Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain in detail how to solve this question OA-14 Close Date: Sat, Apr 9, 2022, 04:00 PM Question 4 of 6 A mortgage for

please explain in detail how to solve this question

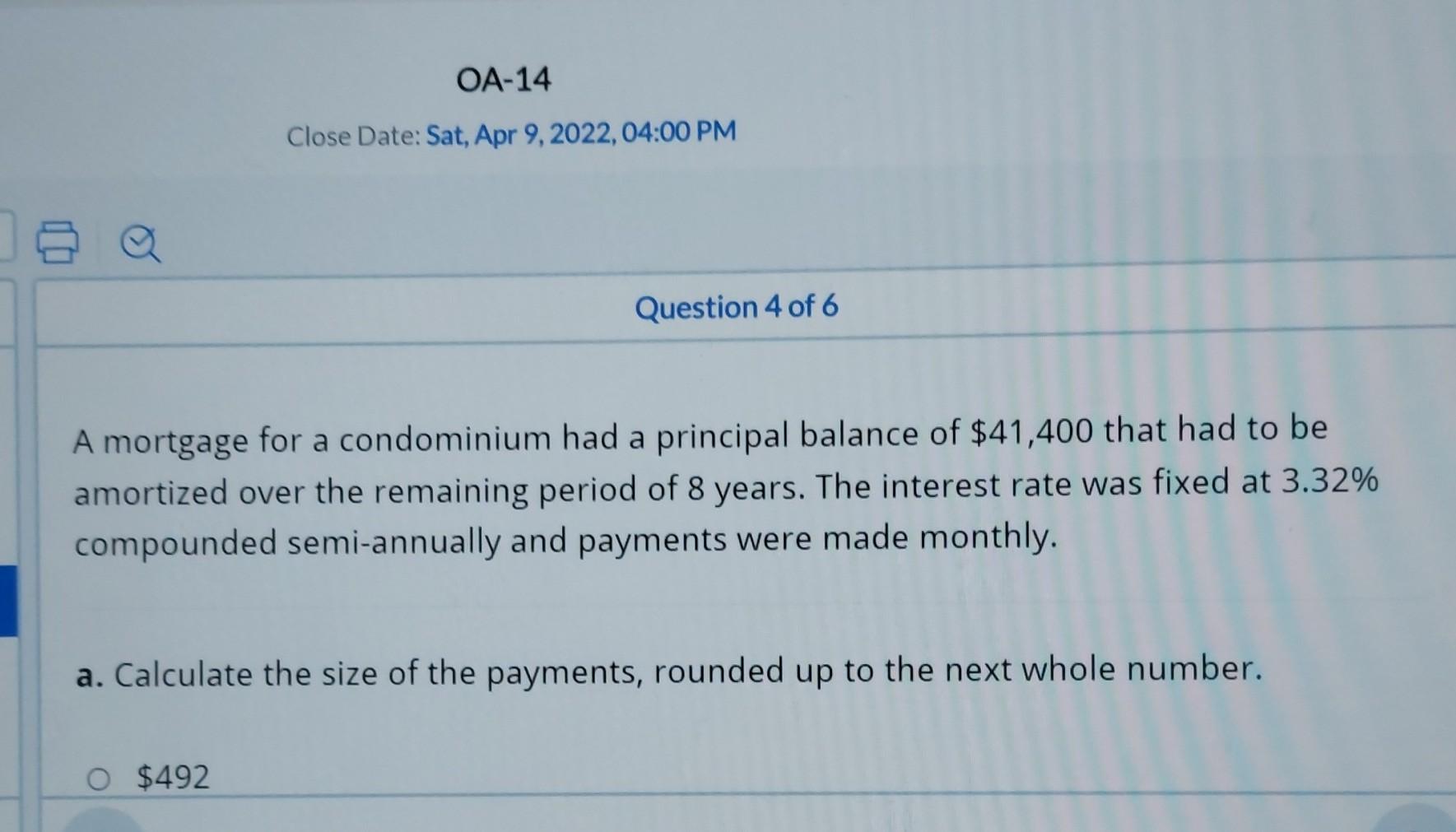

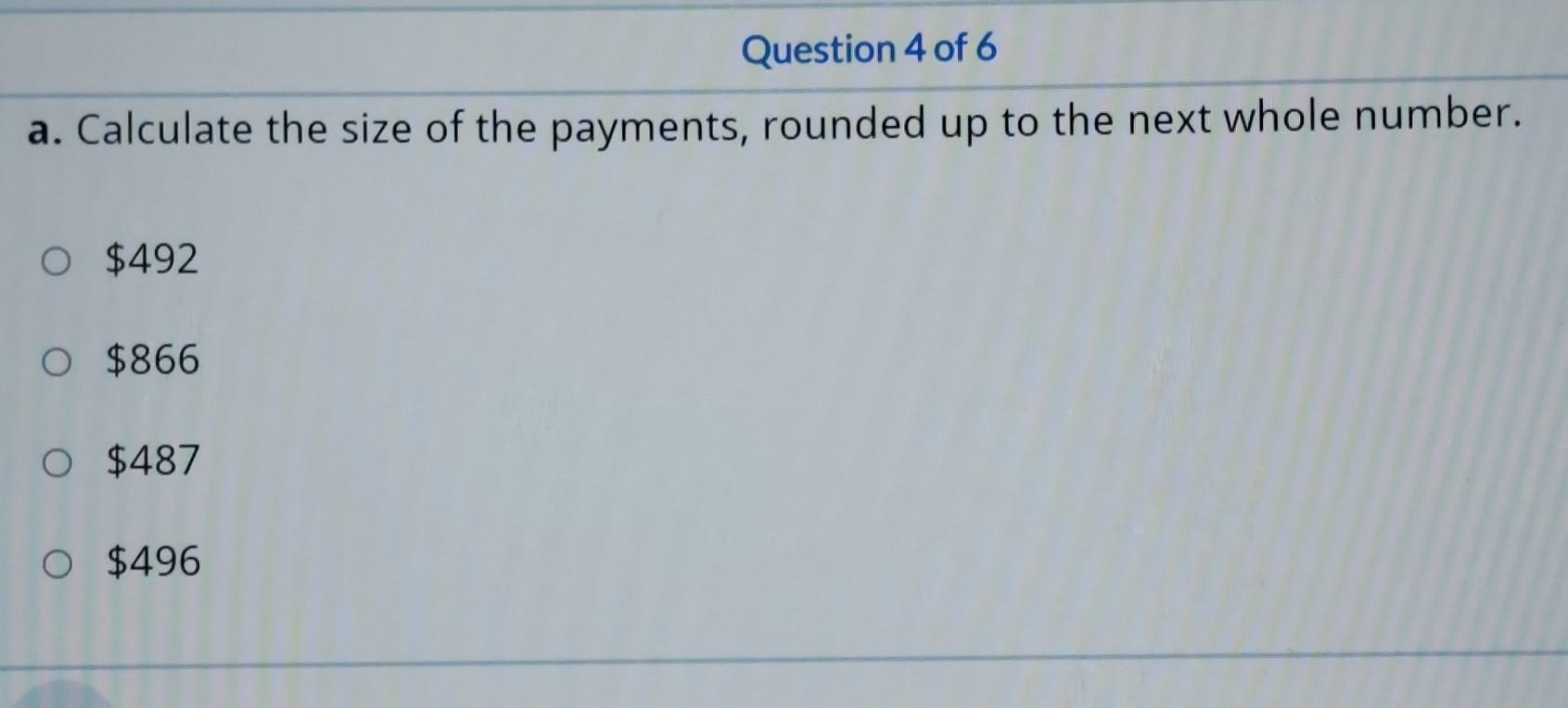

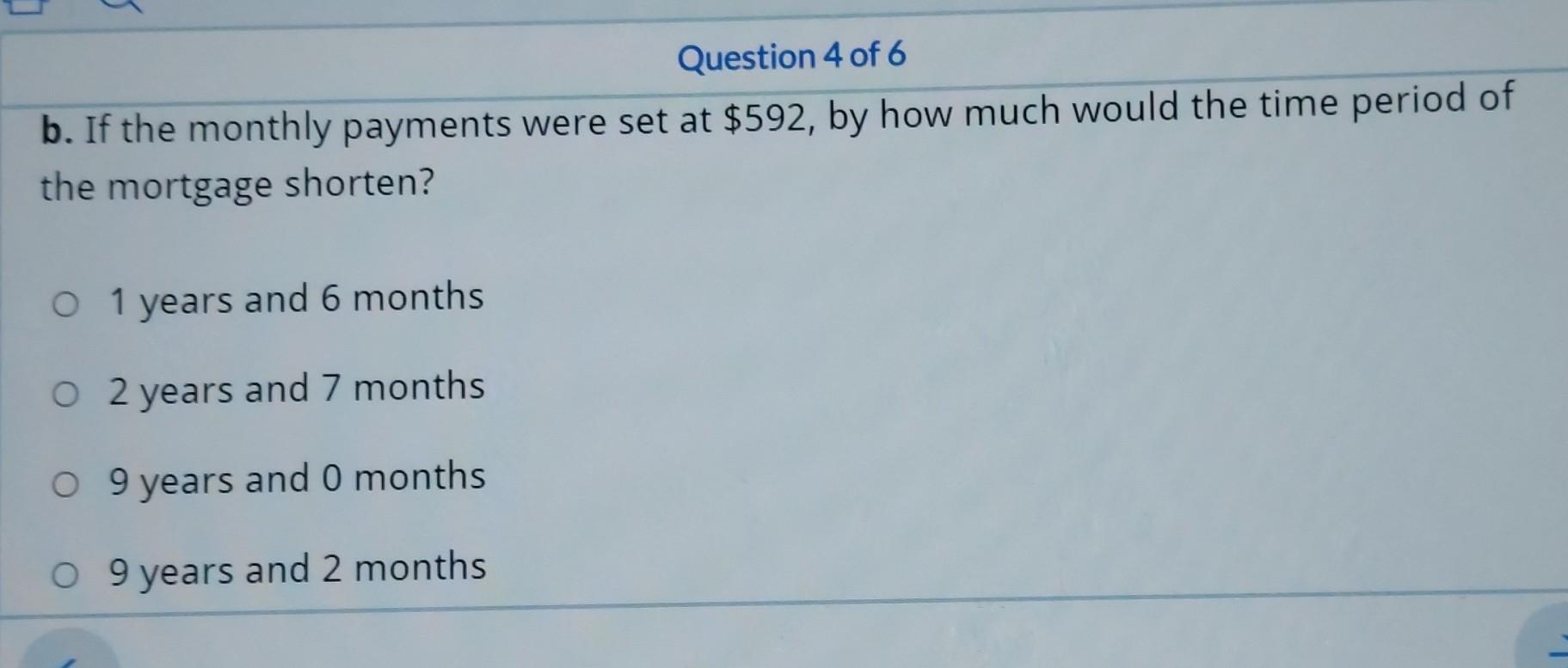

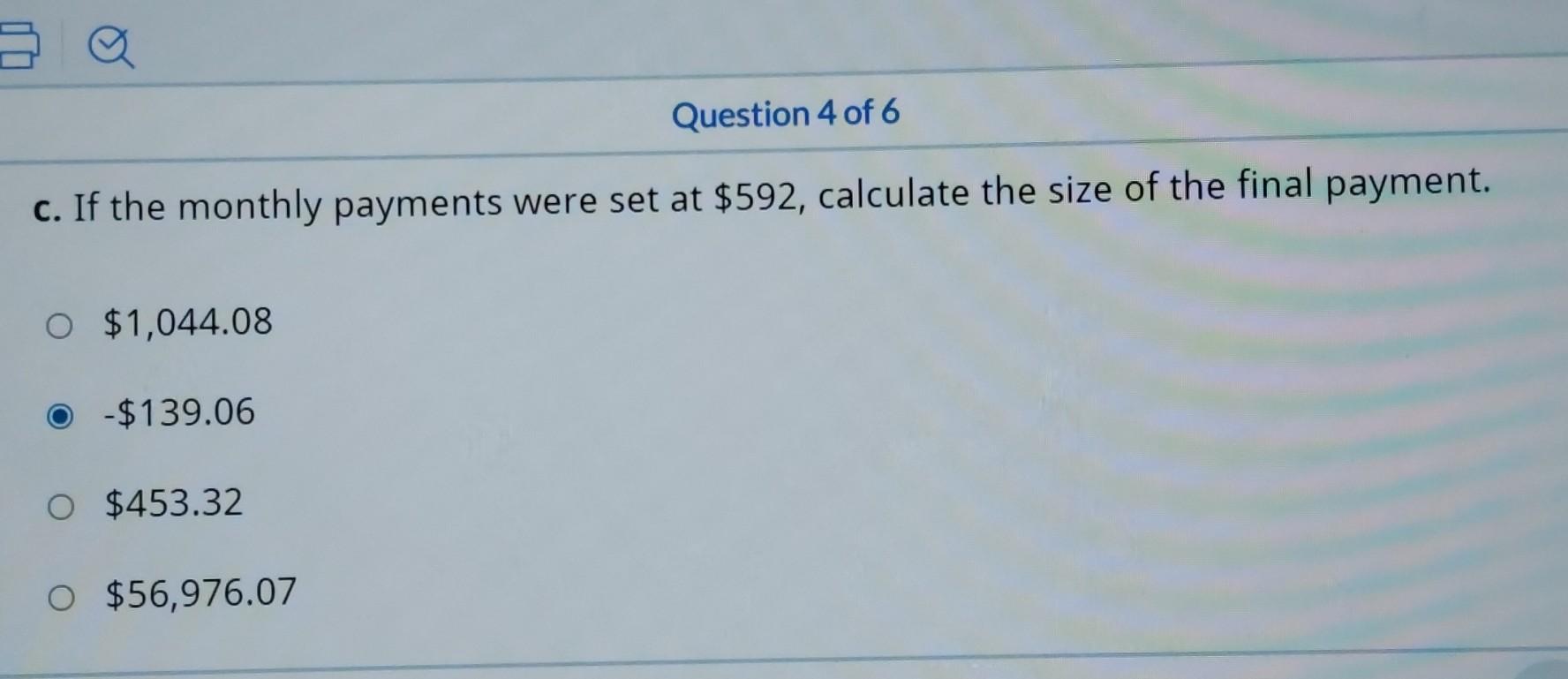

OA-14 Close Date: Sat, Apr 9, 2022, 04:00 PM Question 4 of 6 A mortgage for a condominium had a principal balance of $41,400 that had to be amortized over the remaining period of 8 years. The interest rate was fixed at 3.32% compounded semi-annually and payments were made monthly. a. Calculate the size of the payments, rounded up to the next whole number. O $492 Question 4 of 6 a. Calculate the size of the payments, rounded up to the next whole number. o $492 O $866 O $487 o $496 Question 4 of 6 b. If the monthly payments were set at $592, by how much would the time period of the mortgage shorten? O 1 years and 6 months O 2 years and 7 months o 9 years and 0 months o 9 years and 2 months Question 4 of 6 c. If the monthly payments were set at $592, calculate the size of the final payment. o $1,044.08 -$139.06 o $453.32 O $56,976.07Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started