Answered step by step

Verified Expert Solution

Question

1 Approved Answer

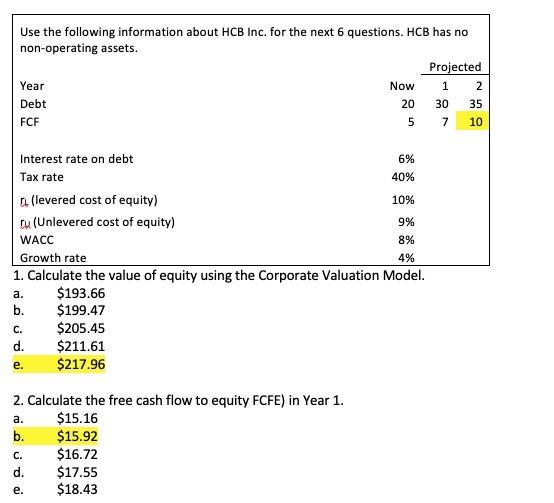

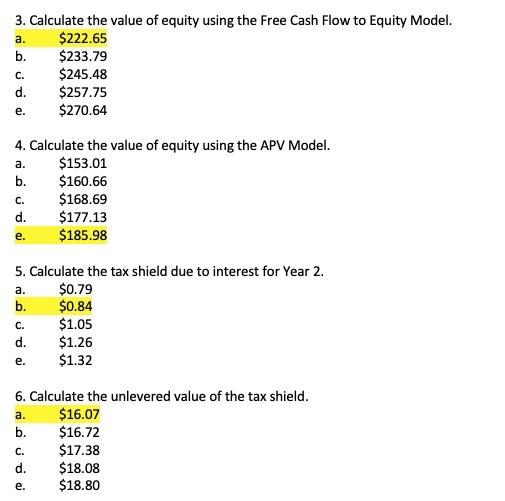

Please explain how to get the following answers from Question 1; parts 1-6 Use the following information about HCB Inc. for the next 6 questions.

Please explain how to get the following answers from Question 1; parts 1-6

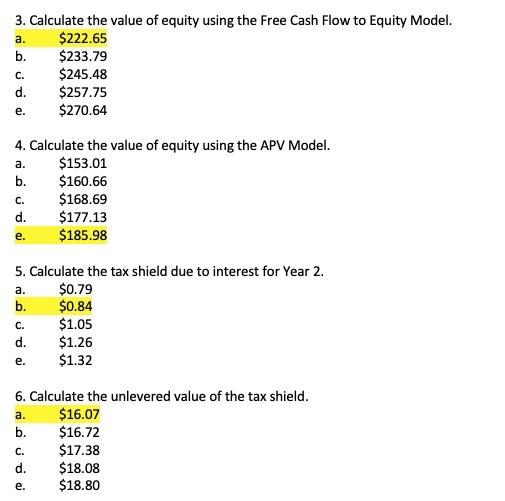

Use the following information about HCB Inc. for the next 6 questions. HCB has no non-operating assets. Projected Year Now 1 2 Debt 20 30 35 FCF 7 10 Interest rate on debt 6% Tax rate 40% (levered cost of equity) 10% tu (Unlevered cost of equity) 9% WACC 8% Growth rate 4% 1. Calculate the value of equity using the Corporate Valuation Model. a. $193.66 b. $199.47 C. $205.45 d. $211.61 e. $217.96 2. Calculate the free cash flow to equity FCFE) in Year 1. a. $15.16 b. $15.92 C. $16.72 d. $17.55 e. $18.43 5 3. Calculate the value of equity using the Free Cash Flow to Equity Model. a. $222.65 b. $233.79 C. $245.48 d. $257.75 e. $270.64 4. Calculate the value of equity using the APV Model. a. $153.01 $160.66 b. C. $168.69 d. $177.13 $185.98 e. 5. Calculate the tax shield due to interest for Year 2. a. $0.79 b. $0.84 C. $1.05 d. $1.26 e. $1.32 6. Calculate the unlevered value of the tax shield. a. $16.07 b. $16.72 C. $17.38 d. $18.08 e. $18.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started