please explain it with details

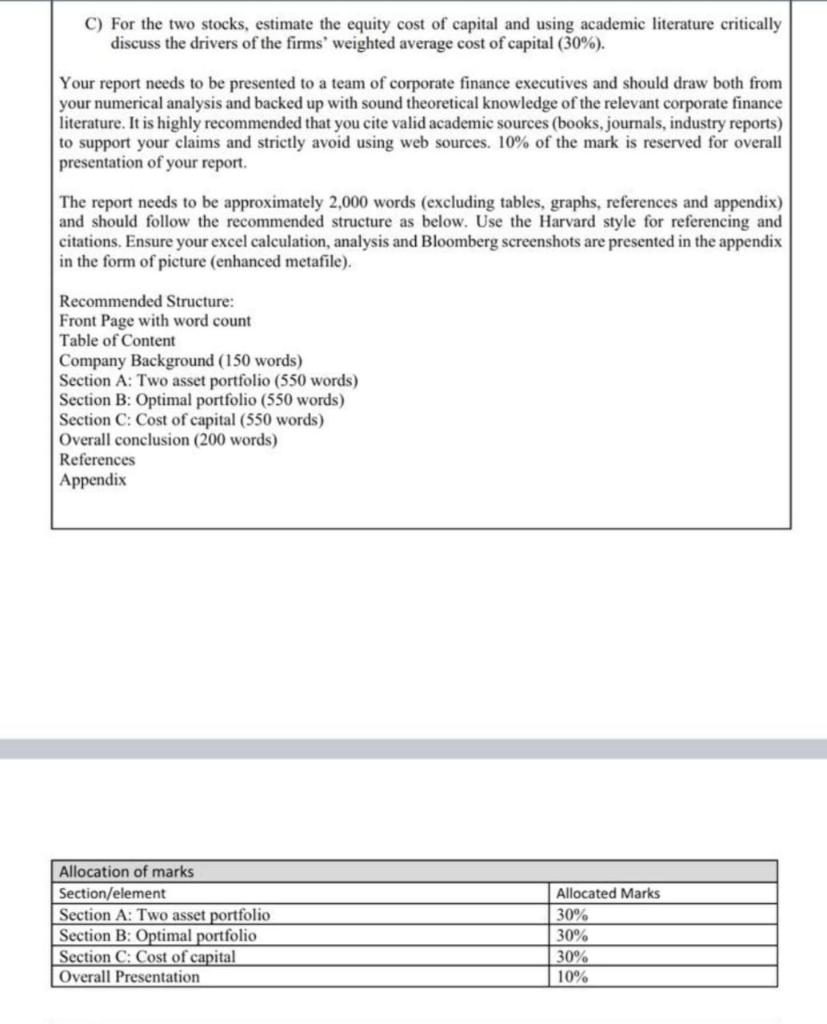

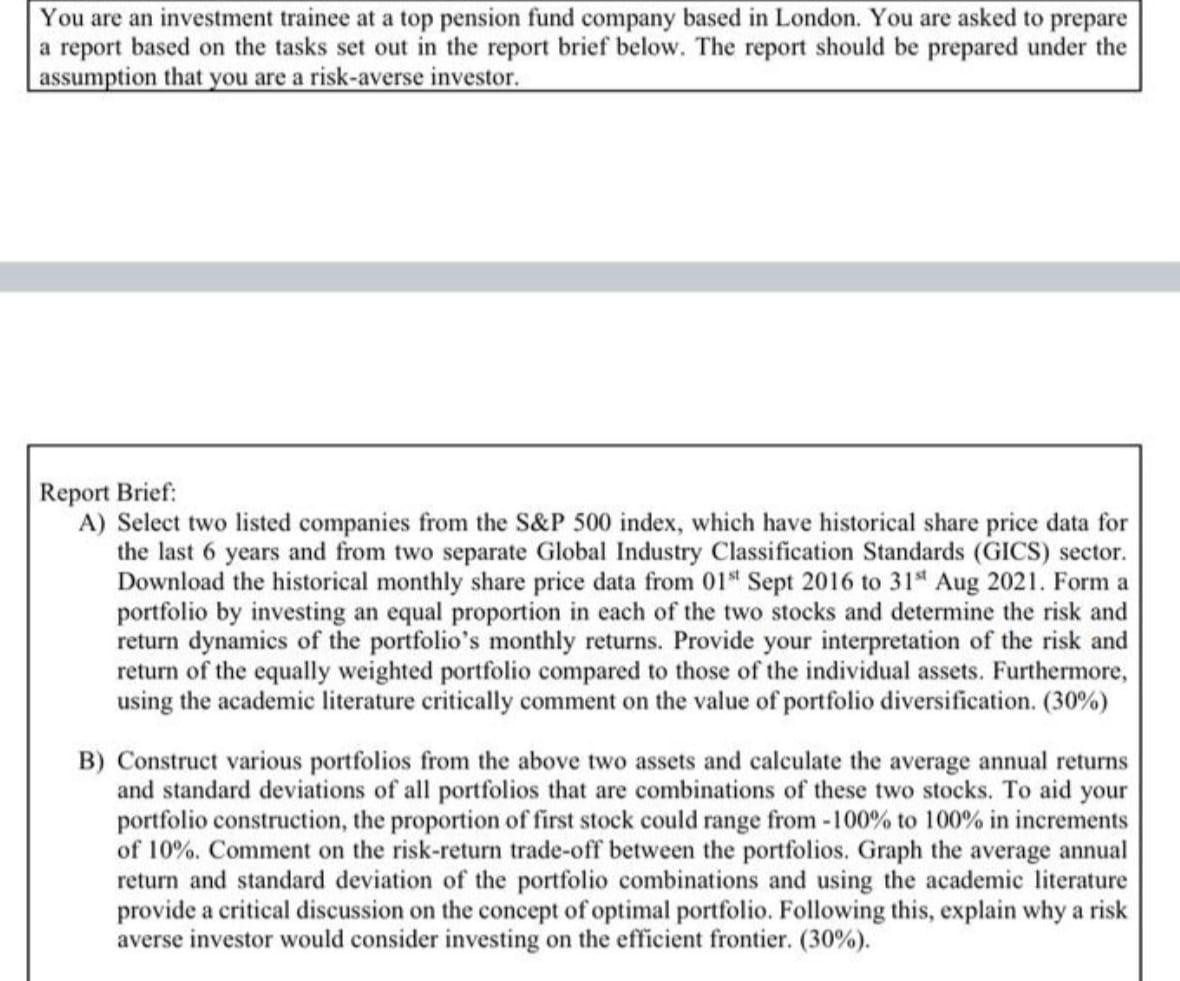

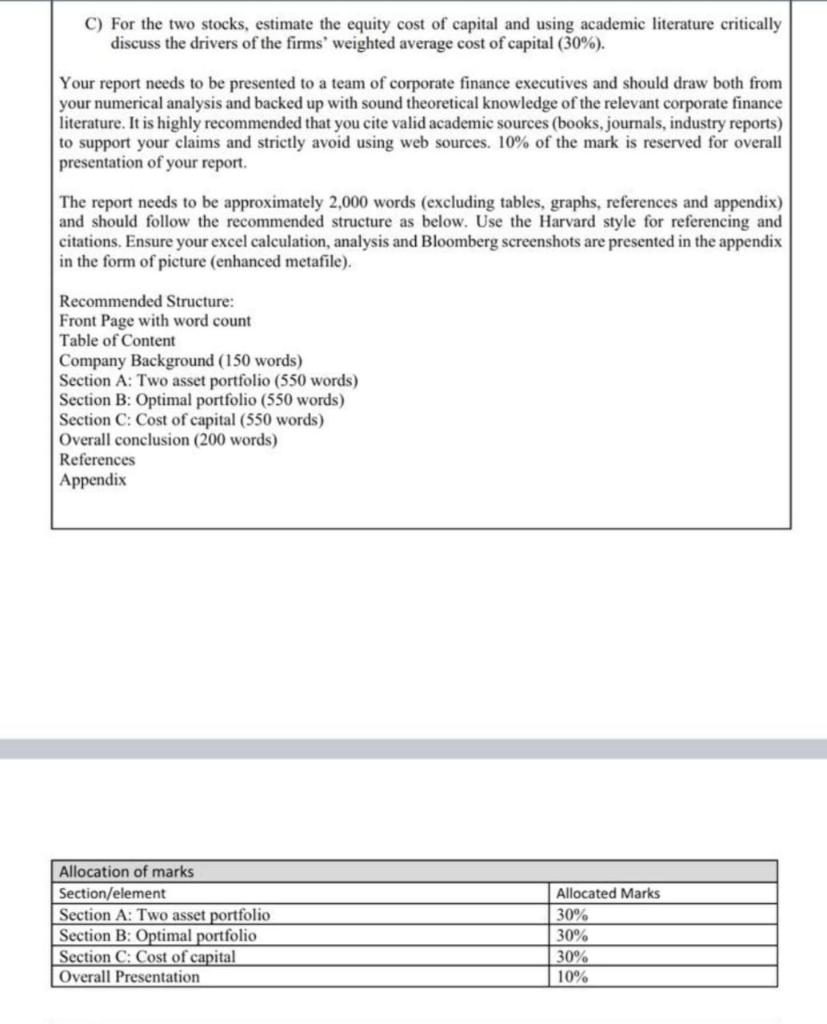

You are an investment trainee at a top pension fund company based in London. You are asked to prepare a report based on the tasks set out in the report brief below. The report should be prepared under the assumption that you are a risk-averse investor. Report Brief: A) Select two listed companies from the S&P 500 index, which have historical share price data for the last 6 years and from two separate Global Industry Classification Standards (GICS) sector. Download the historical monthly share price data from 01" Sept 2016 to 31** Aug 2021. Form a portfolio by investing an equal proportion in each of the two stocks and determine the risk and return dynamics of the portfolio's monthly returns. Provide your interpretation of the risk and return of the equally weighted portfolio compared to those of the individual assets. Furthermore, using the academic literature critically comment on the value of portfolio diversification. (30%) B) Construct various portfolios from the above two assets and calculate the average annual returns and standard deviations of all portfolios that are combinations of these two stocks. To aid your portfolio construction, the proportion of first stock could range from - 100% to 100% in increments of 10%. Comment on the risk-return trade-off between the portfolios. Graph the average annual return and standard deviation of the portfolio combinations and using the academic literature provide a critical discussion on the concept of optimal portfolio. Following this, explain why a risk averse investor would consider investing on the efficient frontier. (30%). C) For the two stocks, estimate the equity cost of capital and using academic literature critically discuss the drivers of the firms' weighted average cost of capital (30%). Your report needs to be presented to a team of corporate finance executives and should draw both from your numerical analysis and backed up with sound theoretical knowledge of the relevant corporate finance literature. It is highly recommended that you cite valid academic sources (books, journals, industry reports) to support your claims and strictly avoid using web sources. 10% of the mark is reserved for overall presentation of your report. The report needs to be approximately 2,000 words (excluding tables, graphs, references and appendix) and should follow the recommended structure as below. Use the Harvard style for referencing and citations. Ensure your excel calculation, analysis and Bloomberg screenshots are presented in the appendix in the form of picture (enhanced metafile). Recommended Structure: Front Page with word count Table of Content Company Background (150 words) Section A: Two asset portfolio (550 words) Section B: Optimal portfolio (550 words) Section C: Cost of capital (550 words) Overall conclusion (200 words) References Appendix Allocation of marks Section/element Section A: Two asset portfolio Section B: Optimal portfolio Section C: Cost of capital Overall Presentation Allocated Marks 30% 30% 30% 10% You are an investment trainee at a top pension fund company based in London. You are asked to prepare a report based on the tasks set out in the report brief below. The report should be prepared under the assumption that you are a risk-averse investor. Report Brief: A) Select two listed companies from the S&P 500 index, which have historical share price data for the last 6 years and from two separate Global Industry Classification Standards (GICS) sector. Download the historical monthly share price data from 01" Sept 2016 to 31** Aug 2021. Form a portfolio by investing an equal proportion in each of the two stocks and determine the risk and return dynamics of the portfolio's monthly returns. Provide your interpretation of the risk and return of the equally weighted portfolio compared to those of the individual assets. Furthermore, using the academic literature critically comment on the value of portfolio diversification. (30%) B) Construct various portfolios from the above two assets and calculate the average annual returns and standard deviations of all portfolios that are combinations of these two stocks. To aid your portfolio construction, the proportion of first stock could range from - 100% to 100% in increments of 10%. Comment on the risk-return trade-off between the portfolios. Graph the average annual return and standard deviation of the portfolio combinations and using the academic literature provide a critical discussion on the concept of optimal portfolio. Following this, explain why a risk averse investor would consider investing on the efficient frontier. (30%). C) For the two stocks, estimate the equity cost of capital and using academic literature critically discuss the drivers of the firms' weighted average cost of capital (30%). Your report needs to be presented to a team of corporate finance executives and should draw both from your numerical analysis and backed up with sound theoretical knowledge of the relevant corporate finance literature. It is highly recommended that you cite valid academic sources (books, journals, industry reports) to support your claims and strictly avoid using web sources. 10% of the mark is reserved for overall presentation of your report. The report needs to be approximately 2,000 words (excluding tables, graphs, references and appendix) and should follow the recommended structure as below. Use the Harvard style for referencing and citations. Ensure your excel calculation, analysis and Bloomberg screenshots are presented in the appendix in the form of picture (enhanced metafile). Recommended Structure: Front Page with word count Table of Content Company Background (150 words) Section A: Two asset portfolio (550 words) Section B: Optimal portfolio (550 words) Section C: Cost of capital (550 words) Overall conclusion (200 words) References Appendix Allocation of marks Section/element Section A: Two asset portfolio Section B: Optimal portfolio Section C: Cost of capital Overall Presentation Allocated Marks 30% 30% 30% 10%