Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain in words how the solution was solved for the Risk Free Rate of Return. Cost of debt Risk-free rate of Return Beta

Please explain in words how the solution was solved for the " Risk Free Rate of Return".

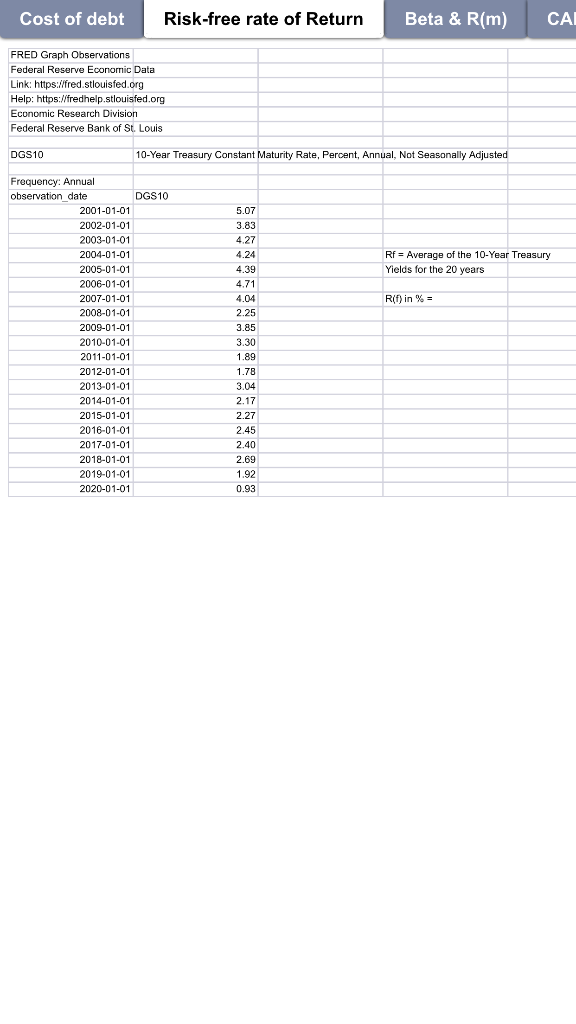

Cost of debt Risk-free rate of Return Beta & R(m) CAI FRED Graph Observations Federal Reserve Economic Data Link: https://fred.stlouisfed.org Help: https://fredhelp.stlouisfed.org Economic Research Division Federal Reserve Bank of St. Louis DGS10 10-Year Treasury Constant Maturity Rate, Percent, Annual, Not Seasonally Adjusted 5.07 Rf = Average of the 10-Year Treasury Yields for the 20 years R(f) in % = Frequency: Annual observation date DGS10 2001-01-01 2002-01-01 2003-01-01 2004-01-01 2005-01-01 2006-01-01 2007-01-01 2008-01-01 2009-01-01 2010-01-01 2011-01-01 2012-01-01 2013-01-01 2014-01-01 2015-01-01 2016-01-01 2017-01-01 2018-01-01 2019-01-01 2020-01-01 3.83 4.27 4.24 4.39 4.71 4.04 2.25 3.85 3.30 1.89 1.78 3,04 2.17 2.27 2.45 2.40 2.69 1.92 0.93Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started