Please explain how to get the above answers. I do not understand them.

Please explain how to get the above answers. I do not understand them.

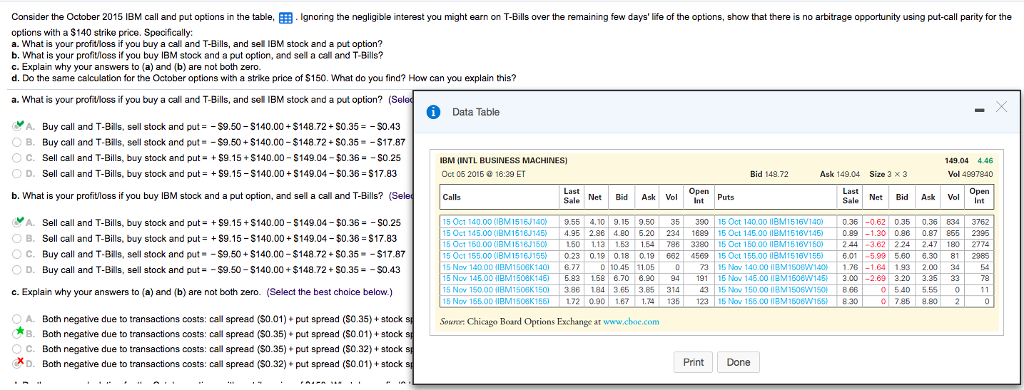

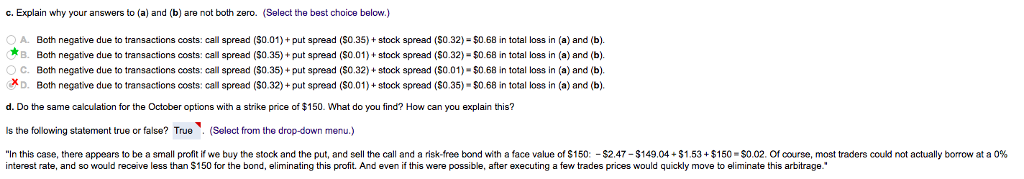

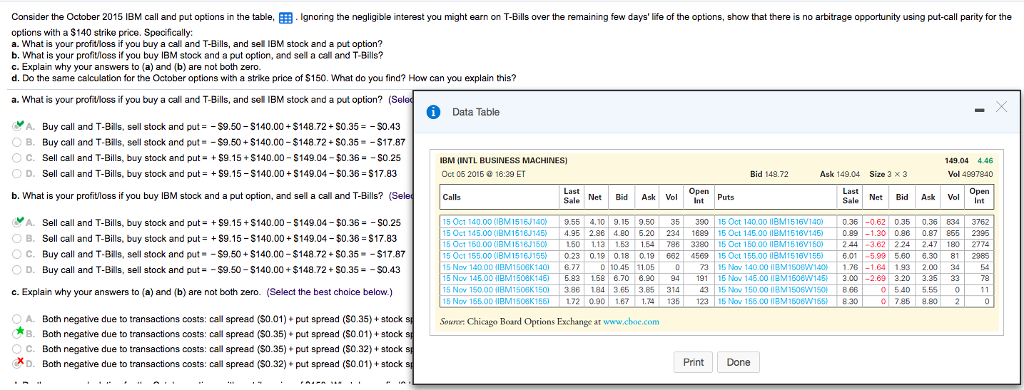

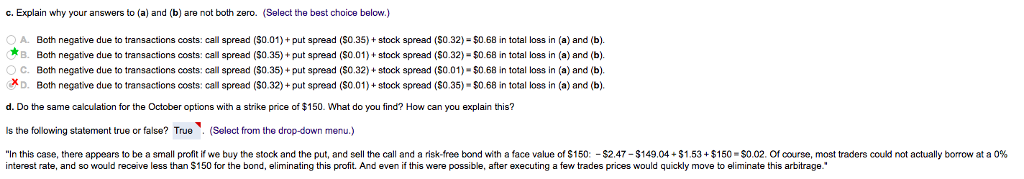

| | Consider the October 2015 IBM call and put options in the table, EIgnoring the negligible interest you might earn on T-Bills over the remaining few days' life of the options, show that there is no arbitrage opportunity using put-call parity for the options with a $140 strike price. Specifically: a. What is your profitiloss if you buy a call and T-Bills, and sel IBM stock and a put option? b. What is your profitloss if you buy IBM stock and a put option, and sell a call and T-Bills? c. Explain why your answers to (a) and (b) are not both zero. d. Do the same calculation for the October options with a strike price of $150. What do you find? How can you explain this? a. What is your profitloss if you buy a call and T-Bills, and sell IBM stock and a put option? (S i Data Table A. Buy call and T-Bills, sell stock and put -$9.50- S140.00 $148.72 S0.35s0.43 B. Buy call and T-Bills, sell stock and put--9.50 $140.00 $148.72 $0.35$17.87 OC. Sell call and T-Bills, buy stock and put- S9.15 $140.00- S149.04-$0.36 -S0.25 D. Sell call and T-Bills, buy stock and put- 59.15- S140.00 S149.04-$0.36 S17.83 IBM (INTL BUSINESS MACHINES Oct 06 2016 18:39 ET 49.04 4.46 Bid 149.72 Ask 149.04 Size 3 x 3 Vol 4997840 b. What is your profitloss if you buy IBM stock and a put option, and sell a call and T-Bills?( Open Puts Open Calls Net Bd Ask Vol Net Bid Ask Vol A Sell call and T-Bills, buy stock and put- S9.15+S140.00 S149.04-$0.36 -S0.25 15CT 140.00 (IBM 1516/14 9.55 4.10| 9.15 9.50 35| 390|15Oct 140.001IBM 15 16V 140) | 0.36|-0.62035|036 834| 3762 15 Oct 145.00 (IBM151?145) 4.95 2.96| 4.80 5.20 234 1889|15 Oct 145.001lBMI 516V146) 0.89|-1.30 0.96 0.87 855| 2395 15 Oct 160.00 (IBMl516J1500 1.50 1.13| 1.63 1.64 7863380|16 Oct 150.00IEM 1516V150) | 2.44|-3.62| 224 2.47 180| 2774 I5 Oct 155,00 (IBM 1516/155) 0.23 0.19 | 0.18 0.19 662| 4569|15Oct 155.00 (iBM 1516V155) 6.01|-5.99 5.60 ?.30 81| 2985 15 Nov 140.00 IEM1508K1401 677 5 Nov 146.00 IIEM1508K14) 6.9 15 8.70 6.0 94 19116 Now 145.00 1BM1608W145 3.00 -2.69 15 Nov 150001IBM1508K 150) | 386 184|365 385 31443| 15tlo, 1500008M 1506w15? B66 15 Nov 155.00 IBM1508K15) 172 0.90187 1.74 135 123 1 Now 156.00 18M1508W155 8.30 B. Sell call and T-Bills, buy stock and put- S9.15-S140.00 S149.04-$0.36 S17.83 ?c. Buy call and T-Bills, sell stock and put--$9.50 + $140.00-$148 72 + $0.35--$17.87 D. Buy call and T-Bills, sell stock and put-$9.50 S140.00+$148.72+S0.35-$0.43 01 10.45 11.05 73 15 Now 140.00 IBM1500W140 1.76 176-1.64 1.93 2.00 34 3.35 33 540 5.55 0 0 788 8.802 54 78 c. Explain why your answers to (a) and (b) are not both zero. (Select the best choice below.) OA. Both negative due to transactions costs: call spread ($0.01) put spread (S0.35)+ stock B. Both negative due to transactions costs: call spread ($0.35) put spread (s0.01)+ stock O C. Both negative due to transactions costs: call spread (S0.35) put spread (S0.32)+ stock XD. Both negative due to transactions costs: call spread ($0.32)+ put spread (S0.01)t stock Sowrer: Chicago Board Options Exchange at www.cboe.com Print Done

Please explain how to get the above answers. I do not understand them.

Please explain how to get the above answers. I do not understand them.