Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE EXPLAIN HOW TO GET THE ANSWERS FOR QUESTIONS 2 AND 3 and what numbers were taken to get the answers. Water Sport Inc. manufactures

PLEASE EXPLAIN HOW TO GET THE ANSWERS FOR QUESTIONS 2 AND 3 and what numbers were taken to get the answers.

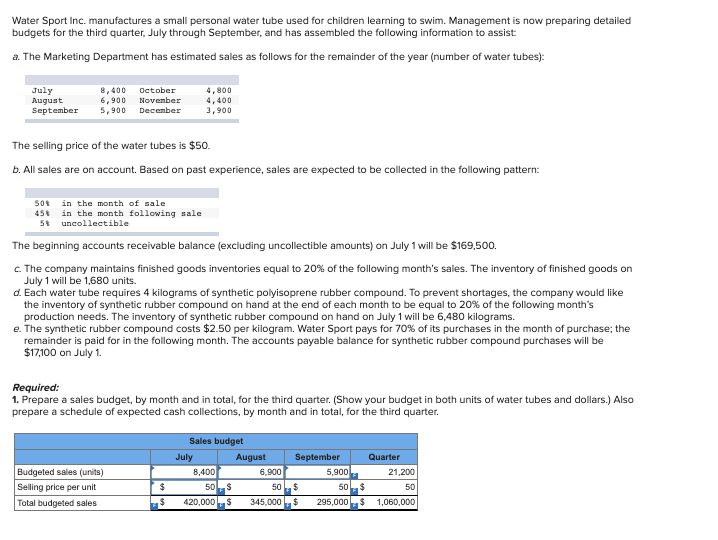

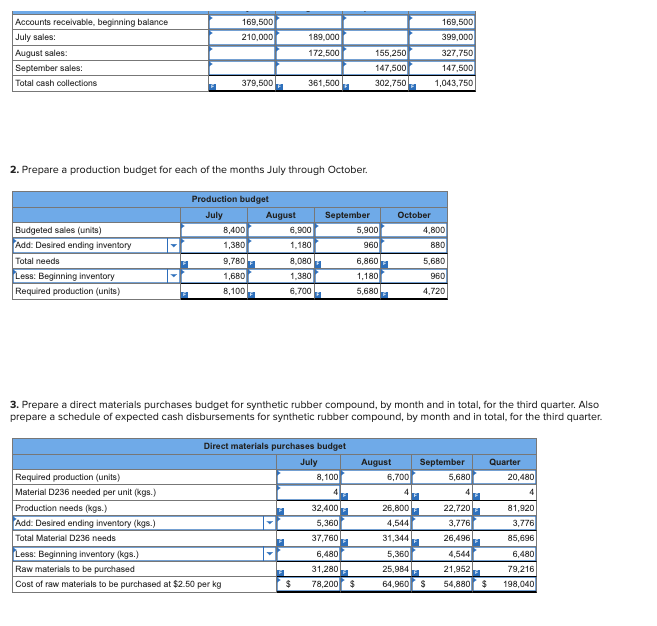

Water Sport Inc. manufactures a small personal water tube used for children learning to swim. Management is now preparing detailed budgets for the third quarter, July through September, and has assembled the following information to assist a. The Marketing Department has estimated sales as follows for the remainder of the year (number of water tubes): July August September 8,400 October 6,900 November 5,900 December 4,800 4,400 3,900 The selling price of the water tubes is $50. b. All sales are on account. Based on past experience, sales are expected to be collected in the following pattern: 508 456 58 in the month of sale in the month following sale uncollectible The beginning accounts receivable balance (excluding uncollectible amounts) on July 1 will be $169,500. c. The company maintains finished goods inventories equal to 20% of the following month's sales. The inventory of finished goods on July 1 will be 1,680 units. d. Each water tube requires 4 kilograms of synthetic polyisoprene rubber compound. To prevent shortages, the company would like the inventory of synthetic rubber compound on hand at the end of each month to be equal to 20% of the following month's production needs. The inventory of synthetic rubber compound on hand on July 1 will be 6,480 kilograms. e. The synthetic rubber compound costs $2.50 per kilogram. Water Sport pays for 70% of its purchases in the month of purchase; the remainder is paid for in the following month. The accounts payable balance for synthetic rubber compound purchases will be $17,100 on July 1. Required: 1. Prepare a sales budget, by month and in total, for the third quarter. (Show your budget in both units of water tubes and dollars.) Also prepare a schedule of expected cash collections, by month and in total, for the third quarter. Budgeted sales (units) Selling price per unit Total budgeted sales Sales budget July August September Quarter 8,400 6.900 5,900 21,200 50S 50$ 50 $ 50 420,000 $ 345.000$ 295,000$ 1,060,000 $ $ 169,500 210,000 Accounts receivable, beginning balance July sales: August sales: September sales: Total cash collections 189.000 172.500 155,250 147,500 302,750 169,500 399,000 327,7501 147,500 1,043,750 379,500 361,500 2. Prepare a production budget for each of the months July through October. Production budget July August 8,400 6.900 1,380 1,180 9,780 8.080 1,680 1,380 8,100 6,700 September 5,900 960 Budgeted sales (units) Add: Desired ending inventory Total needs Less: Beginning inventory Required production (units) October 4,800 880 5,680 960 4,720 6,860 1,180 5,680 3. Prepare a direct materials purchases budget for synthetic rubber compound, by month and in total, for the third quarter. Also prepare a schedule of expected cash disbursements for synthetic rubber compound, by month and in total, for the third quarter. August 6,700 Quarter 20,480 Direct materials purchases budget July Required production (units) 8,100 Material D236 needed per unit (kgs.) 4 Production needs (kgs.) 32,400 Add: Desired ending inventory (kgs.) 5,360 Total Material D236 needs 37,760 Less: Beginning inventory (kgs.) 6,480 Raw materials to be purchased 31,280 Cost of raw materials to be purchased at $2.50 per kg $ 78,200 $ 26,800 4,544 31,344 5,360 25,984 64,960 September 5,680 4 22,720 3,776 26,496 4,544 81,920 3,776 85,696 6,480 79,216 198,040 21,952 $ 54,880 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started