Answered step by step

Verified Expert Solution

Question

1 Approved Answer

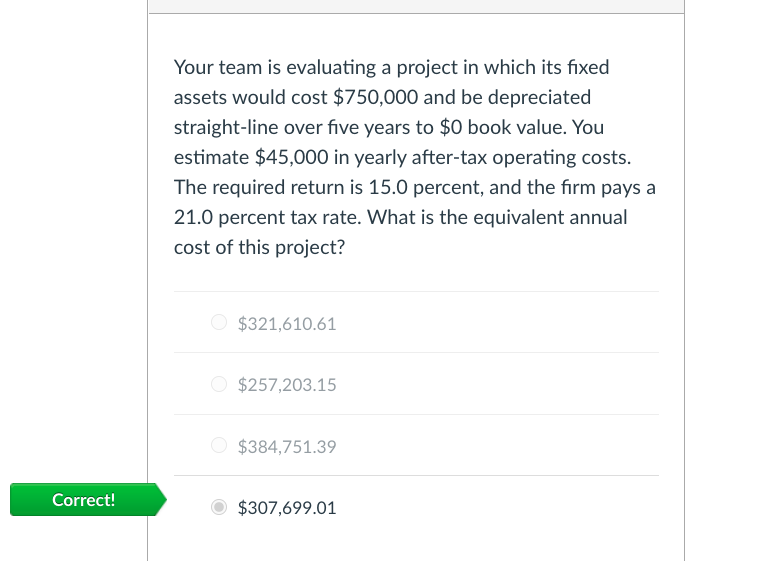

PLEASE EXPLAIN HOW TO DO IT STEP BY STEP EXCEL Your team is evaluating a project in which its fixed assets would cost $750,000 and

PLEASE EXPLAIN HOW TO DO IT STEP BY STEP EXCEL

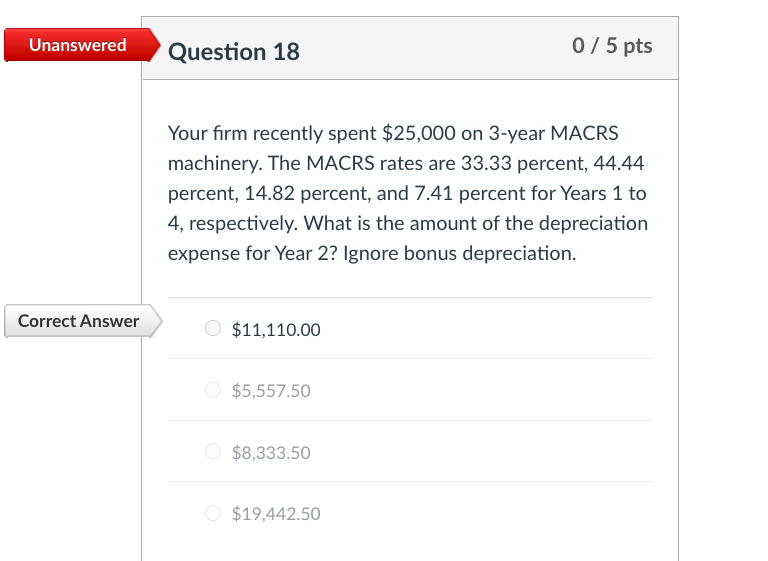

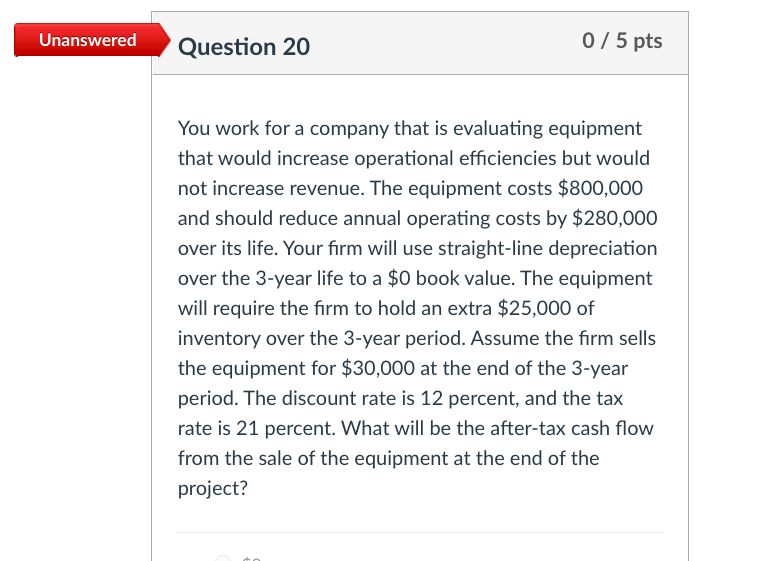

Your team is evaluating a project in which its fixed assets would cost $750,000 and be depreciated straight-line over five years to $0 book value. You estimate $45,000 in yearly after-tax operating costs. The required return is 15.0 percent, and the firm pays a 21.0 percent tax rate. What is the equivalent annual cost of this project? $321,610.61 $257,203.15 $384,751.39 Correct! $307,699.01 Unanswered Question 18 0/5 pts Your firm recently spent $25,000 on 3-year MACRS machinery. The MACRS rates are 33.33 percent, 44.44 percent, 14.82 percent, and 7.41 percent for Years 1 to 4, respectively. What is the amount of the depreciation expense for Year 2? Ignore bonus depreciation. Correct Answer $11,110.00 $5,557.50 $8,333.50 $19,442.50 Unanswered Question 20 0 / 5 pts You work for a company that is evaluating equipment that would increase operational efficiencies but would not increase revenue. The equipment costs $800,000 and should reduce annual operating costs by $280,000 over its life. Your firm will use straight-line depreciation over the 3-year life to a $0 book value. The equipment will require the firm to hold an extra $25,000 of inventory over the 3-year period. Assume the firm sells the equipment for $30,000 at the end of the 3-year period. The discount rate is 12 percent, and the tax rate is 21 percent. What will be the after-tax cash flow from the sale of the equipment at the end of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started