Answered step by step

Verified Expert Solution

Question

1 Approved Answer

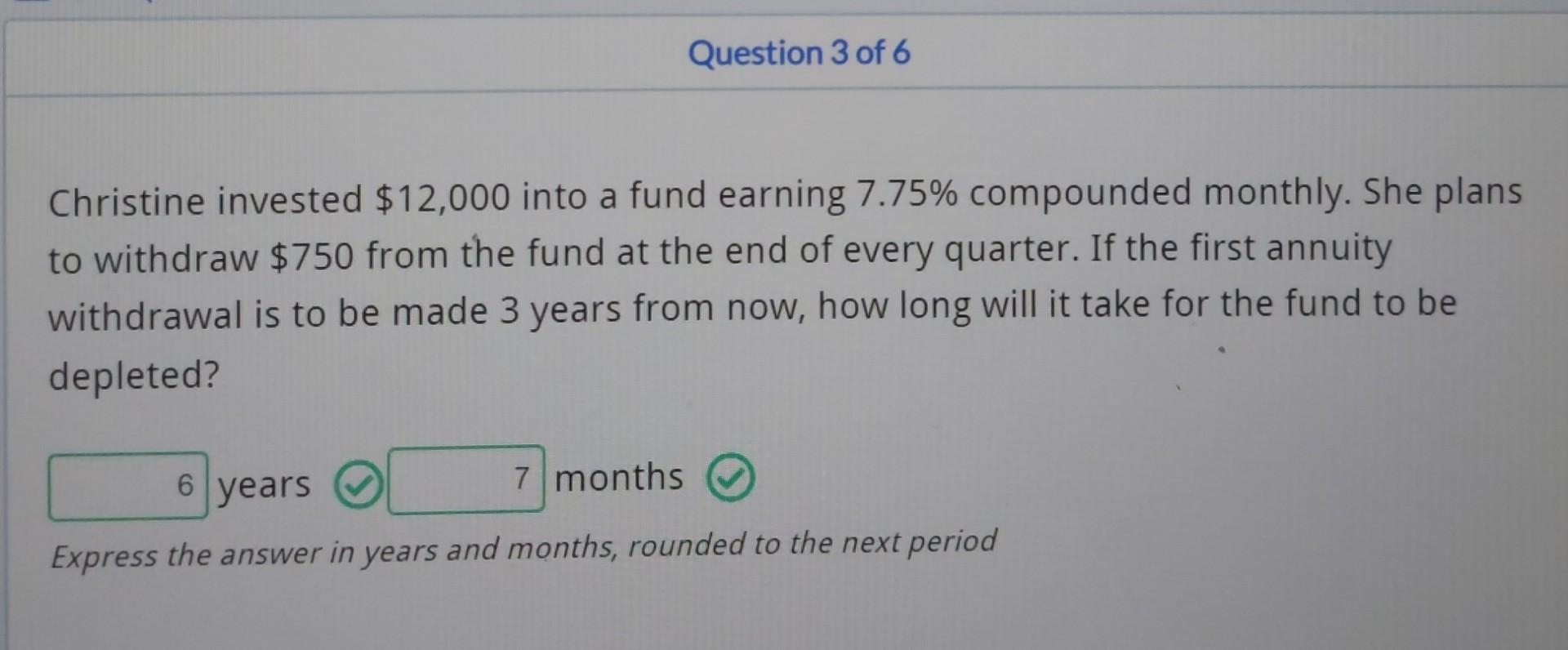

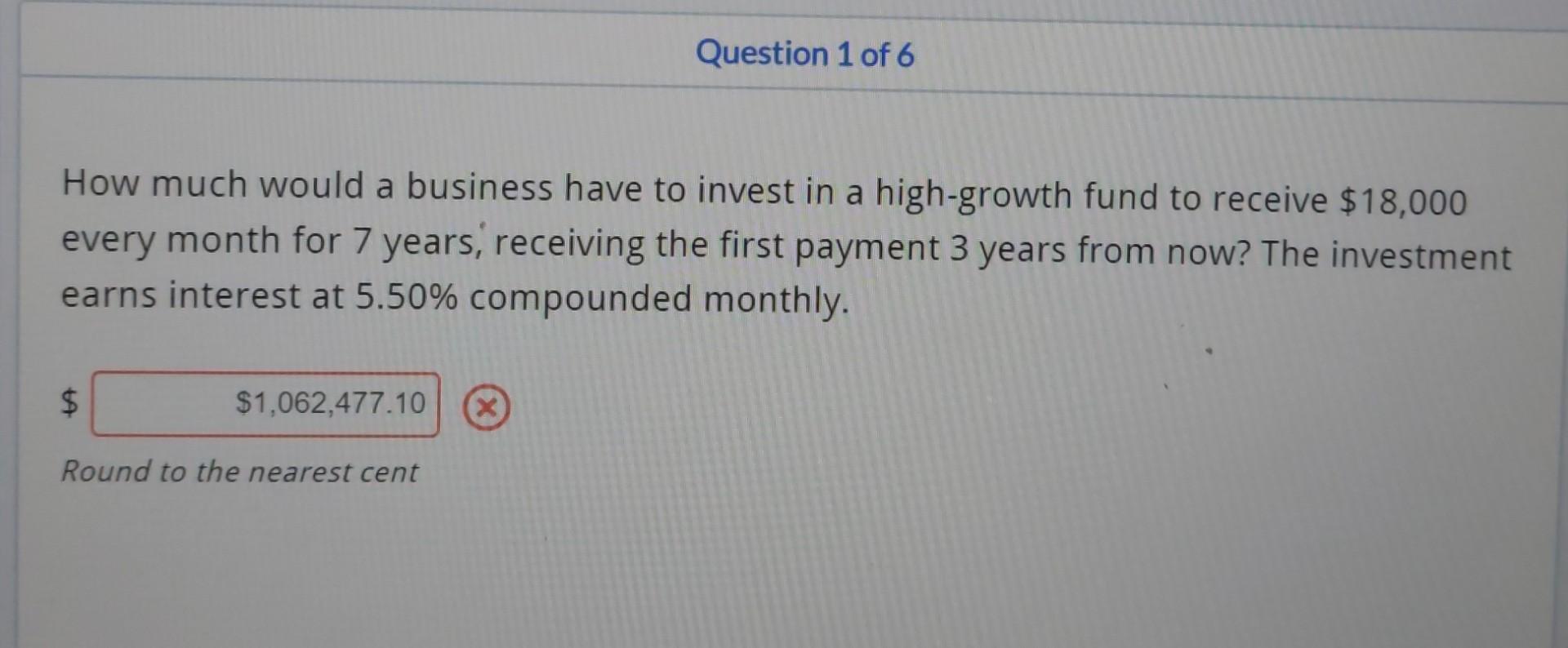

Please explain how to solve 3rd and 1st question in detail Thank you!! Question 3 of 6 Christine invested $12,000 into a fund earning 7.75%

Please explain how to solve 3rd and 1st question in detail

Thank you!!

Question 3 of 6 Christine invested $12,000 into a fund earning 7.75% compounded monthly. She plans to withdraw $750 from the fund at the end of every quarter. If the first annuity withdrawal is to be made 3 years from now, how long will it take for the fund to be depleted? 6 years 7 months 7 Express the answer in years and months, rounded to the next period Question 1 of 6 How much would a business have to invest in a high-growth fund to receive $18,000 every month for 7 years, receiving the first payment 3 years from now? The investment 3 earns interest at 5.50% compounded monthly. $ $1,062,477.10 x Round to the nearest centStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started