Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Explain How You Got The Answer. Please Explain How You Got The Answer. Please Explain How You Got The Answer. 7. A company paid

Please Explain How You Got The Answer.

Please Explain How You Got The Answer.

Please Explain How You Got The Answer.

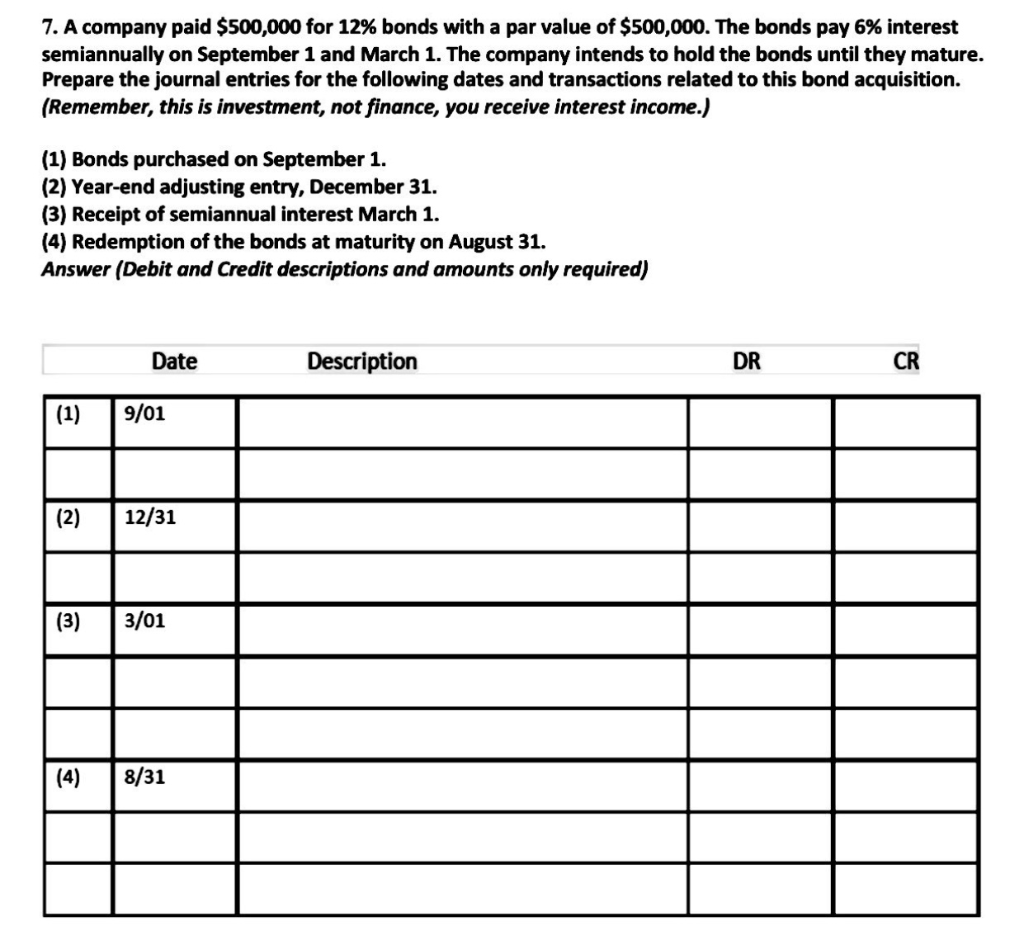

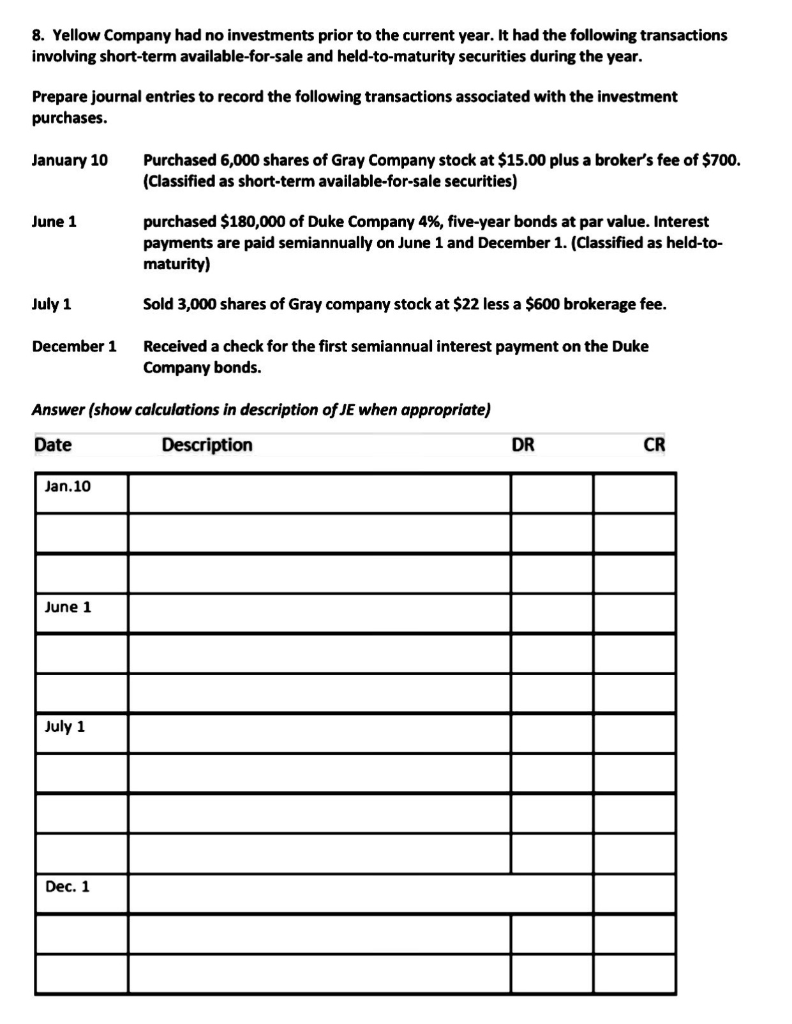

7. A company paid $500,000 for 12% bonds with a par value of $500,000. The bonds pay 6% interest semiannually on September 1 and March 1. The company intends to hold the bonds until they mature. Prepare the journal entries for the following dates and transactions related to this bond acquisition. (Remember, this is investment, not finance, you receive interest income.) (1) Bonds purchased on September 1. (2) Year-end adjusting entry, December 31. (3) Receipt of semiannual interest March 1. (4) Redemption of the bonds at maturity on August 31. Answer (Debit and Credit descriptions and amounts only required) Date Description DR CR (1) 9/01 (2) 12/31 (3) 3/01 (4) 8/31 8. Yellow Company had no investments prior to the current year. It had the following transactions involving short-term available-for-sale and held-to-maturity securities during the year. Prepare journal entries to record the following transactions associated with the investment purchases. January 10 Purchased 6,000 shares of Gray Company stock at $15.00 plus a broker's fee of $700. (Classified as short-term available-for-sale securities) June 1 purchased $180,000 of Duke Company 4%, five-year bonds at par value. Interest payments are paid semiannually on June 1 and December 1. (Classified as held-to- maturity) July 1 Sold 3,000 shares of Gray company stock at $22 less a $600 brokerage fee. December 1 Received a check for the first semiannual interest payment on the Duke Company bonds. Answer (show calculations in description of JE when appropriate) Date Description DR CR Jan. 10 June 1 July 1 Dec. 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started