Answered step by step

Verified Expert Solution

Question

1 Approved Answer

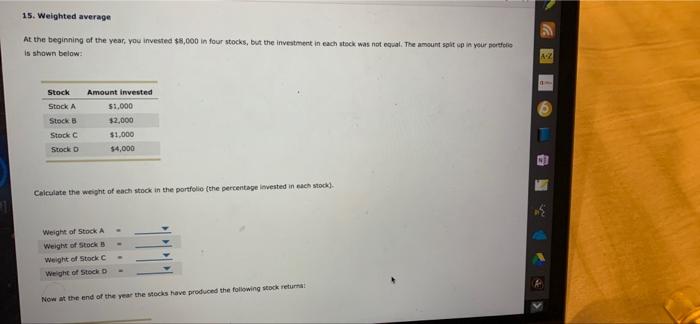

please explain how you got answers 15. Weighted average At the beginning of the year, you invested $8,000 in four stocks, but the investment in

please explain how you got answers

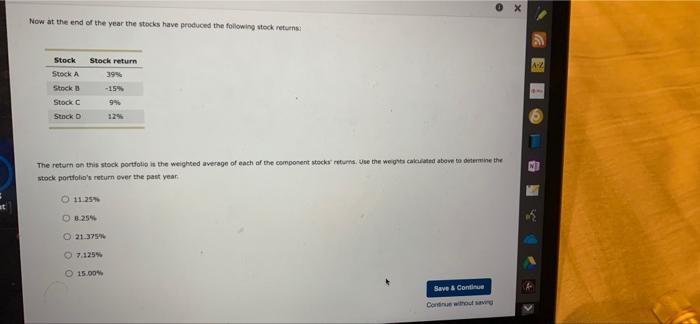

15. Weighted average At the beginning of the year, you invested $8,000 in four stocks, but the investment in each stock was not equal. The amount soit up in your portfolio is shown below: AZ Stock Stock A Stock Stock Stock Amount invested $1,000 $2,000 $1,000 $4,000 Calculate the weight of each stock in the portfolio (the percentage invested in each stock) Weight of Stock A Weight of Stock Weight of Stock Weight of Stock Now at the end of the year the stocks have produced the following stock returns Now at the end of the year the stocks have produced the following stock returns AZ Stock Stock return Stock 39% Stock -15% Stock 9% Stock The return on this stock portfolio is the weighted average of each of the component stock returns. Use the wes calculated above to termine the stock portfolo's return over the past year 11:25 0.8.255 21.375 7.125% 15.00 Save & Continue Catwo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started