Question

Please explain!!!! I have answers to all of these, but have no idea how to get the correct answer. 5. Larry purchased Bond Q four

Please explain!!!! I have answers to all of these, but have no idea how to get the correct answer.

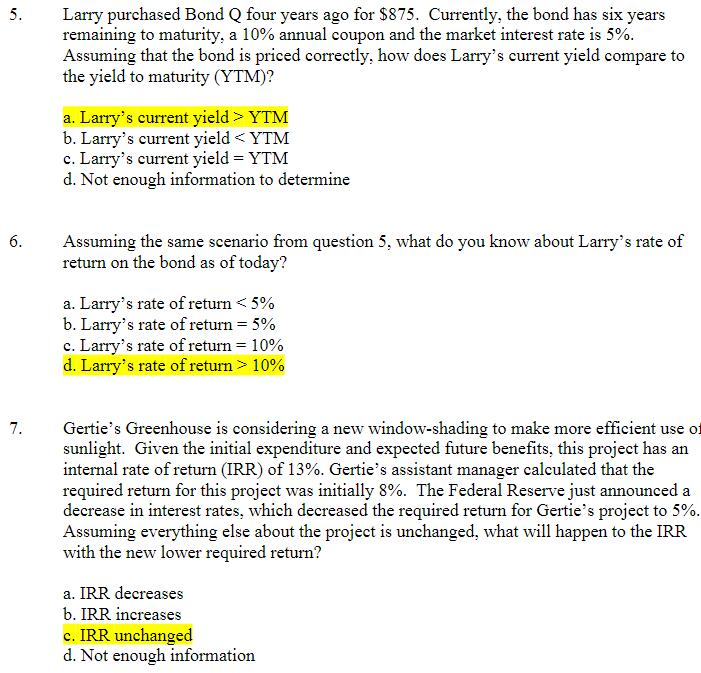

5. Larry purchased Bond Q four years ago for $875. Currently, the bond has six years remaining to maturity, a 10% annual coupon and the market interest rate is 5%.

Assuming that the bond is priced correctly, how does Larrys current yield compare to the yield to maturity (YTM)?

a. Larrys current yield > YTM

b. Larrys current yield

c. Larrys current yield = YTM

d. Not enough information to determine

6. Assuming the same scenario from question 5, what do you know about Larrys rate of return on the bond as of today?

a. Larrys rate of return

b. Larrys rate of return = 5%

c. Larrys rate of return = 10%

d. Larrys rate of return > 10%

7. Gerties Greenhouse is considering a new window-shading to make more efficient use of sunlight. Given the initial expenditure and expected future benefits, this project has an internal rate of return (IRR) of 13%. Gerties assistant manager calculated that the required return for this project was initially 8%. The Federal Reserve just announced a decrease in interest rates, which decreased the required return for Gerties project to 5%. Assuming everything else about the project is unchanged, what will happen to the IRR with the new lower required return?

a. IRR decreases

b. IRR increases

c. IRR unchanged

d. Not enough information

Picture Format, in case I missed something while copying.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started