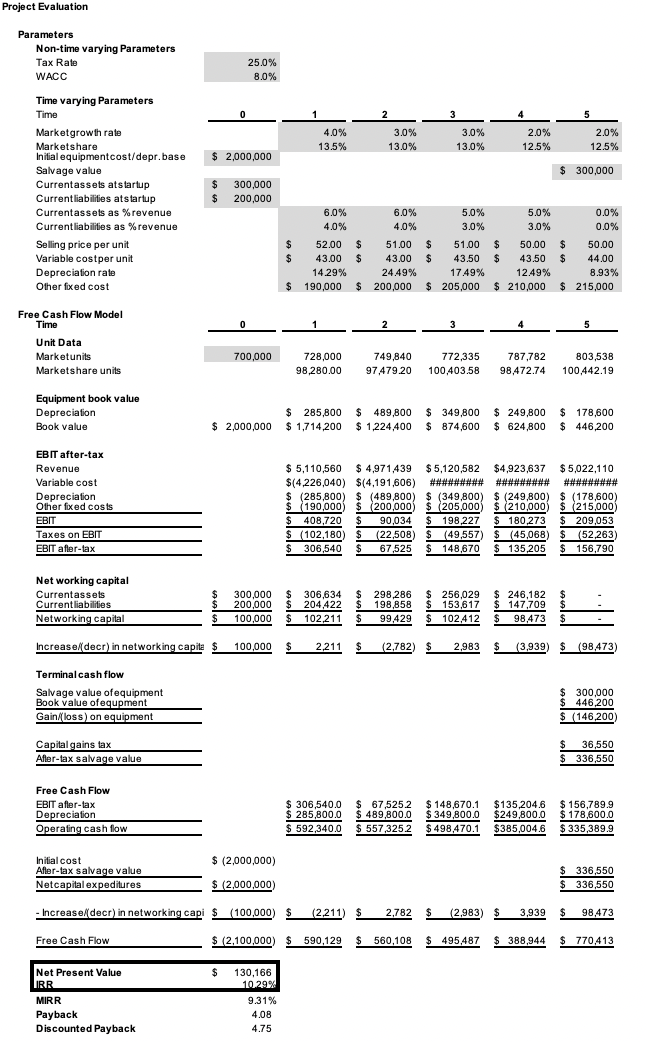

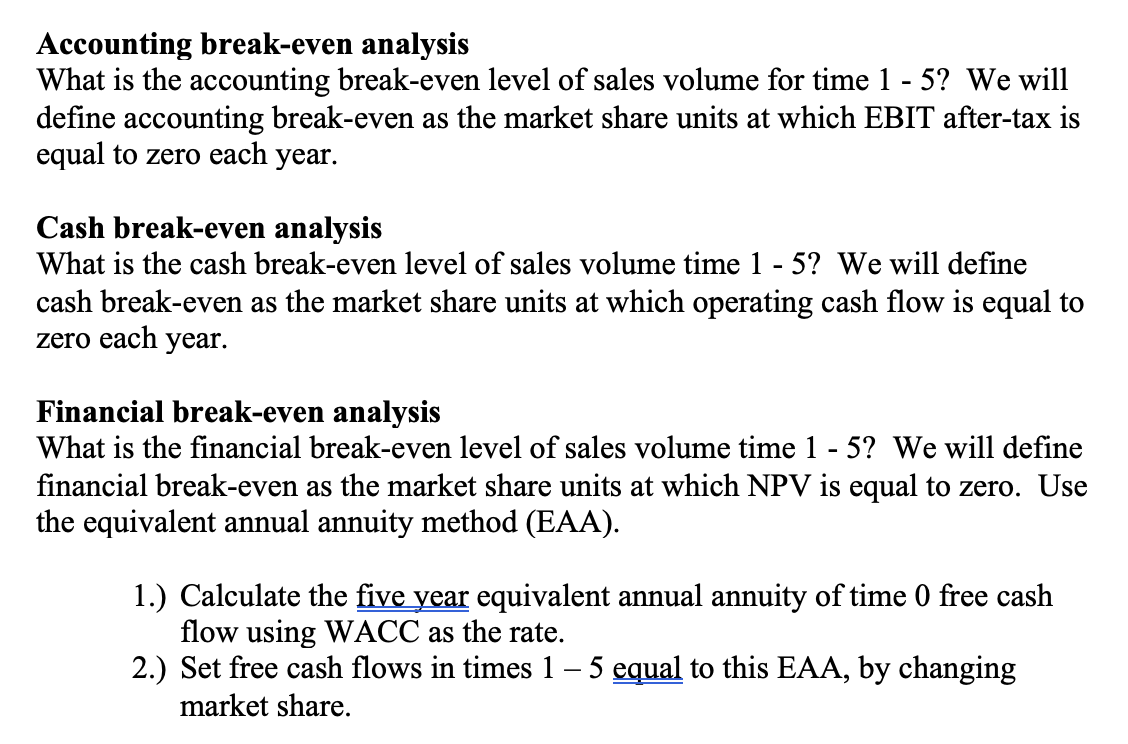

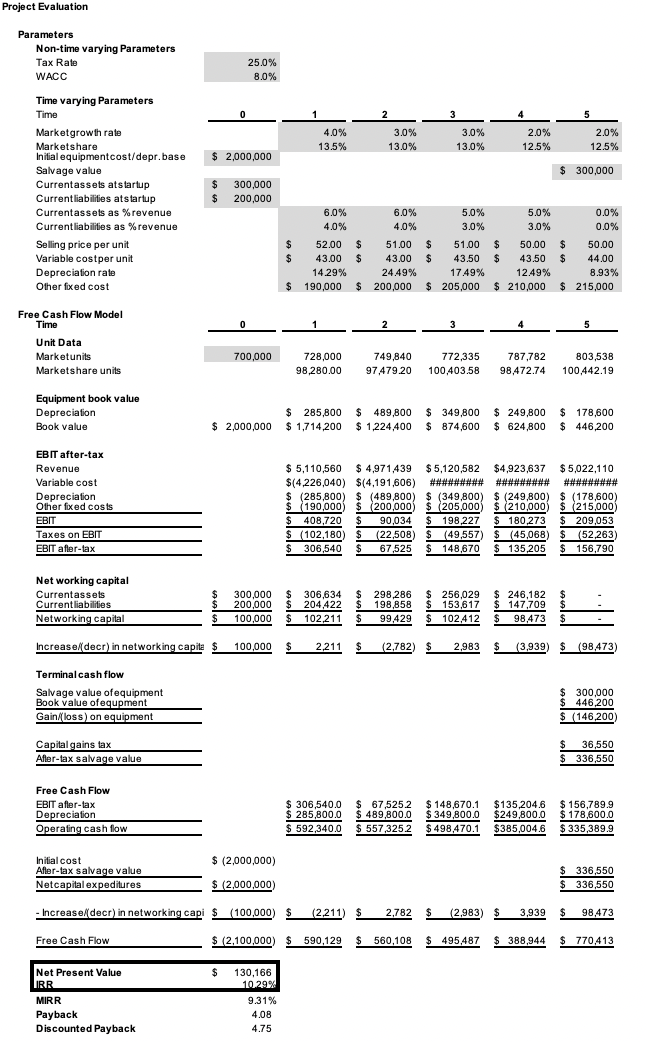

Accounting break-even analysis What is the accounting break-even level of sales volume for time 1 - 5? We will 1 define accounting break-even as the market share units at which EBIT after-tax is equal to zero each year. Cash break-even analysis What is the cash break-even level of sales volume time 1 - 5? We will define cash break-even as the market share units at which operating cash flow is equal to zero each year. Financial break-even analysis What is the financial break-even level of sales volume time 1 - 5? We will define financial break-even as the market share units at which NPV is equal to zero. Use the equivalent annual annuity method (EAA). 1.) Calculate the five year equivalent annual annuity of time 0 free cash flow using WACC as the rate. 2.) Set free cash flows in times 1 5 equal to this EAA, by changing market share. Project Evaluation Parameters Non-time varying Parameters Tax Rate WACC 25.0% 8.0% 0 2 3 5 4.0% 13.5% 3.0% 13.0% 3.0% 13.0% 2.0% 12.5% 2.0% 12.5% $ 2,000,000 $ 300,000 Time varying Parameters Time Marketgrowth rate Marketshare Initial equipmentcost/depr. base . Salvage value Currentassets atstartup Current liabilities atstartup Currentassets as %revenue Current liabilities as % revenue Selling price per unit Variable costper unit Depreciation rate Other fixed cost $ $ 300,000 200,000 6.0% 6.0% 4.0% 4.0% $ $ 52.00 $ 51.00 $ 43.00 $ $ 43.00 1429% 24.49% $ 190,000 $ 200,000 5.0% 3.0% $ 51.00 $ 43.50 17.49% $ 205,000 5.0% 0.0% 3.0% 0.0% $ 50.00 $ 50.00 $ 43.50 $ 44.00 12.49% 8.93% $ 210,000 $ 215,000 0 1 2 3 4 5 Free Cash Flow Model Time Unit Data Marketunits Marketshare units 700,000 728,000 98,280.00 749,840 97,479.20 772,335 100,403.58 787,782 98,472.74 803,538 100,442.19 Equipment book value Depreciation Book value $ 249,800 $ 285,800 $ 2,000,000 $1,714,200 $ 489,800 $ 1,224,400 $ 349,800 $ 874,600 $ 624,800 $ 178,600 $ 446,200 EBIT after-tax Revenue Variable cost Depreciation Other fixed costs EBIT Taxes on EBIT EBIT after-tax $ 5,110,560 $ $ 4,971,439 $5,120,582 $ $4,923,637 $5,022,110 $(4,226,040) $(4,191,606) ################## $ (285,800) $ (489,800 $ (349,800) $ (249,800) $ (249,800) $ (178,600 $ ) $ 190,000 $ 200,000 $ 205,000 () $ 200,000) $ 205,000) $ 210,000) $ (215,000 $ 408,720 $ 90,034 $ 198,227 $ 180,273 $ 209,053 $ (102,180) $ (22,508) $ (49,557) $ (45,068) $ (52.263) $ 306,540 $ 67,525 $ 148,670 $ 135,205 $ 156,790 $ Net working capital Currentassets Current liabilities Networking capital 300,000 200,000 100,000 $ $ $ 306,634 204.422 102.211 $ $ 298,286 $ 198,858 $ 99,429 $ 256,029 $ 153,617 $ 102,412 $ 246,182 $ 147,709 $ 98.473 $ $ Increase decr) in networking capita /$ 100,000 $ 2.211 (2,782 $ 2,983 $ (3,939) $ (98,473 ( ) Terminal cash flow Salvage value of equipment Book value ofequpment Gain/loss) on equipment $ 300,000 $ 446,200 $ (146,200 Capital gains tax After-tax salvage value 36,550 $ 336,550 Free Cash Flow EBIT after-tax Depreciation Operating cash flow $ 306,540.0 $ 285,800.0 $ 592,340.0 $ 67,525.2 $ 489,800.0 $ 557,325.2 $ 148,670.1 $ 349,800.0 $ 498,470.1 $135,204.6 $249,8000 $385,004.6 $ 156,789.9 $ 178,600.0 $335,389.9 $ 2,000,000) Initial cost Afler-tax salvage value Netcapital expeditures $ 336,550 $ 336,550 $ 2,000,000 - Increase/ decr) in networking capi $ (100,000) $ (2211) ($ 2.782 $ $ (2,983) $ 3,939 $ 98,473 Free Cash Flow $ (2,100,000) $590,129 $ 560,108 $ $ $ 495,487 $ 388,944 $ 770,413 Net Present Value $ IRR MIRR Payback Discounted Payback 130,166 10.29% 9.31% 4.08 4.75 Accounting break-even analysis What is the accounting break-even level of sales volume for time 1 - 5? We will 1 define accounting break-even as the market share units at which EBIT after-tax is equal to zero each year. Cash break-even analysis What is the cash break-even level of sales volume time 1 - 5? We will define cash break-even as the market share units at which operating cash flow is equal to zero each year. Financial break-even analysis What is the financial break-even level of sales volume time 1 - 5? We will define financial break-even as the market share units at which NPV is equal to zero. Use the equivalent annual annuity method (EAA). 1.) Calculate the five year equivalent annual annuity of time 0 free cash flow using WACC as the rate. 2.) Set free cash flows in times 1 5 equal to this EAA, by changing market share. Project Evaluation Parameters Non-time varying Parameters Tax Rate WACC 25.0% 8.0% 0 2 3 5 4.0% 13.5% 3.0% 13.0% 3.0% 13.0% 2.0% 12.5% 2.0% 12.5% $ 2,000,000 $ 300,000 Time varying Parameters Time Marketgrowth rate Marketshare Initial equipmentcost/depr. base . Salvage value Currentassets atstartup Current liabilities atstartup Currentassets as %revenue Current liabilities as % revenue Selling price per unit Variable costper unit Depreciation rate Other fixed cost $ $ 300,000 200,000 6.0% 6.0% 4.0% 4.0% $ $ 52.00 $ 51.00 $ 43.00 $ $ 43.00 1429% 24.49% $ 190,000 $ 200,000 5.0% 3.0% $ 51.00 $ 43.50 17.49% $ 205,000 5.0% 0.0% 3.0% 0.0% $ 50.00 $ 50.00 $ 43.50 $ 44.00 12.49% 8.93% $ 210,000 $ 215,000 0 1 2 3 4 5 Free Cash Flow Model Time Unit Data Marketunits Marketshare units 700,000 728,000 98,280.00 749,840 97,479.20 772,335 100,403.58 787,782 98,472.74 803,538 100,442.19 Equipment book value Depreciation Book value $ 249,800 $ 285,800 $ 2,000,000 $1,714,200 $ 489,800 $ 1,224,400 $ 349,800 $ 874,600 $ 624,800 $ 178,600 $ 446,200 EBIT after-tax Revenue Variable cost Depreciation Other fixed costs EBIT Taxes on EBIT EBIT after-tax $ 5,110,560 $ $ 4,971,439 $5,120,582 $ $4,923,637 $5,022,110 $(4,226,040) $(4,191,606) ################## $ (285,800) $ (489,800 $ (349,800) $ (249,800) $ (249,800) $ (178,600 $ ) $ 190,000 $ 200,000 $ 205,000 () $ 200,000) $ 205,000) $ 210,000) $ (215,000 $ 408,720 $ 90,034 $ 198,227 $ 180,273 $ 209,053 $ (102,180) $ (22,508) $ (49,557) $ (45,068) $ (52.263) $ 306,540 $ 67,525 $ 148,670 $ 135,205 $ 156,790 $ Net working capital Currentassets Current liabilities Networking capital 300,000 200,000 100,000 $ $ $ 306,634 204.422 102.211 $ $ 298,286 $ 198,858 $ 99,429 $ 256,029 $ 153,617 $ 102,412 $ 246,182 $ 147,709 $ 98.473 $ $ Increase decr) in networking capita /$ 100,000 $ 2.211 (2,782 $ 2,983 $ (3,939) $ (98,473 ( ) Terminal cash flow Salvage value of equipment Book value ofequpment Gain/loss) on equipment $ 300,000 $ 446,200 $ (146,200 Capital gains tax After-tax salvage value 36,550 $ 336,550 Free Cash Flow EBIT after-tax Depreciation Operating cash flow $ 306,540.0 $ 285,800.0 $ 592,340.0 $ 67,525.2 $ 489,800.0 $ 557,325.2 $ 148,670.1 $ 349,800.0 $ 498,470.1 $135,204.6 $249,8000 $385,004.6 $ 156,789.9 $ 178,600.0 $335,389.9 $ 2,000,000) Initial cost Afler-tax salvage value Netcapital expeditures $ 336,550 $ 336,550 $ 2,000,000 - Increase/ decr) in networking capi $ (100,000) $ (2211) ($ 2.782 $ $ (2,983) $ 3,939 $ 98,473 Free Cash Flow $ (2,100,000) $590,129 $ 560,108 $ $ $ 495,487 $ 388,944 $ 770,413 Net Present Value $ IRR MIRR Payback Discounted Payback 130,166 10.29% 9.31% 4.08 4.75

Please explain how to create accounting and break even analysis using Goal Seek in excel

Please explain how to create accounting and break even analysis using Goal Seek in excel