Please explain how you found each answer. TY!

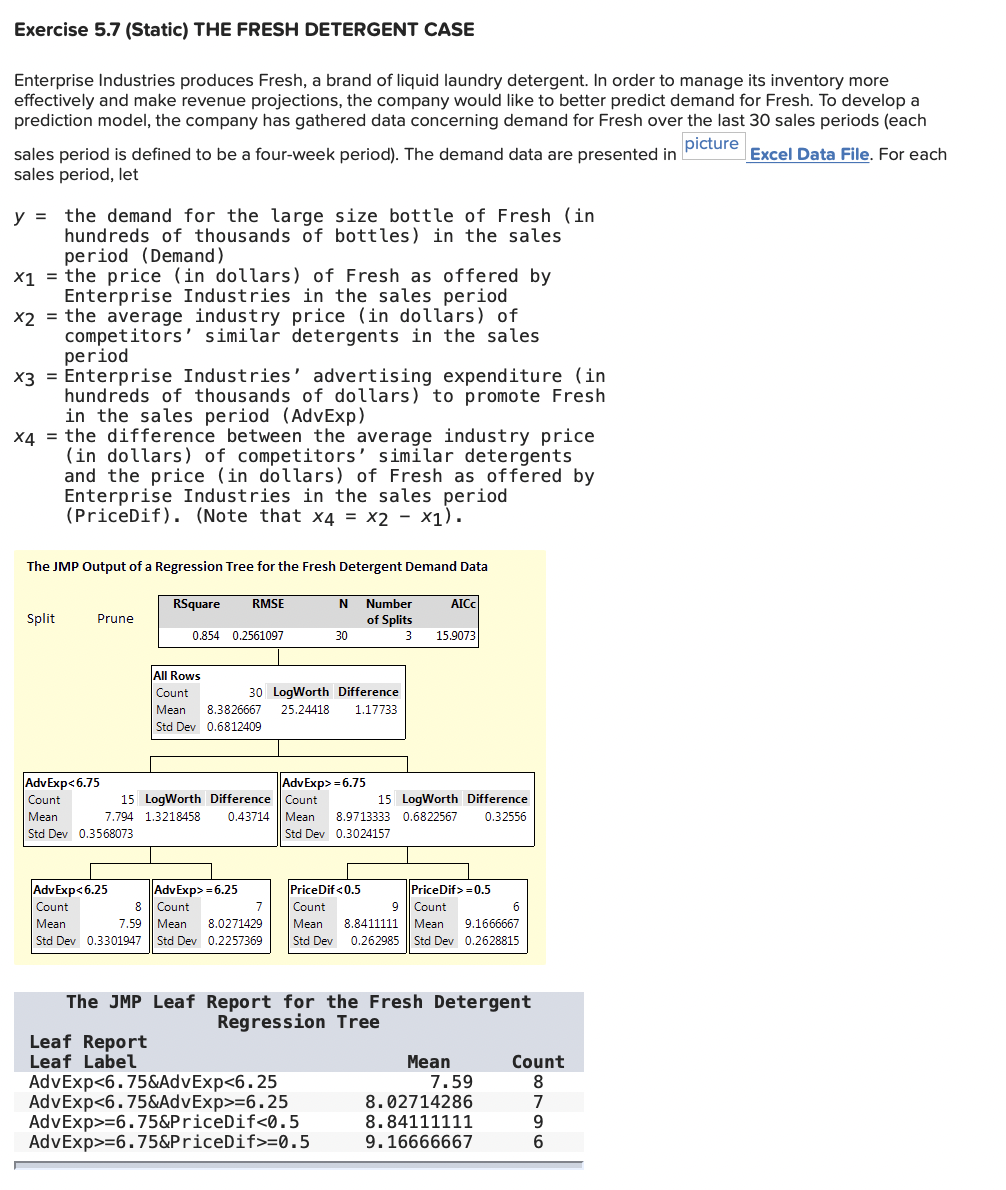

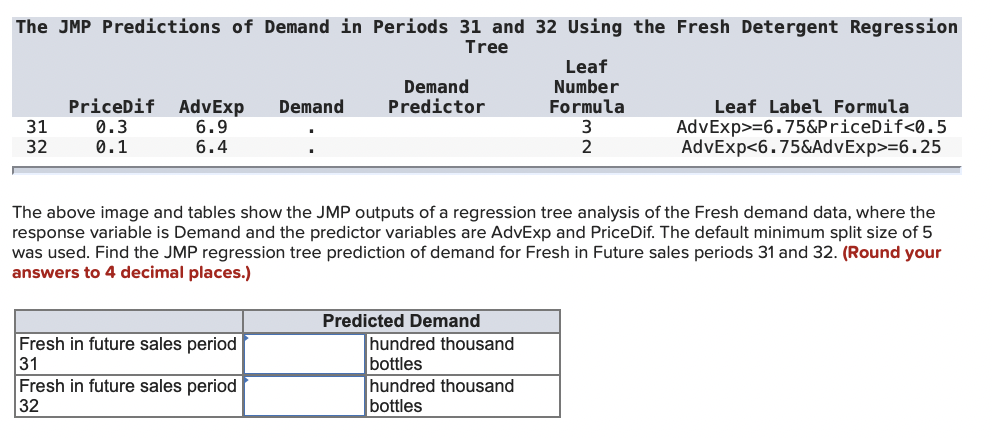

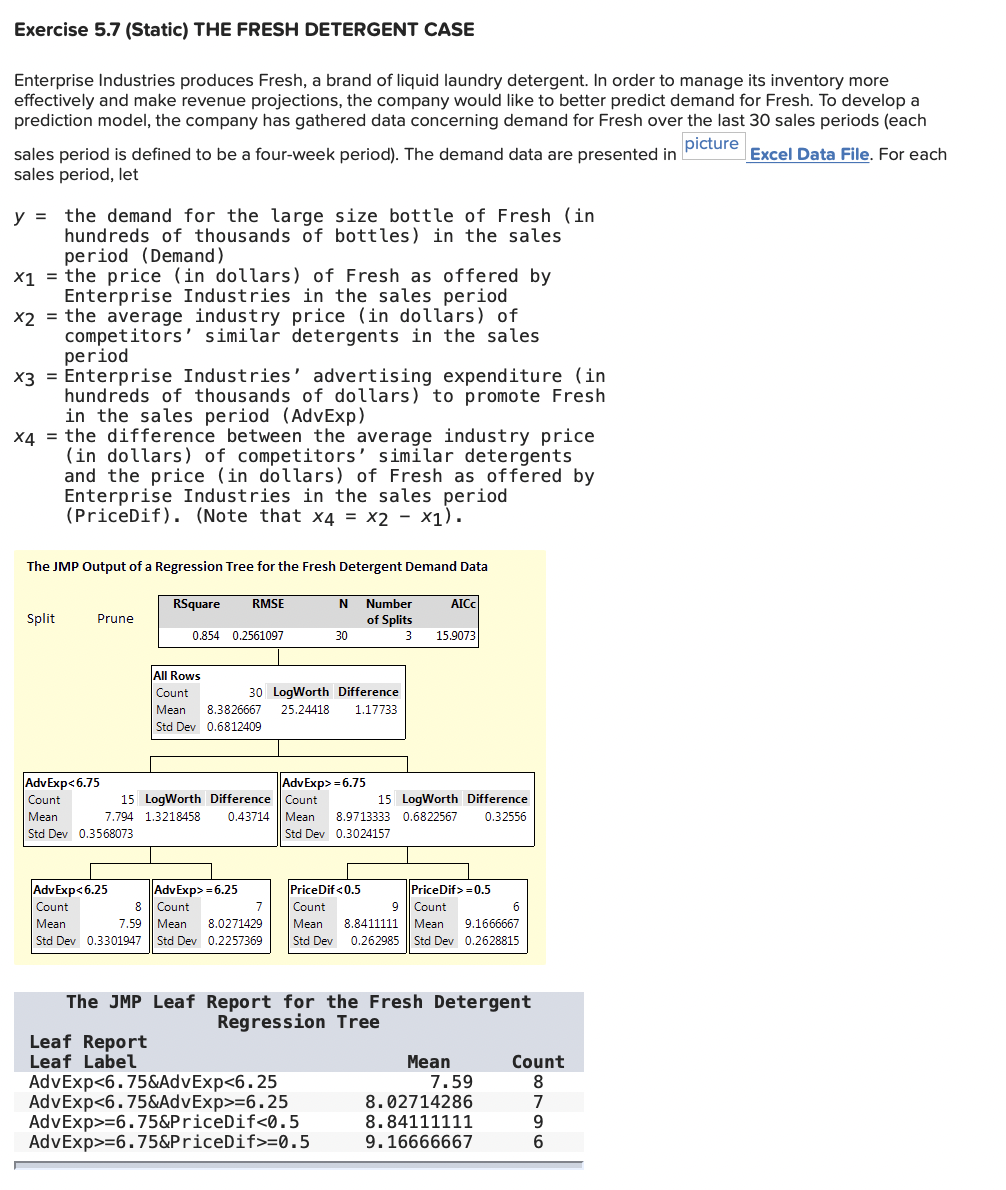

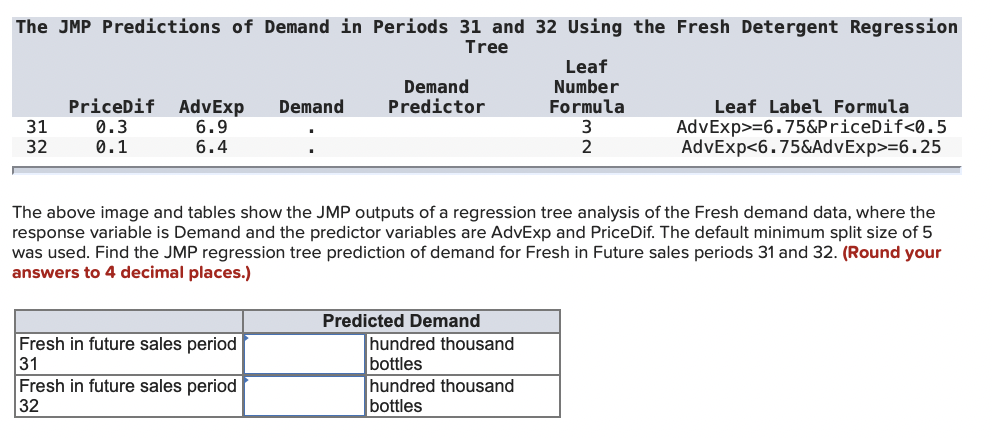

Exercise 5.7 (Static) THE FRESH DETERGENT CASE Enterprise Industries produces Fresh, a brand of liquid laundry detergent. In order to manage its inventory more effectively and make revenue projections, the company would like to better predict demand for Fresh. To develop a prediction model, the company has gathered data concerning demand for Fresh over the last 30 sales periods (each picture sales period is defined to be a four-week period). The demand data are presented in Excel Data File. For each sales period, let y = the demand for the large size bottle of Fresh (in hundreds of thousands of bottles) in the sales period (Demand) x1 = the price (in dollars) of Fresh as offered by Enterprise Industries in the sales period x2 = the average industry price (in dollars) of competitors' similar detergents in the sales period x3 = Enterprise Industries' advertising expenditure (in hundreds of thousands of dollars) to promote Fresh in the sales period (AdvExp) X4 = the difference between the average industry price (in dollars) of competitors' similar detergents and the price (in dollars) of Fresh as offered by Enterprise Industries in the sales period (PriceDif). (Note that x4 = x2 - x1). The JMP Output of a Regression Tree for the Fresh Detergent Demand Data RSquare RMSE N AICC Split Prune Number of Splits 3 0.854 0.2561097 30 15.9073 All Rows Count 30 LogWorth Difference Mean 8.3826667 25.24418 1.17733 Std Dev 0.6812409 Adv Exp=6.75 Count 15 LogWorth Difference Mean 8.9713333 0.6822567 0.32556 Std Dev 0.3024157 AdvExp=6.25 Count 8 Count Mean 7.59 || Mean 8.0271429 Std Dev 0.3301947 Std Dev 0.2257369 Price Difc0.5 PriceDif>=0.5 Count 9 Count Mean 8.8411111 Mean 9.1666667 Std Dev 0.262985 Std Dev 0.2628815 The JMP Leaf Report for the Fresh Detergent Regression Tree Leaf Report Leaf Label Mean Count AdvExp=6.25 8.02714286 7 AdvExp>=6.75&PriceDif=6.75&PriceDif>=0.5 9.16666667 6 The JMP Predictions of Demand in Periods 31 and 32 Using the Fresh Detergent Regression Tree Leaf Demand Number PriceDif AdvExp Demand Predictor Formula Leaf Label Formula 31 0.3 6.9 3 AdvExp>=6.75&PriceDif=6.25 The above image and tables show the JMP outputs of a regression tree analysis of the Fresh demand data, where the response variable is Demand and the predictor variables are AdvExp and Price Dif. The default minimum split size of 5 was used. Find the JMP regression tree prediction of demand for Fresh in Future sales periods 31 and 32. (Round your answers to 4 decimal places.) Fresh in future sales period 31 Fresh in future sales period 32 Predicted Demand hundred thousand bottles hundred thousand bottles Exercise 5.7 (Static) THE FRESH DETERGENT CASE Enterprise Industries produces Fresh, a brand of liquid laundry detergent. In order to manage its inventory more effectively and make revenue projections, the company would like to better predict demand for Fresh. To develop a prediction model, the company has gathered data concerning demand for Fresh over the last 30 sales periods (each picture sales period is defined to be a four-week period). The demand data are presented in Excel Data File. For each sales period, let y = the demand for the large size bottle of Fresh (in hundreds of thousands of bottles) in the sales period (Demand) x1 = the price (in dollars) of Fresh as offered by Enterprise Industries in the sales period x2 = the average industry price (in dollars) of competitors' similar detergents in the sales period x3 = Enterprise Industries' advertising expenditure (in hundreds of thousands of dollars) to promote Fresh in the sales period (AdvExp) X4 = the difference between the average industry price (in dollars) of competitors' similar detergents and the price (in dollars) of Fresh as offered by Enterprise Industries in the sales period (PriceDif). (Note that x4 = x2 - x1). The JMP Output of a Regression Tree for the Fresh Detergent Demand Data RSquare RMSE N AICC Split Prune Number of Splits 3 0.854 0.2561097 30 15.9073 All Rows Count 30 LogWorth Difference Mean 8.3826667 25.24418 1.17733 Std Dev 0.6812409 Adv Exp=6.75 Count 15 LogWorth Difference Mean 8.9713333 0.6822567 0.32556 Std Dev 0.3024157 AdvExp=6.25 Count 8 Count Mean 7.59 || Mean 8.0271429 Std Dev 0.3301947 Std Dev 0.2257369 Price Difc0.5 PriceDif>=0.5 Count 9 Count Mean 8.8411111 Mean 9.1666667 Std Dev 0.262985 Std Dev 0.2628815 The JMP Leaf Report for the Fresh Detergent Regression Tree Leaf Report Leaf Label Mean Count AdvExp=6.25 8.02714286 7 AdvExp>=6.75&PriceDif=6.75&PriceDif>=0.5 9.16666667 6 The JMP Predictions of Demand in Periods 31 and 32 Using the Fresh Detergent Regression Tree Leaf Demand Number PriceDif AdvExp Demand Predictor Formula Leaf Label Formula 31 0.3 6.9 3 AdvExp>=6.75&PriceDif=6.25 The above image and tables show the JMP outputs of a regression tree analysis of the Fresh demand data, where the response variable is Demand and the predictor variables are AdvExp and Price Dif. The default minimum split size of 5 was used. Find the JMP regression tree prediction of demand for Fresh in Future sales periods 31 and 32. (Round your answers to 4 decimal places.) Fresh in future sales period 31 Fresh in future sales period 32 Predicted Demand hundred thousand bottles hundred thousand bottles