Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain how you got the specific numbers or show the journal entries. Tony and Suzie see the need for a rugged all-terrain vehicle to

Please explain how you got the specific numbers or show the journal entries.

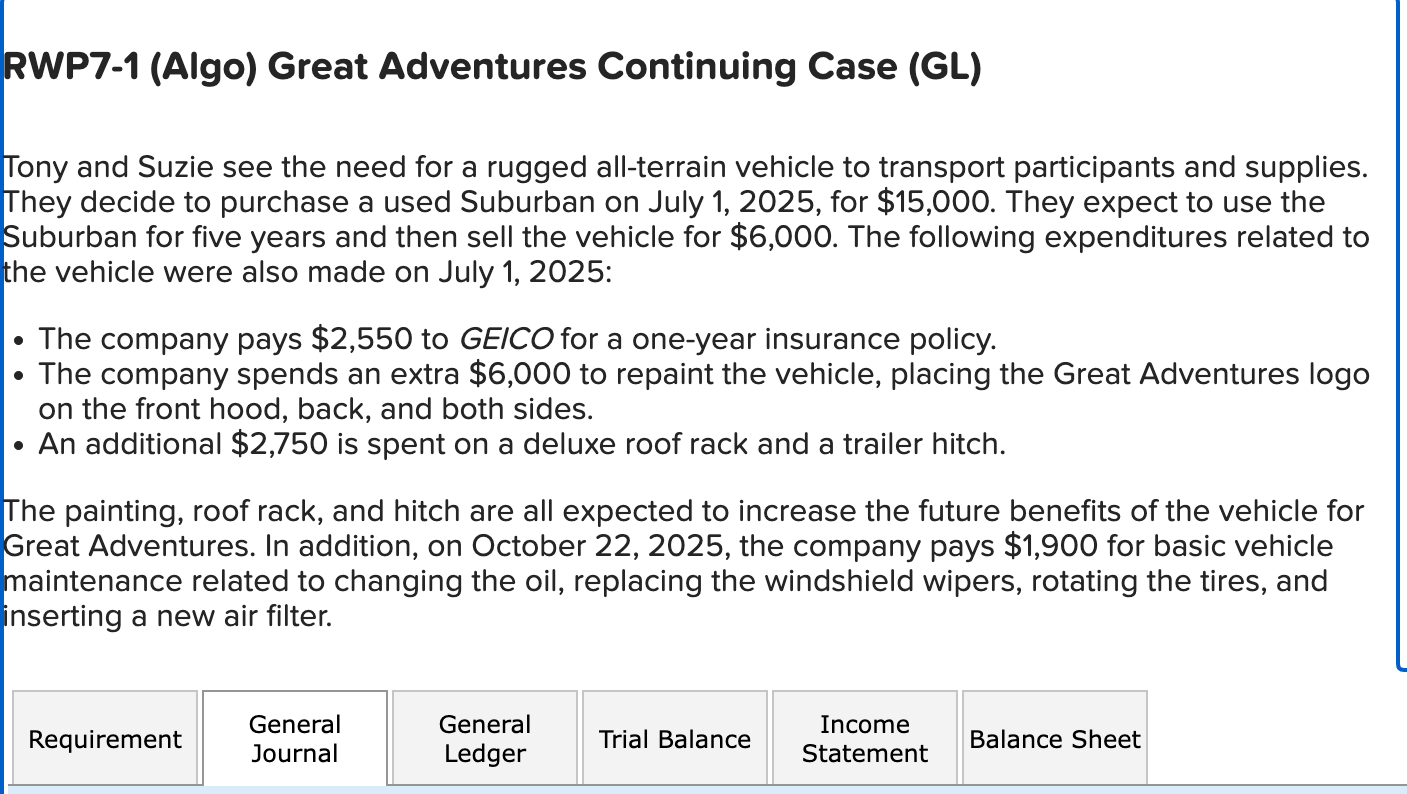

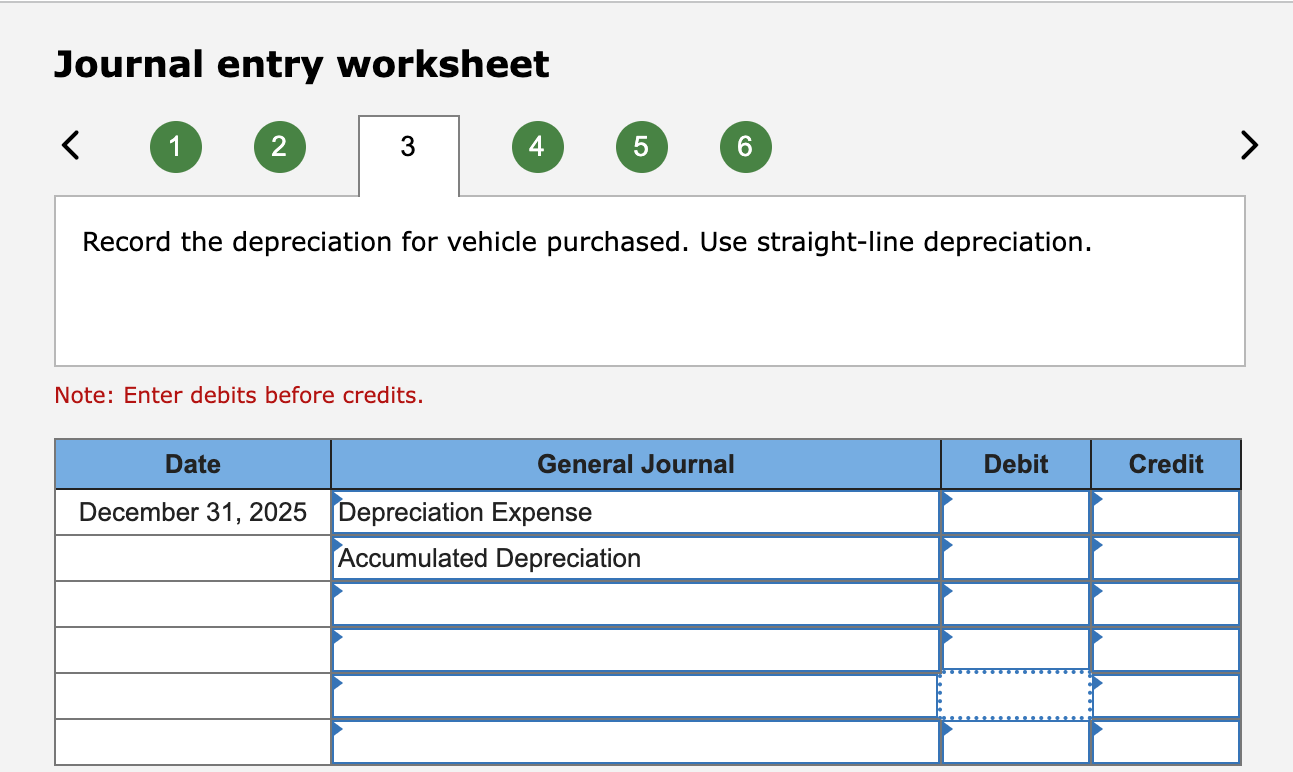

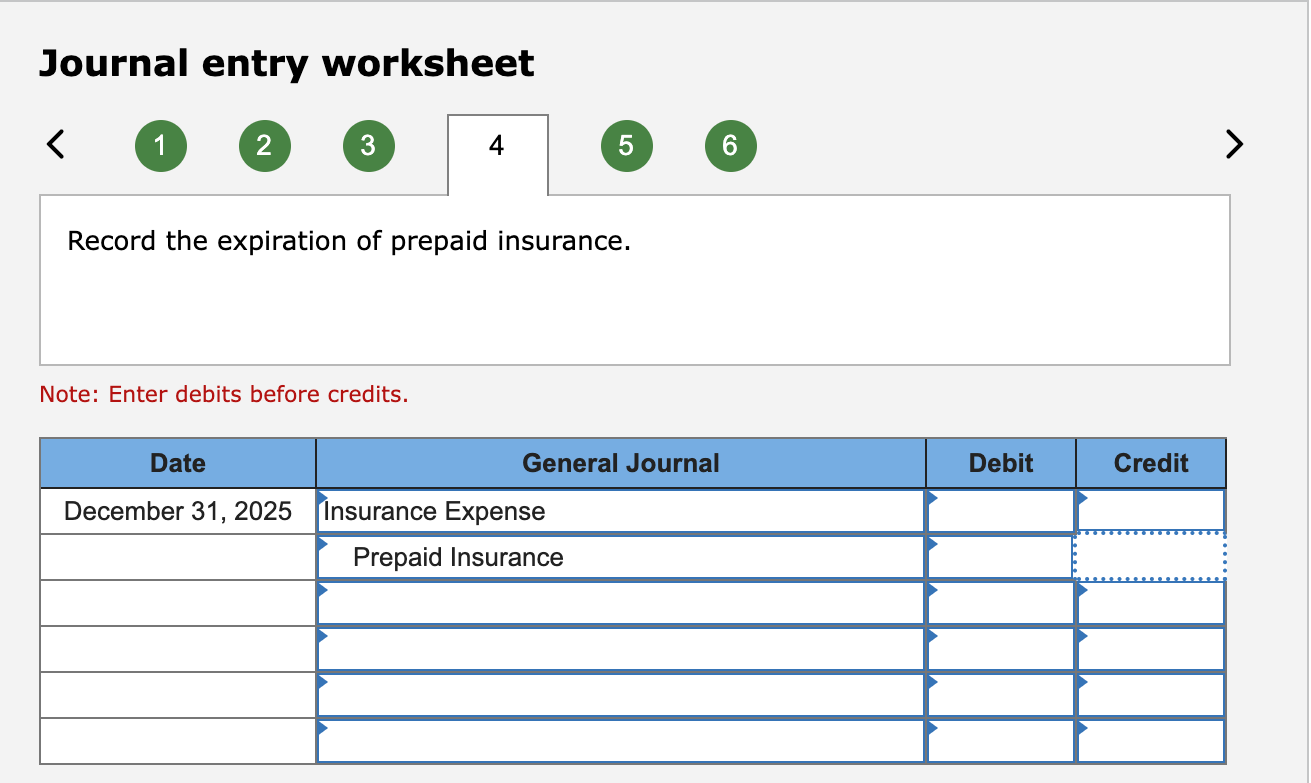

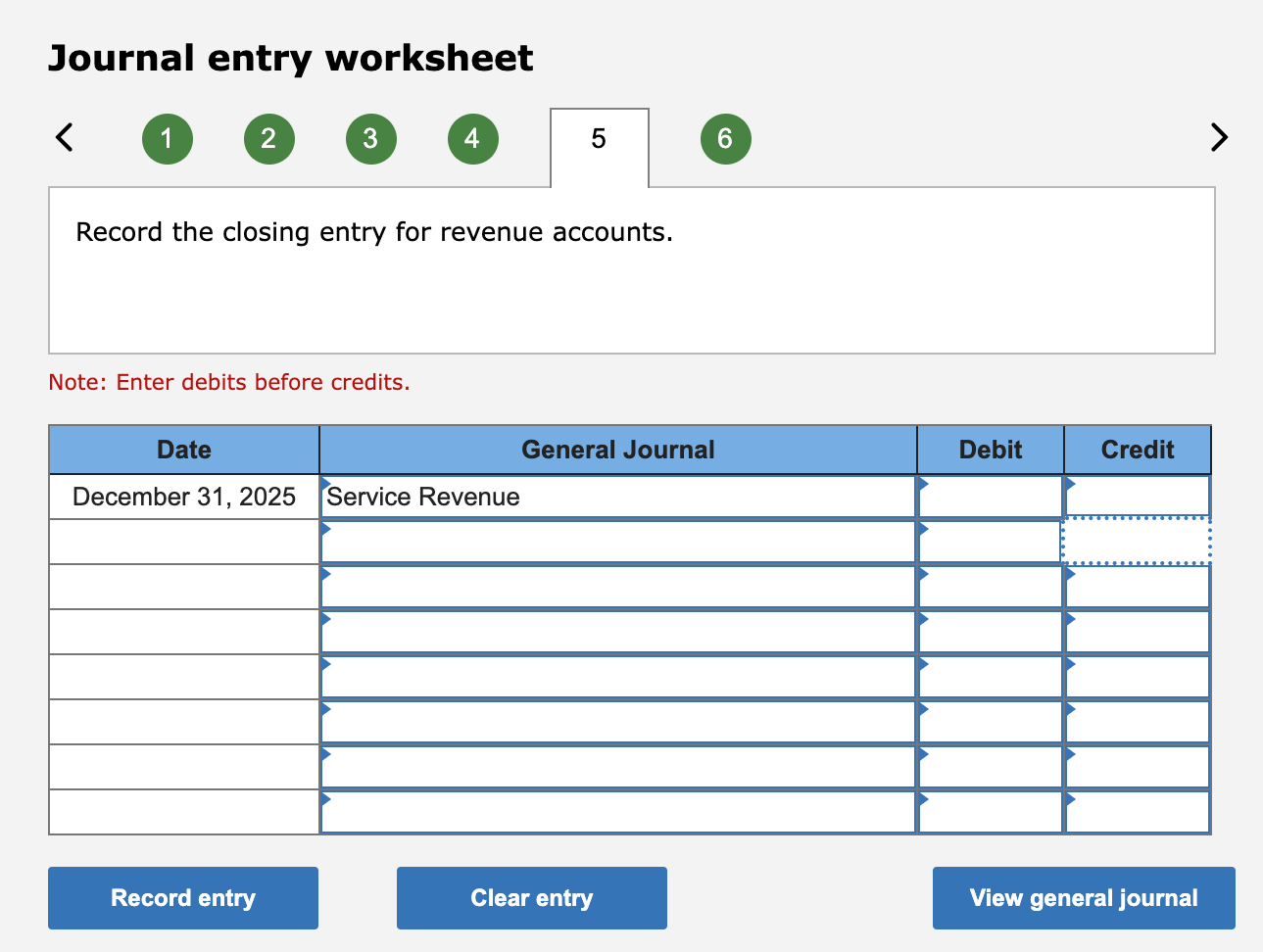

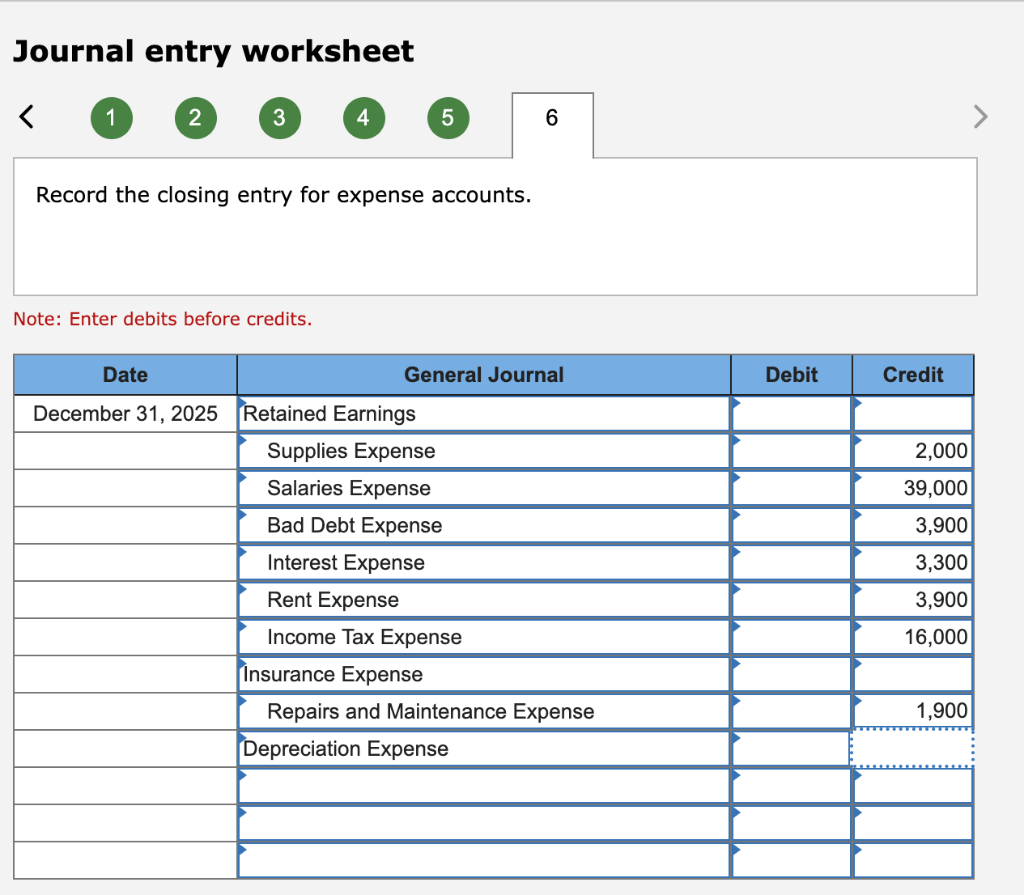

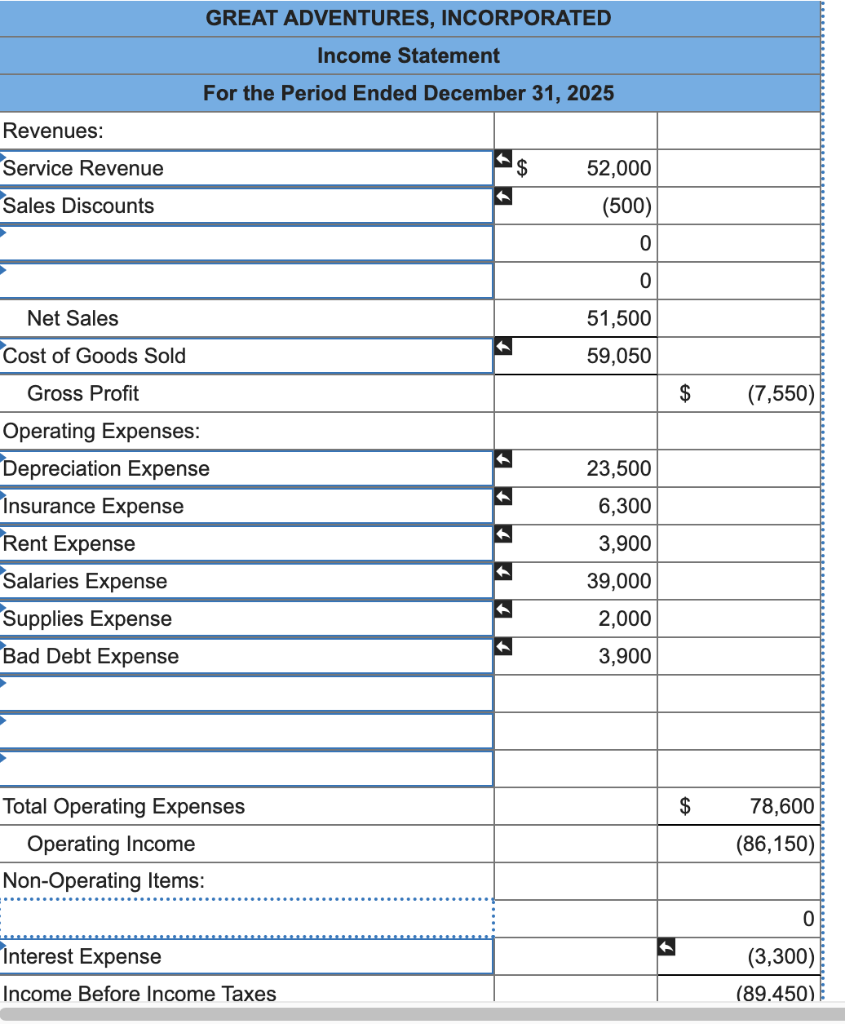

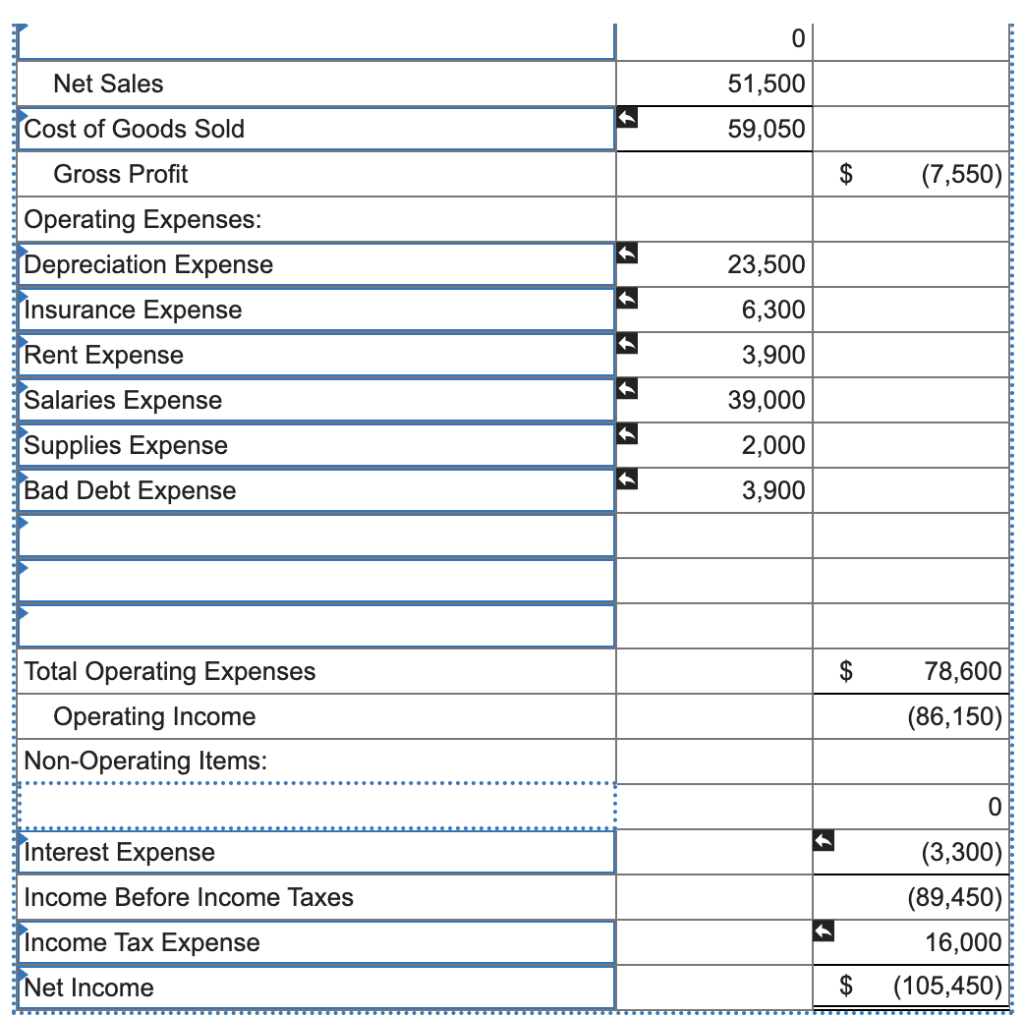

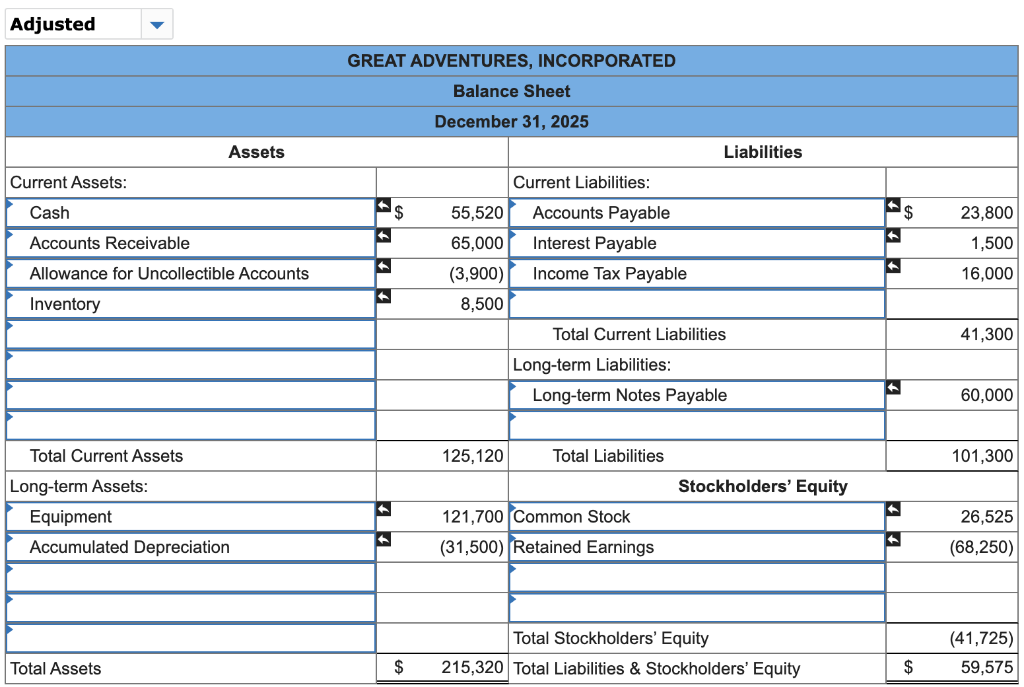

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025 , for $15,000. They expect to use the Suburban for five years and then sell the vehicle for $6,000. The following expenditures related to the vehicle were also made on July 1,2025 : - The company pays $2,550 to GEICO for a one-year insurance policy. - The company spends an extra $6,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,750 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2025, the company pays $1,900 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Journal entry worksheet Record the depreciation for vehicle purchased. Use straight-line depreciation. Note: Enter debits before credits. Journal entry worksheet 1 2 Note: Enter debits before credits. Journal entry worksheet 2 Record the closing entry for revenue accounts. Note: Enter debits before credits. Journal entry worksheet Record the closing entry for expense accounts. Note: Enter debits before credits. GREAT ADVENTURES, INCORPORATED Income Statement For the Period Ended December 31, 2025 Revenues: Service Revenue Sales Discounts \begin{tabular}{c} Net Sales \\ Cost of Goods Sold \\ \hline Gross Profit \\ \hline Operating Expenses: \end{tabular} Depreciation Expense A 23,500 Insurance Expense Rent Expense 3,900 Salaries Expense Supplies Expense Bad Debt Expense Total Operating Expenses Operating Income Non-Operating Items: \begin{tabular}{l|r|} Interest Expense & 0 \\ \hline Income Before Income Taxes & (3,300) \\ \hline \end{tabular} Adjusted GREAT ADVENTURES, INCORPORATED Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started