Answered step by step

Verified Expert Solution

Question

1 Approved Answer

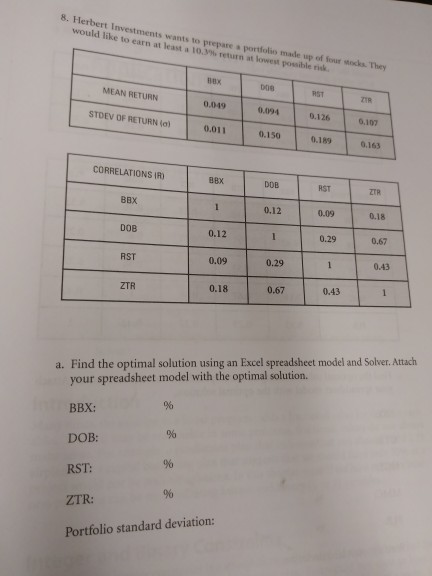

please EXPLAIN how you came to the answers. thanks! 8. Herbert Investments wants to prepare a portfolio made up of four socks They turn at

please EXPLAIN how you came to the answers. thanks!

8. Herbert Investments wants to prepare a portfolio made up of four socks They turn at lowest possible rik D08 RST ZIR MEAN RETURN 0.094 0.1260.107 0.189 0.163 0049 STDEV OF RETURN (a) 0.011 0.150 CORRELATIONS IR) BBX DOB ZTR BBX 0.12 0.09 0.18 DOB 0.12 0.09 0.18 0.29 AST 0.29 0.43 0.67 0.43 ZTR your spreadsheet model with the optimal solution. BBX: DOB: RST: ZTR: Portfolio standard deviation: a. Find the optimal solution using an Excel spreadsheet model and Solver. AttachStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started