Answered step by step

Verified Expert Solution

Question

1 Approved Answer

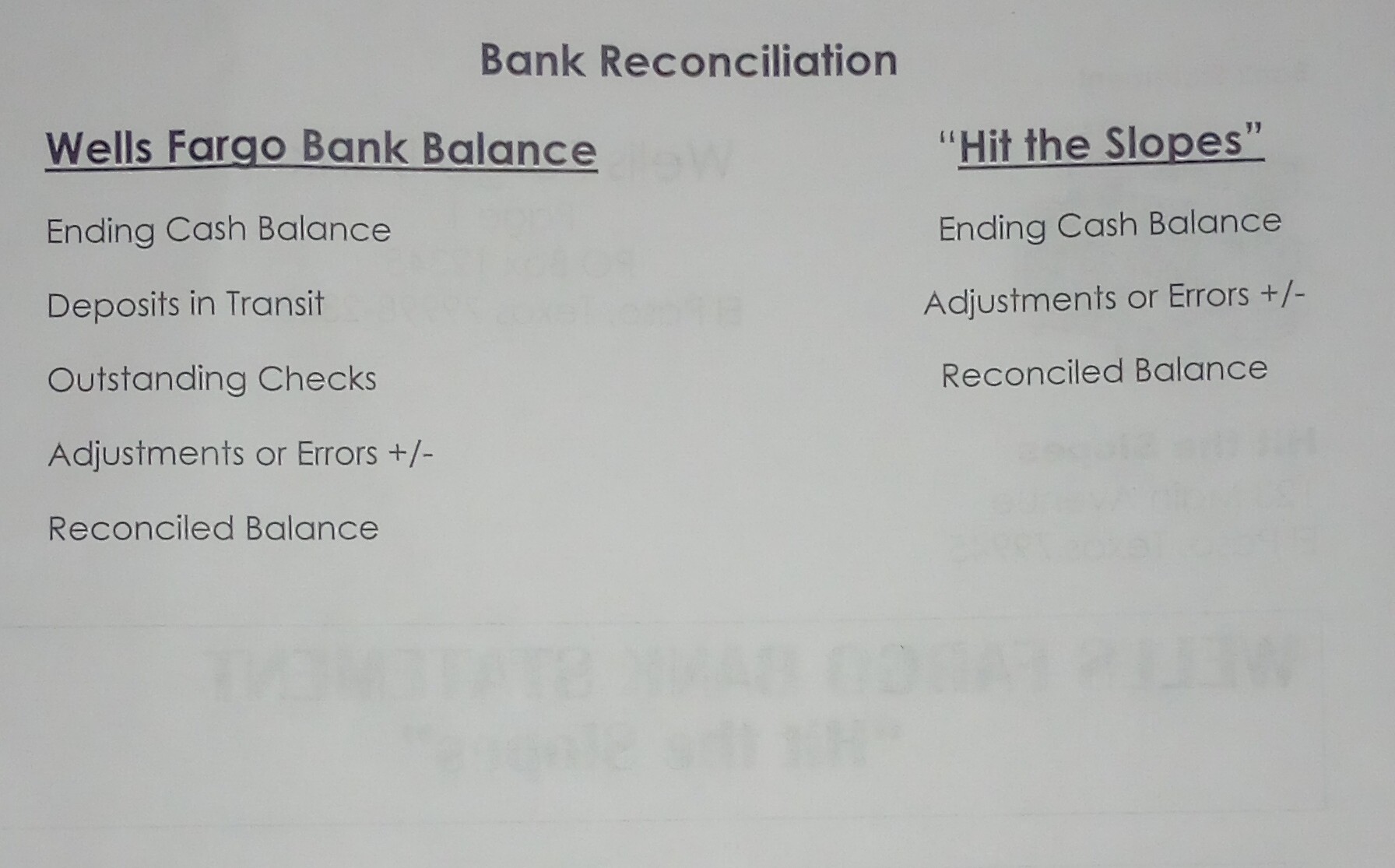

Please explain how you got the Bank Reconcile. Thank you Bank Reconciliation Wells Fargo Bank Balance Hit the Slopes Ending Cash Balance Ending Cash Balance

Please explain how you got the Bank Reconcile. Thank you

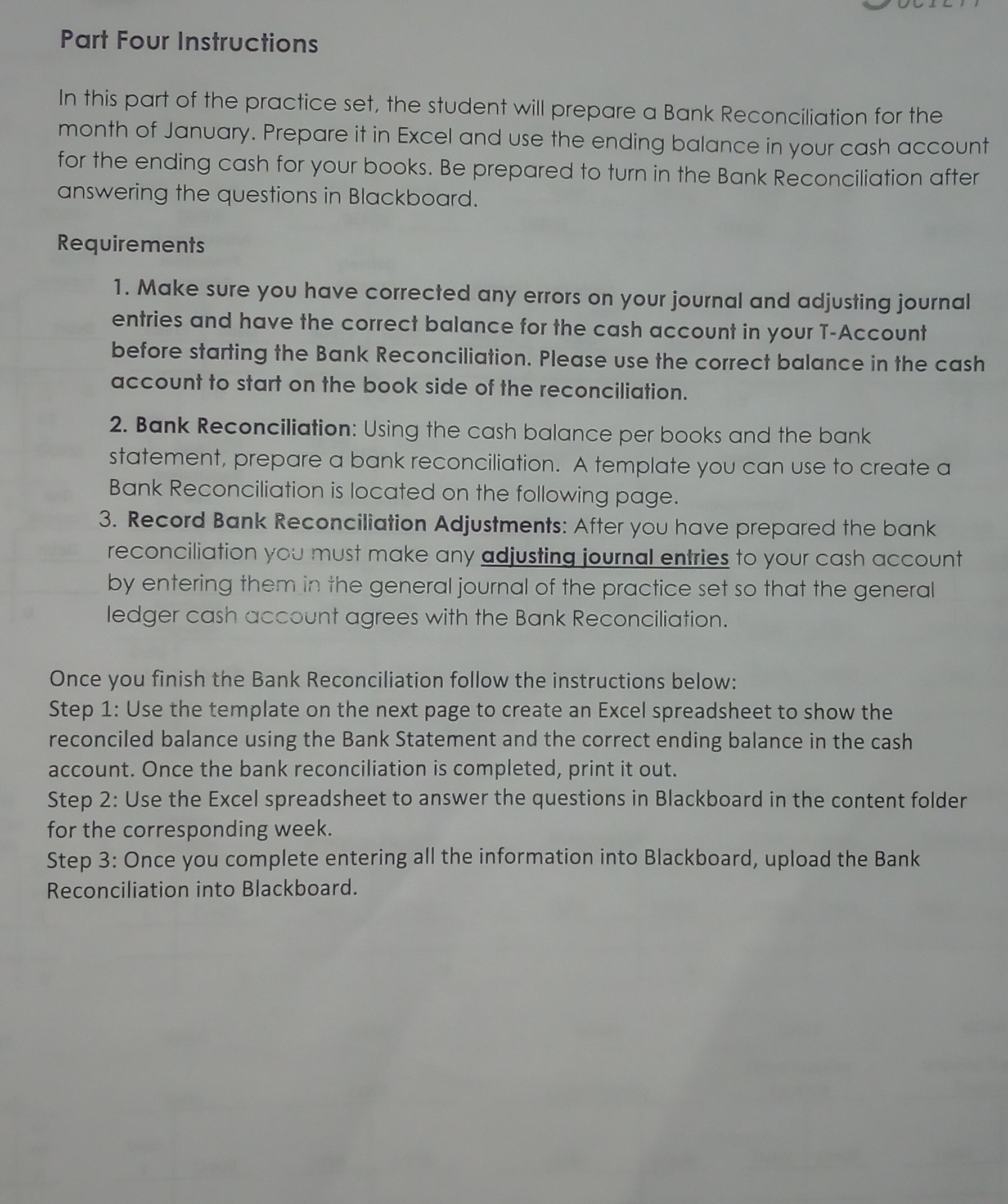

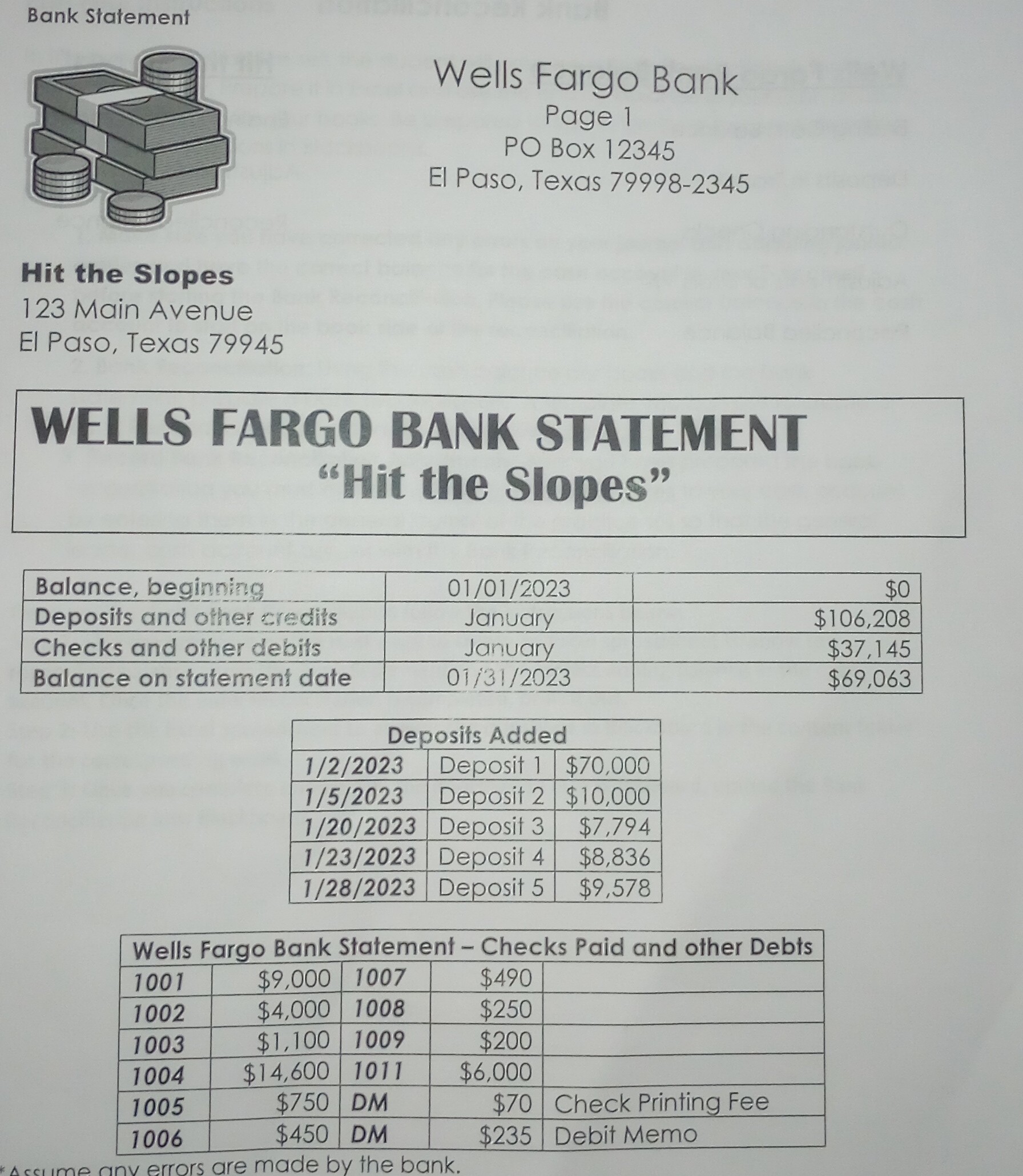

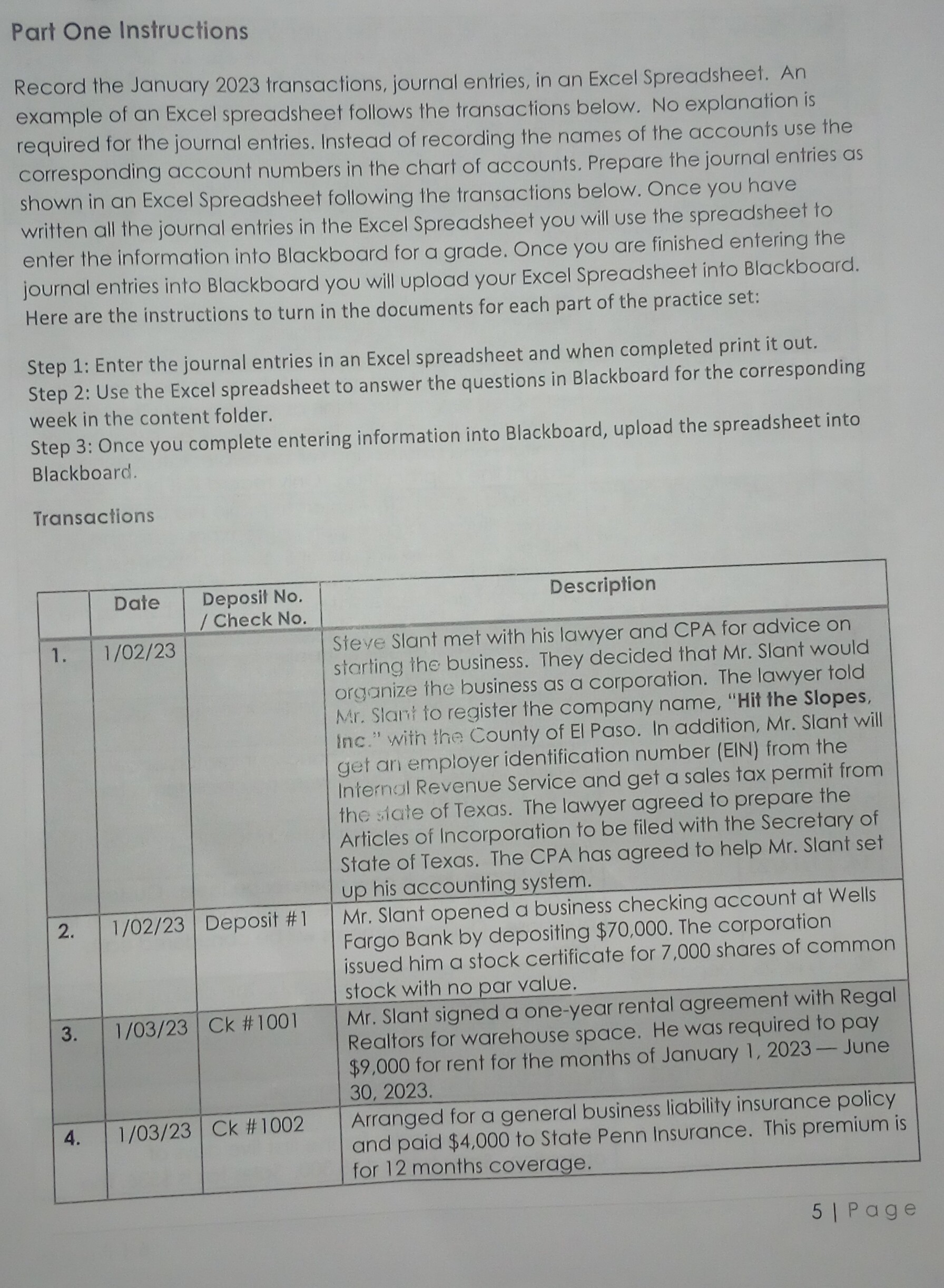

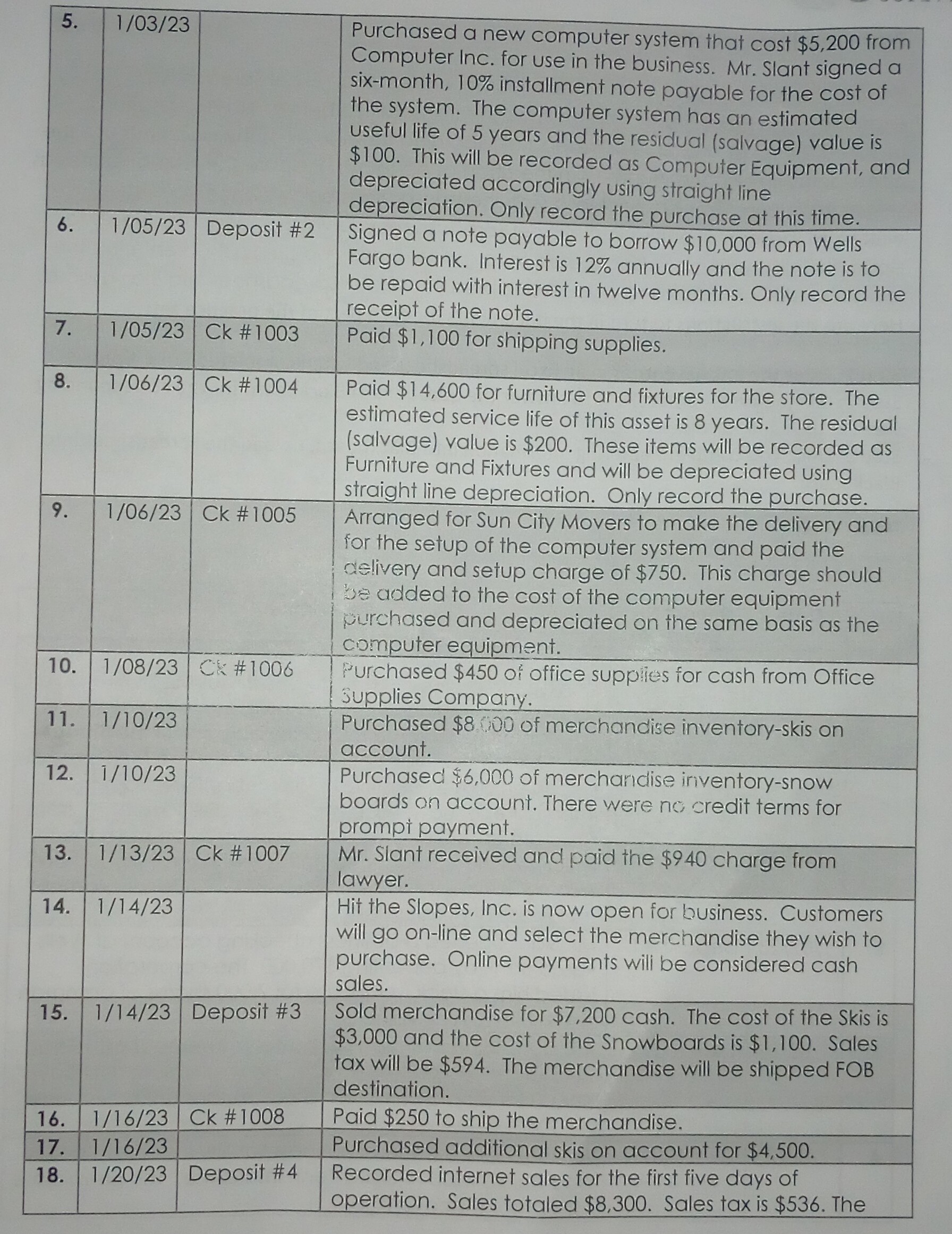

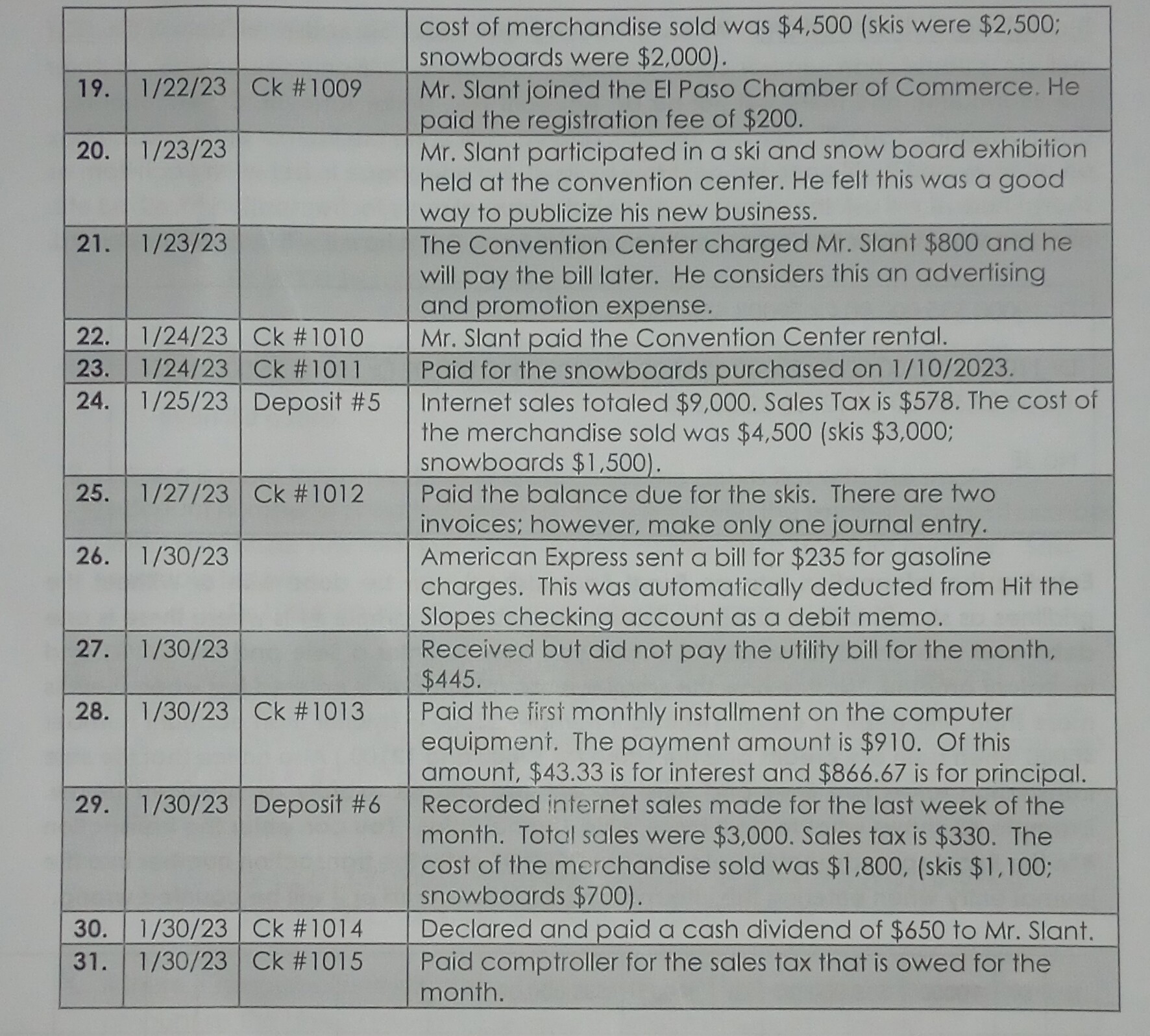

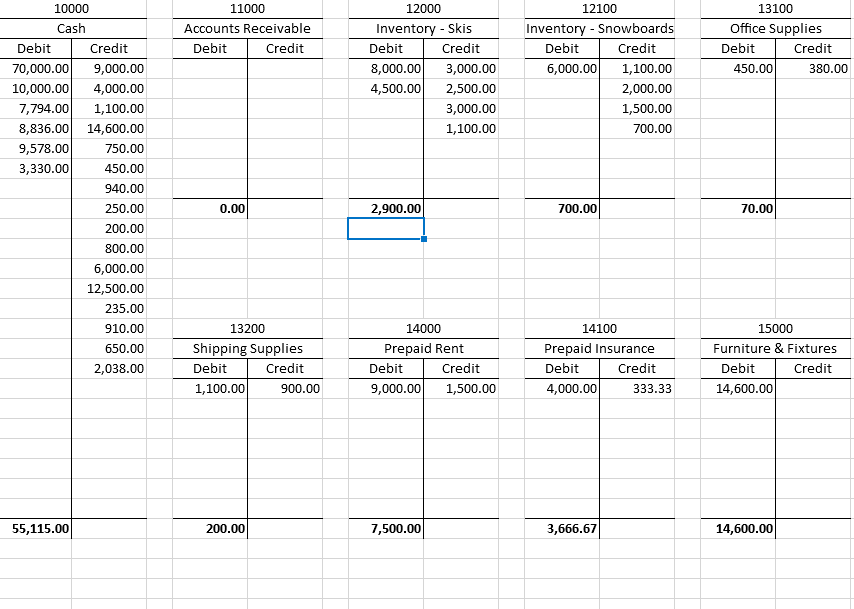

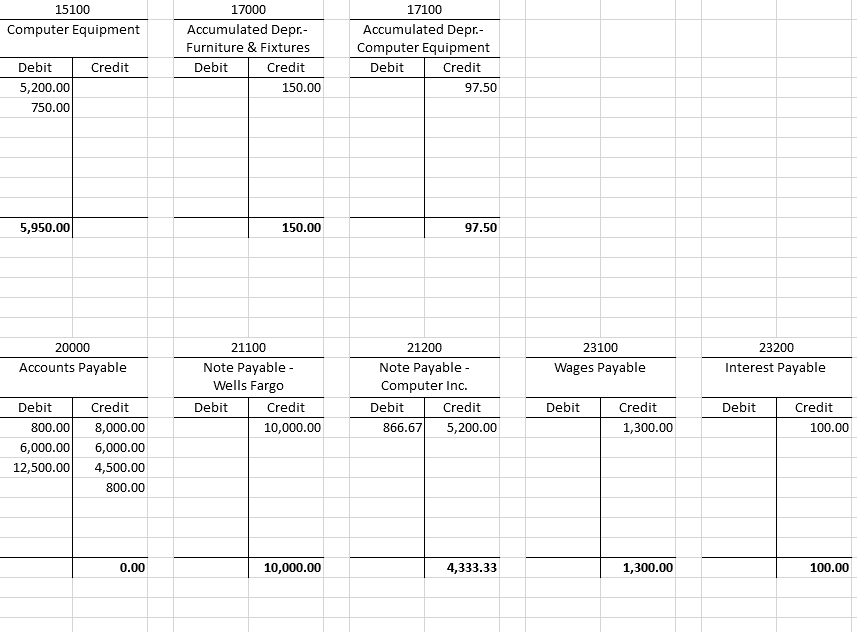

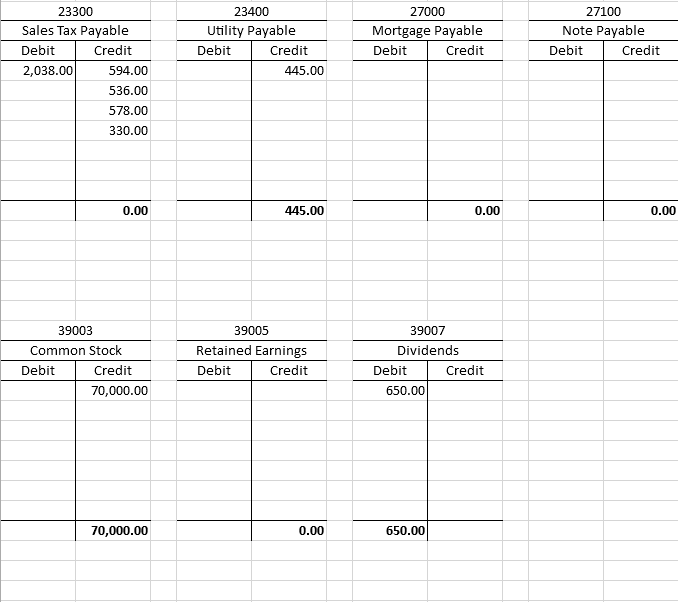

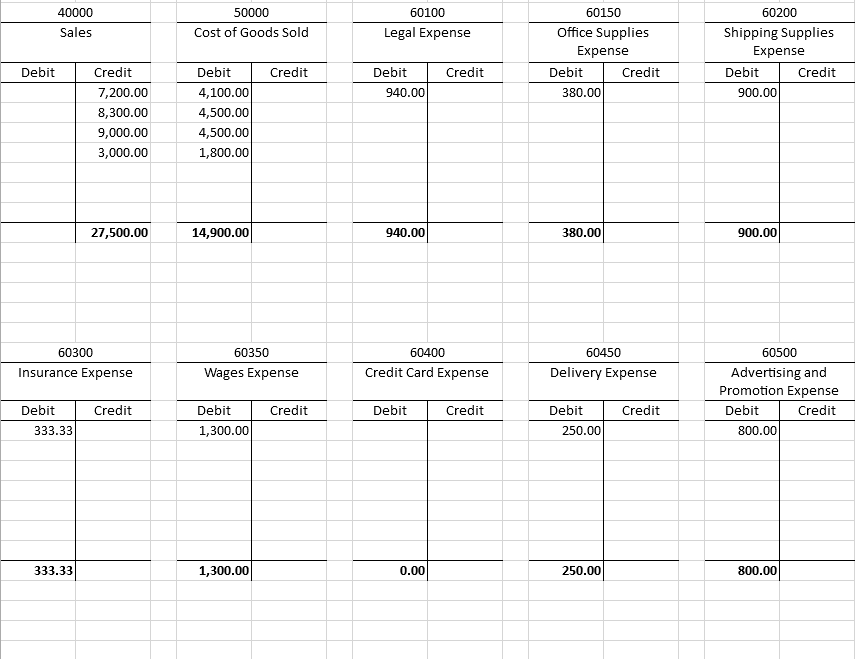

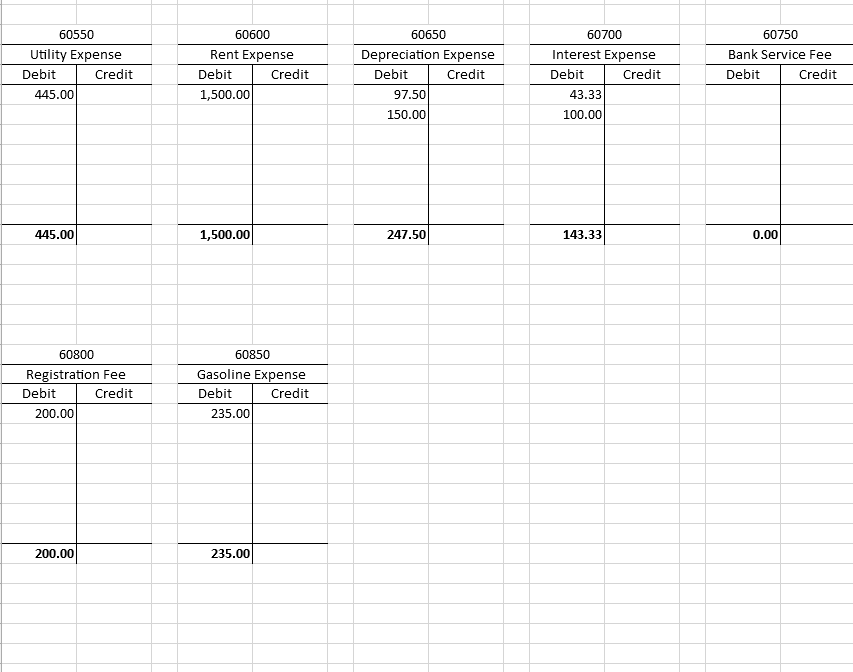

Bank Reconciliation Wells Fargo Bank Balance "Hit the Slopes" Ending Cash Balance Ending Cash Balance Deposits in Transit Adjustments or Errors +/- Outstanding Checks Reconciled Balance Adjustments or Errors +/- Reconciled Balance In this part of the practice set, the student will prepare a Bank Reconciliation for the month of January. Prepare it in Excel and use the ending balance in your cash account for the ending cash for your books. Be prepared to turn in the Bank Reconciliation after answering the questions in Blackboard. Requirements 1. Make sure you have correcied any errors on your journal and adjusting journal entries and have the correct balance for the cash account in your T-Account before starting the Bank Reconciliation. Please use the correct balance in the cash account to start on the book side of the reconciliation. 2. Bank Reconciliation: Using the cash balance per books and the bank statement, prepare a bank reconciliation. A template you can use to create a Bank Reconciliation is located on the following page. 3. Record Bank Reconciliation Adjustments: After you have prepared the bank reconciliation you must make any adjusting journal entries to your cash account by entering them in the general journal of the practice set so that the general ledger cash account agrees with the Bank Reconciliation. Once you finish the Bank Reconciliation follow the instructions below: Step 1: Use the template on the next page to create an Excel spreadsheet to show the reconciled balance using the Bank Statement and the correct ending balance in the cash account. Once the bank reconciliation is completed, print it out. Step 2: Use the Excel spreadsheet to answer the questions in Blackboard in the content folder for the corresponding week. Step 3: Once you complete entering all the information into Blackboard, upload the Bank Reconciliation into Blackboard. Bank Statement Wells Fargo Bank Page 1 PO Box 12345 El Paso, Texas 79998-2345 Hit the Slopes 123 Main Avenue El Paso, Texas 79945 WELLS FARGO BANK STATEMENT "Hit the Slopes" Part One Instructions Record the January 2023 transactions, journal entries, in an Excel Spreadsheet. An example of an Excel spreadsheet follows the transactions below. No explanation is required for the journal entries. Instead of recording the names of the accounts use the corresponding account numbers in the chart of accounts. Prepare the journal entries as shown in an Excel Spreadsheet following the transactions below. Once you have written all the journal entries in the Excel Spreadsheet you will use the spreadsheet to enter the information into Blackboard for a grade. Once you are finished entering the journal entries into Blackboard you will upload your Excel Spreadsheet into Blackboard. Here are the instructions to turn in the documents for each part of the practice set: Step 1: Enter the journal entries in an Excel spreadsheet and when completed print it out. Step 2: Use the Excel spreadsheet to answer the questions in Blackboard for the corresponding week in the content folder. Step 3: Once you complete entering information into Blackboard, upload the spreadsheet into Blackboard. \begin{tabular}{|c|r|} \hline \multicolumn{2}{|c|}{13100} \\ \hline Office Supplies \\ \hline Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline 450.00 & 380.00 \\ \hline & \\ \hline 70.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \multicolumn{2}{c|}{14000} \\ \hline \multicolumn{2}{|c|}{ Prepaid Rent } \\ \hline Debit & Credit \\ \hline 9,000.00 & 1,500.00 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{14100} \\ \hline \multicolumn{2}{|c|}{ Prepaid Insurance } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline 4,000.00 & 333.33 \\ \hline & \\ \hline 3,666.67 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \multicolumn{2}{|c}{15000} \\ \hline \multicolumn{2}{|c|}{ Furniture \& Fixtures } \\ \hline Debit & Credit \\ \hline 14,600.00 & \\ & \\ \hline 14,600.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \multicolumn{2}{c|}{17000} \\ \hline \multicolumn{2}{|c|}{ Accumulated Depr.- } \\ Furniture \& Fixtures \\ \hline Debit & Credit \\ \hline & 150.00 \\ \hline & \\ \hline & 150.00 \\ \hline \end{tabular} \begin{tabular}{|} \multicolumn{2}{|c|}{20000} \\ \hline \multicolumn{2}{|c|}{ Accounts Payable } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline 800.00 & 8,000.00 \\ \hline 6,000.00 & 6,000.00 \\ \hline 12,500.00 & 4,500.00 \\ & 800.00 \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{21100} \\ \hline \multicolumn{2}{|c|}{NotePayable-WellsFargo} \\ \hline Debit & Credit \\ \hline & 10,000.00 \\ \hline & \\ \hline & 10,000.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{21200} \\ \hline \multicolumn{2}{|c|}{NotePayable-ComputerInc.} \\ \hline Debit & Credit \\ \hline 866.67 & 5,200.00 \\ & \\ \hline & 4,333.33 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{23100} \\ \hline Wages Payable \\ \hline Debit & Credit \\ \hline & 1,300.00 \\ \hline & \\ \hline & 1,300.00 \\ \hline \end{tabular} \begin{tabular}{|} \multicolumn{2}{|c|}{23200} \\ \hline \multicolumn{2}{|c|}{ Interest Payable } \\ \hline Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline & 100.00 \\ \hline & \\ \hline & 100.00 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{23300} \\ \hline \multicolumn{2}{|c|}{ Sales Tax Payable } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline 2,038.00 & 594.00 \\ \hline & 536.00 \\ & 578.00 \\ & 330.00 \\ \hline & \\ \hline & 0.00 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{2}{c|}{23400} \\ \hline \multicolumn{2}{|c|}{ Utility Payable } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline & 445.00 \\ \hline & 445.00 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \multicolumn{2}{|c}{27000} \\ \hline \multicolumn{2}{|c|}{ Mortgage Payable } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline & 0.00 \\ \hline \end{tabular} 27100 \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Note Payable } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline & \\ \hline & 0.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{39007} \\ \hline \multicolumn{2}{c|}{ Dividends } \\ \hline Debit & Credit \\ \hline 650.00 & \\ \hline & \\ \hline 650.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{60100} \\ \hline Legal Expense \\ \hline Debit & Credit \\ \hline 940.00 & \\ \hline & \\ \hline 940.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{60150} \\ \hline \multicolumn{2}{c|}{ Office Supplies } \\ Expense \\ \hline Debit & Credit \\ \hline 380.00 & \\ \hline & \\ \hline 380.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60300} \\ \hline Insurance Expense \\ \hline Debit & Credit \\ \hline 333.33 & \\ \hline & \\ \hline & \\ \hline 333.33 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60350} \\ \hline \multicolumn{2}{|c|}{ Wages Expense } \\ \hline Debit & Credit \\ \hline 1,300.00 & \\ & \\ \hline 1,300.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c}{60400} \\ \hline Credit Card Expense \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline 0.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{60450} \\ \hline \multicolumn{2}{|c|}{ Delivery Expense } \\ \hline Debit & Credit \\ \hline 250.00 & \\ \hline & \\ \hline 250.00 & \\ \hline \end{tabular} \begin{tabular}{|r|c|} \multicolumn{2}{c|}{60650} \\ \hline \multicolumn{2}{|c|}{ Depreciation Expense } \\ \hline Debit & Credit \\ \hline 97.50 & \\ 150.00 & \\ \hline & \\ \hline 247.50 & \\ \hline \end{tabular} \begin{tabular}{|r|r|} \multicolumn{2}{c}{60700} \\ \hline \multicolumn{2}{c|}{ Interest Expense } \\ \hline Debit & Credit \\ \hline 43.33 & \\ \hline 100.00 & \\ \hline & \\ \hline 143.33 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60750} \\ \hline \multicolumn{2}{|c|}{ Bank Service Fee } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline 0.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60800} \\ \hline \multicolumn{2}{|c|}{ Registration Fee } \\ \hline Debit & Credit \\ \hline 200.00 & \\ \hline & \\ \hline & \\ \hline 200.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c} \multicolumn{2}{c}{60850} \\ \hline \multicolumn{2}{|c}{ Gasoline Expense } \\ \hline Debit & Credit \\ \hline 235.00 & \\ \hline \end{tabular} Bank Reconciliation Wells Fargo Bank Balance "Hit the Slopes" Ending Cash Balance Ending Cash Balance Deposits in Transit Adjustments or Errors +/- Outstanding Checks Reconciled Balance Adjustments or Errors +/- Reconciled Balance In this part of the practice set, the student will prepare a Bank Reconciliation for the month of January. Prepare it in Excel and use the ending balance in your cash account for the ending cash for your books. Be prepared to turn in the Bank Reconciliation after answering the questions in Blackboard. Requirements 1. Make sure you have correcied any errors on your journal and adjusting journal entries and have the correct balance for the cash account in your T-Account before starting the Bank Reconciliation. Please use the correct balance in the cash account to start on the book side of the reconciliation. 2. Bank Reconciliation: Using the cash balance per books and the bank statement, prepare a bank reconciliation. A template you can use to create a Bank Reconciliation is located on the following page. 3. Record Bank Reconciliation Adjustments: After you have prepared the bank reconciliation you must make any adjusting journal entries to your cash account by entering them in the general journal of the practice set so that the general ledger cash account agrees with the Bank Reconciliation. Once you finish the Bank Reconciliation follow the instructions below: Step 1: Use the template on the next page to create an Excel spreadsheet to show the reconciled balance using the Bank Statement and the correct ending balance in the cash account. Once the bank reconciliation is completed, print it out. Step 2: Use the Excel spreadsheet to answer the questions in Blackboard in the content folder for the corresponding week. Step 3: Once you complete entering all the information into Blackboard, upload the Bank Reconciliation into Blackboard. Bank Statement Wells Fargo Bank Page 1 PO Box 12345 El Paso, Texas 79998-2345 Hit the Slopes 123 Main Avenue El Paso, Texas 79945 WELLS FARGO BANK STATEMENT "Hit the Slopes" Part One Instructions Record the January 2023 transactions, journal entries, in an Excel Spreadsheet. An example of an Excel spreadsheet follows the transactions below. No explanation is required for the journal entries. Instead of recording the names of the accounts use the corresponding account numbers in the chart of accounts. Prepare the journal entries as shown in an Excel Spreadsheet following the transactions below. Once you have written all the journal entries in the Excel Spreadsheet you will use the spreadsheet to enter the information into Blackboard for a grade. Once you are finished entering the journal entries into Blackboard you will upload your Excel Spreadsheet into Blackboard. Here are the instructions to turn in the documents for each part of the practice set: Step 1: Enter the journal entries in an Excel spreadsheet and when completed print it out. Step 2: Use the Excel spreadsheet to answer the questions in Blackboard for the corresponding week in the content folder. Step 3: Once you complete entering information into Blackboard, upload the spreadsheet into Blackboard. \begin{tabular}{|c|r|} \hline \multicolumn{2}{|c|}{13100} \\ \hline Office Supplies \\ \hline Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline 450.00 & 380.00 \\ \hline & \\ \hline 70.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \multicolumn{2}{c|}{14000} \\ \hline \multicolumn{2}{|c|}{ Prepaid Rent } \\ \hline Debit & Credit \\ \hline 9,000.00 & 1,500.00 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{14100} \\ \hline \multicolumn{2}{|c|}{ Prepaid Insurance } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline 4,000.00 & 333.33 \\ \hline & \\ \hline 3,666.67 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \multicolumn{2}{|c}{15000} \\ \hline \multicolumn{2}{|c|}{ Furniture \& Fixtures } \\ \hline Debit & Credit \\ \hline 14,600.00 & \\ & \\ \hline 14,600.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \multicolumn{2}{c|}{17000} \\ \hline \multicolumn{2}{|c|}{ Accumulated Depr.- } \\ Furniture \& Fixtures \\ \hline Debit & Credit \\ \hline & 150.00 \\ \hline & \\ \hline & 150.00 \\ \hline \end{tabular} \begin{tabular}{|} \multicolumn{2}{|c|}{20000} \\ \hline \multicolumn{2}{|c|}{ Accounts Payable } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline 800.00 & 8,000.00 \\ \hline 6,000.00 & 6,000.00 \\ \hline 12,500.00 & 4,500.00 \\ & 800.00 \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{21100} \\ \hline \multicolumn{2}{|c|}{NotePayable-WellsFargo} \\ \hline Debit & Credit \\ \hline & 10,000.00 \\ \hline & \\ \hline & 10,000.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{21200} \\ \hline \multicolumn{2}{|c|}{NotePayable-ComputerInc.} \\ \hline Debit & Credit \\ \hline 866.67 & 5,200.00 \\ & \\ \hline & 4,333.33 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{23100} \\ \hline Wages Payable \\ \hline Debit & Credit \\ \hline & 1,300.00 \\ \hline & \\ \hline & 1,300.00 \\ \hline \end{tabular} \begin{tabular}{|} \multicolumn{2}{|c|}{23200} \\ \hline \multicolumn{2}{|c|}{ Interest Payable } \\ \hline Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline & 100.00 \\ \hline & \\ \hline & 100.00 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{23300} \\ \hline \multicolumn{2}{|c|}{ Sales Tax Payable } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline 2,038.00 & 594.00 \\ \hline & 536.00 \\ & 578.00 \\ & 330.00 \\ \hline & \\ \hline & 0.00 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{2}{c|}{23400} \\ \hline \multicolumn{2}{|c|}{ Utility Payable } \\ \hline Debit & \multicolumn{1}{c|}{ Credit } \\ \hline & 445.00 \\ \hline & 445.00 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \multicolumn{2}{|c}{27000} \\ \hline \multicolumn{2}{|c|}{ Mortgage Payable } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline & 0.00 \\ \hline \end{tabular} 27100 \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Note Payable } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline & \\ \hline & 0.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{39007} \\ \hline \multicolumn{2}{c|}{ Dividends } \\ \hline Debit & Credit \\ \hline 650.00 & \\ \hline & \\ \hline 650.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{60100} \\ \hline Legal Expense \\ \hline Debit & Credit \\ \hline 940.00 & \\ \hline & \\ \hline 940.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{60150} \\ \hline \multicolumn{2}{c|}{ Office Supplies } \\ Expense \\ \hline Debit & Credit \\ \hline 380.00 & \\ \hline & \\ \hline 380.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60300} \\ \hline Insurance Expense \\ \hline Debit & Credit \\ \hline 333.33 & \\ \hline & \\ \hline & \\ \hline 333.33 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60350} \\ \hline \multicolumn{2}{|c|}{ Wages Expense } \\ \hline Debit & Credit \\ \hline 1,300.00 & \\ & \\ \hline 1,300.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c}{60400} \\ \hline Credit Card Expense \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline 0.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{c|}{60450} \\ \hline \multicolumn{2}{|c|}{ Delivery Expense } \\ \hline Debit & Credit \\ \hline 250.00 & \\ \hline & \\ \hline 250.00 & \\ \hline \end{tabular} \begin{tabular}{|r|c|} \multicolumn{2}{c|}{60650} \\ \hline \multicolumn{2}{|c|}{ Depreciation Expense } \\ \hline Debit & Credit \\ \hline 97.50 & \\ 150.00 & \\ \hline & \\ \hline 247.50 & \\ \hline \end{tabular} \begin{tabular}{|r|r|} \multicolumn{2}{c}{60700} \\ \hline \multicolumn{2}{c|}{ Interest Expense } \\ \hline Debit & Credit \\ \hline 43.33 & \\ \hline 100.00 & \\ \hline & \\ \hline 143.33 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60750} \\ \hline \multicolumn{2}{|c|}{ Bank Service Fee } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline 0.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{60800} \\ \hline \multicolumn{2}{|c|}{ Registration Fee } \\ \hline Debit & Credit \\ \hline 200.00 & \\ \hline & \\ \hline & \\ \hline 200.00 & \\ \hline \end{tabular} \begin{tabular}{|c|c} \multicolumn{2}{c}{60850} \\ \hline \multicolumn{2}{|c}{ Gasoline Expense } \\ \hline Debit & Credit \\ \hline 235.00 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started