Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain how you get everything this is all the information I was given Seattle Infonautics, Inc., produces Windows phones. Seattle Infonautics markets three different

please explain how you get everything

this is all the information I was given

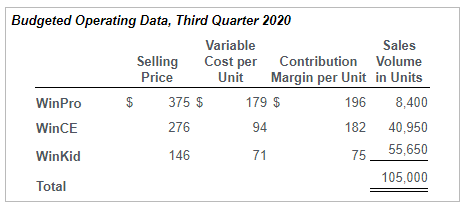

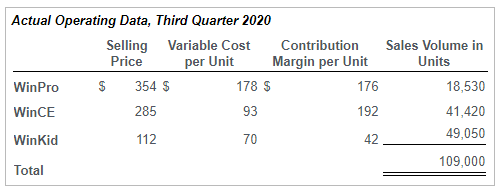

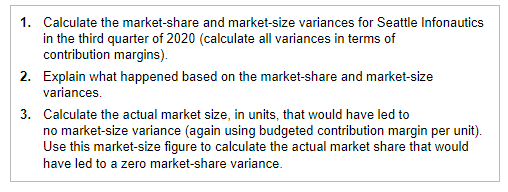

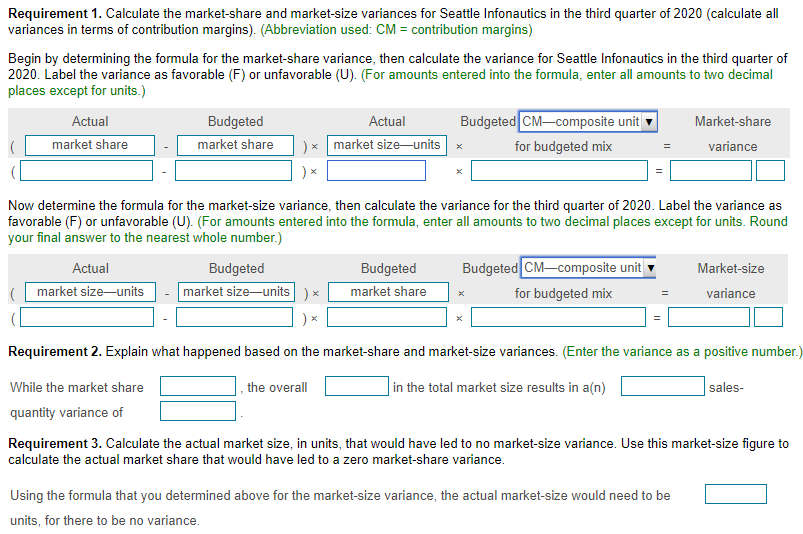

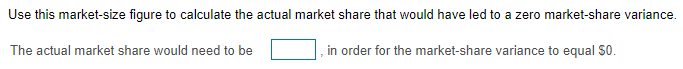

Seattle Infonautics, Inc., produces Windows phones. Seattle Infonautics markets three different handheld models: WinPro is a souped-up version for the executive on the go, WinCE is a consumer-oriented version, and WinKid is a stripped-down version for the young adult market. (Click the icon to view additional information.) Budgeted and actual operating data for the company's third quarter of 2020 are as follows: (Click the icon to view the budgeted data.) (Click the icon to view the actual data.) Read the requirements. Budgeted Operating Data, Third Quarter 2020 Actual Operating Data, Third Quarter 2020 \begin{tabular}{lcrrrr} & SellingPrice & \multicolumn{2}{c}{VariableCostperUnit} & ContributionMarginperUnit & \multicolumn{2}{c}{SalesVolumeinUnits} \\ \hline WinPro & $ & 354$ & 178$ & 176 & 18,530 \\ WinCE & & 285 & 93 & 192 & 41,420 \\ WinKid & 112 & 70 & 42 & 49,050 \\ Total & & & & & 109,000 \\ \hline \hline \end{tabular} 1. Calculate the market-share and market-size variances for Seattle Infonautics in the third quarter of 2020 (calculate all variances in terms of contribution margins). 2. Explain what happened based on the market-share and market-size variances. 3. Calculate the actual market size, in units, that would have led to no market-size variance (again using budgeted contribution margin per unit). Use this market-size figure to calculate the actual market share that would have led to a zero market-share variance. Requirement 1. Calculate the market-share and market-size variances for Seattle Infonautics in the third quarter of 2020 (calculate all variances in terms of contribution margins). (Abbreviation used: CM= contribution margins) Begin by determining the formula for the market-share variance, then calculate the variance for Seattle Infonautics in the third quarter of 2020. Label the variance as favorable (F) or unfavorable (U). (For amounts entered into the formula, enter all amounts to two decimal places except for units.) Now determine the formula for the market-size variance, then calculate the variance for the third quarter of 2020 . Label the variance as favorable (F) or unfavorable (U). (For amounts entered into the formula, enter all amounts to two decimal places except for units. Round your final answer to the nearest whole number.) Requirement 2. Explain what happened based on the market-share and market-size variances. (Enter the variance as a positive number While the market share , the overall in the total market size results in a(n) salesquantity variance of Requirement 3. Calculate the actual market size, in units, that would have led to no market-size variance. Use this market-size figure to calculate the actual market share that would have led to a zero market-share variance. Using the formula that you determined above for the market-size variance, the actual market-size would need to be units, for there to be no variance. Use this market-size figure to calculate the actual market share that would have led to a zero market-share variance. The actual market share would need to be , in order for the market-share variance to equal $0. Seattle Infonautics, Inc., produces Windows phones. Seattle Infonautics markets three different handheld models: WinPro is a souped-up version for the executive on the go, WinCE is a consumer-oriented version, and WinKid is a stripped-down version for the young adult market. (Click the icon to view additional information.) Budgeted and actual operating data for the company's third quarter of 2020 are as follows: (Click the icon to view the budgeted data.) (Click the icon to view the actual data.) Read the requirements. Budgeted Operating Data, Third Quarter 2020 Actual Operating Data, Third Quarter 2020 \begin{tabular}{lcrrrr} & SellingPrice & \multicolumn{2}{c}{VariableCostperUnit} & ContributionMarginperUnit & \multicolumn{2}{c}{SalesVolumeinUnits} \\ \hline WinPro & $ & 354$ & 178$ & 176 & 18,530 \\ WinCE & & 285 & 93 & 192 & 41,420 \\ WinKid & 112 & 70 & 42 & 49,050 \\ Total & & & & & 109,000 \\ \hline \hline \end{tabular} 1. Calculate the market-share and market-size variances for Seattle Infonautics in the third quarter of 2020 (calculate all variances in terms of contribution margins). 2. Explain what happened based on the market-share and market-size variances. 3. Calculate the actual market size, in units, that would have led to no market-size variance (again using budgeted contribution margin per unit). Use this market-size figure to calculate the actual market share that would have led to a zero market-share variance. Requirement 1. Calculate the market-share and market-size variances for Seattle Infonautics in the third quarter of 2020 (calculate all variances in terms of contribution margins). (Abbreviation used: CM= contribution margins) Begin by determining the formula for the market-share variance, then calculate the variance for Seattle Infonautics in the third quarter of 2020. Label the variance as favorable (F) or unfavorable (U). (For amounts entered into the formula, enter all amounts to two decimal places except for units.) Now determine the formula for the market-size variance, then calculate the variance for the third quarter of 2020 . Label the variance as favorable (F) or unfavorable (U). (For amounts entered into the formula, enter all amounts to two decimal places except for units. Round your final answer to the nearest whole number.) Requirement 2. Explain what happened based on the market-share and market-size variances. (Enter the variance as a positive number While the market share , the overall in the total market size results in a(n) salesquantity variance of Requirement 3. Calculate the actual market size, in units, that would have led to no market-size variance. Use this market-size figure to calculate the actual market share that would have led to a zero market-share variance. Using the formula that you determined above for the market-size variance, the actual market-size would need to be units, for there to be no variance. Use this market-size figure to calculate the actual market share that would have led to a zero market-share variance. The actual market share would need to be , in order for the market-share variance to equal $0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started