Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain how to get accumulated depreciation for equipment. And please post to where half the answer isnt cut off! thanks! Sale of Equipment Instructions

please explain how to get accumulated depreciation for equipment. And please post to where half the answer isnt cut off! thanks!

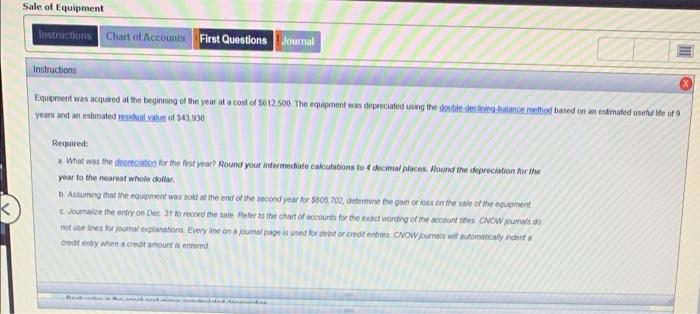

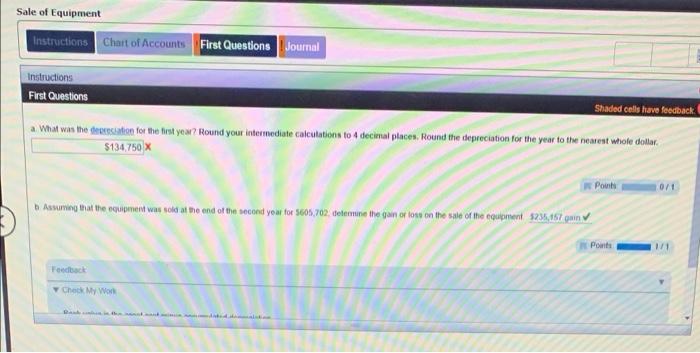

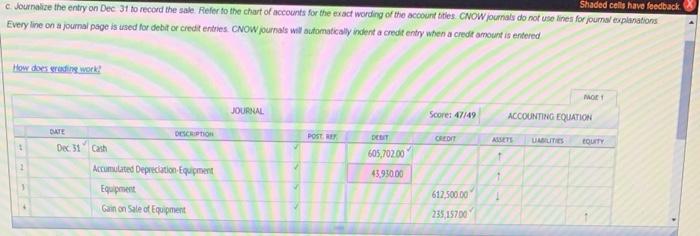

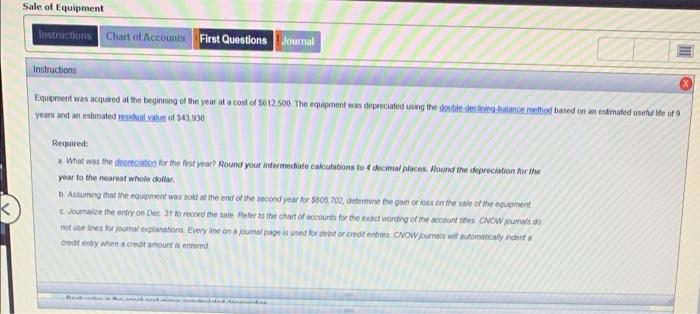

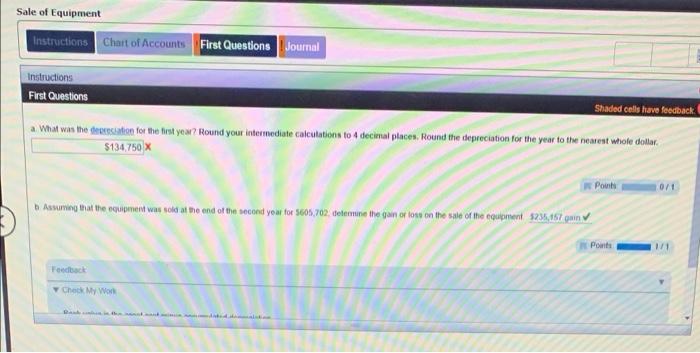

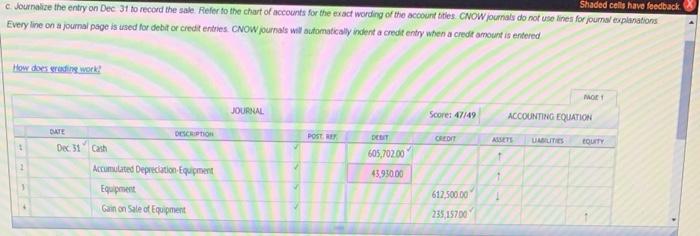

Sale of Equipment Instructions Chart of Accounts First Questions Journal Instructions Equipment was acquired at the beginning ot the year at a cost of 5612.500. The equipment was decercated using the gentle sectores lance method bated on an estimated unetu te of 9 years and an entrated festlust value of 543,930, Required: a What was the search for the first year Round your intermediate calculations to decimal places. Round the depreciation for the year to the nearest whole dollar Assuming that the equipment was told at the end of the second year to 60, 702, done the gun or loss on the sale of the comment C, Journalize the entry on Dec 31 to record the sole refer to the chart of accounts for the exact wording of the account the CNOW formas do not une tres for youma exploration. Every time on a journal page is used for tett or credit entries CNOW Journals war automatically inderta Credit entry when a credit amount is entered k Sale of Equipment Instructions Chart of Accounts First Questions Journal Instructions First Questions Shaded cells have feedback a What was the desiaton for the first year? Round your intermediate calculations to 4 decimal places. Round the depreciation for the year to the nearest whole dollar S134,750 X Pouls 0/1 Assuming that the equipment was sold at the end of the second year for 5605,702. feline the gain or lose on the sale of the equipment $234.157 gain Point 11 Feedback Check My Wor Shaded cells have feedback c. Journalize the entry on Dec 31 to record the sale. Refer to the chart of accounts for the exact wording of the account titles CNOWjournals do not use lines for journal explanations Every line on a journal page is used for debitor credit entries. CNOW journals will automatically indent a credit entry when a credit amount is endered How does erading work! MO JOURNAL Score: 47/49 ACCOUNTING EQUATION DATE DESCRIPTION POST IT DEBIT CREDIT ASETS UUTIES LOUITY 605,702.00 Dec 31 Cash Accumulated Depreciation Equipment 1 43,950.00 1 617,500.00 Equipment Gain on Salet Equipment 235,15700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started