Answered step by step

Verified Expert Solution

Question

1 Approved Answer

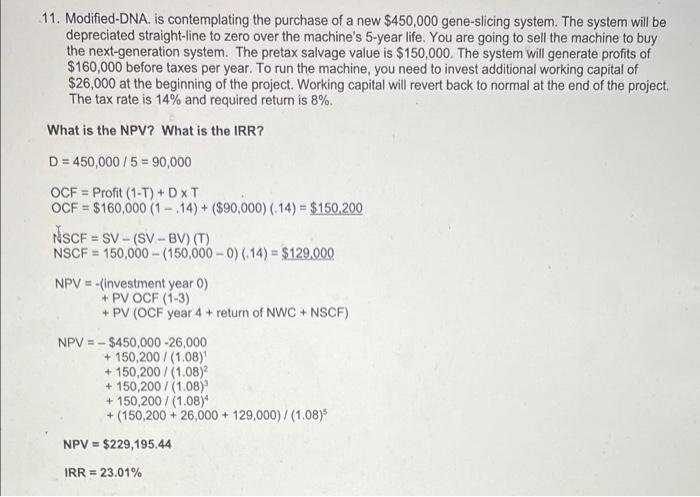

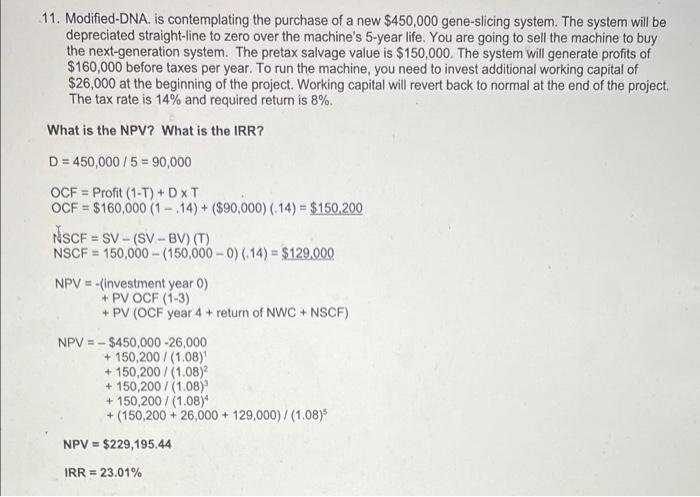

Please explain how to get the IRR and the NPV 11. Modified-DNA. is contemplating the purchase of a new $450,000 gene-slicing system. The system will

Please explain how to get the IRR and the NPV

11. Modified-DNA. is contemplating the purchase of a new $450,000 gene-slicing system. The system will be depreciated straight-line to zero over the machine's 5-year life. You are going to sell the machine to buy the next-generation system. The pretax salvage value is $150,000. The system will generate profits of $160,000 before taxes per year. To run the machine, you need to invest additional working capital of $26,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. The tax rate is 14% and required return is 8%. What is the NPV? What is the IRR? D = 450,000/5 = 90,000 OCF = Profit (1-T) + DXT OCF = $160,000 (1 - 14) + ($90,000) (14) = $150.200 NSCF = SV - (SV-BV) (1) NSCF = 150,000 - (150,000 - 0) (14) = $129.000 NPV (Investment year) + PV OCF (1-3) + PV (OCF year 4 + return of NWC + NSCF) NPV = - $450,000 -26,000 + 150,200/(1.08) + 150,200/(1.08) + 150,200/(1.08) + 150,200/(1.08) + (150,200 + 26,000 + 129,000)/(1.08)* NPV = $229,195.44 IRR = 23.01%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started