please explain net present value as best as u can step by step

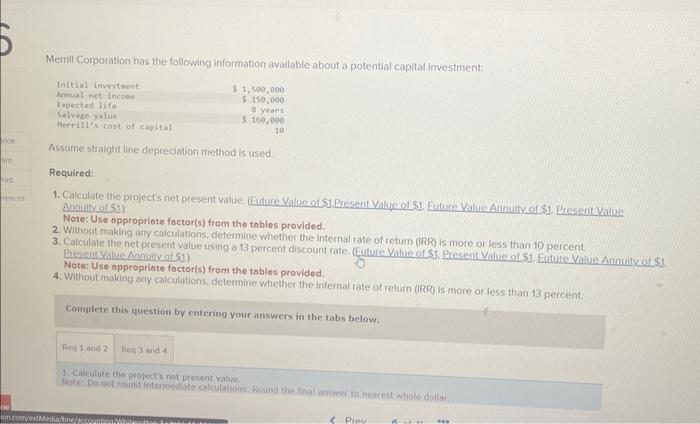

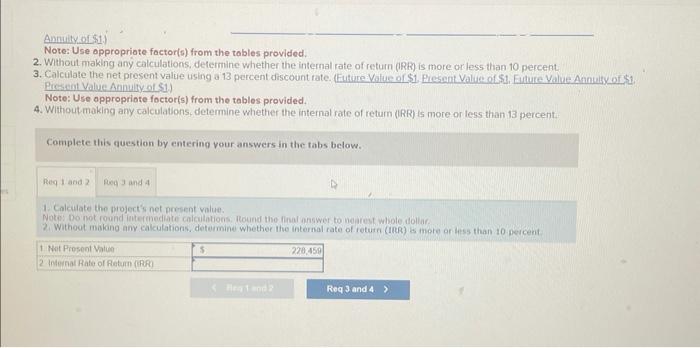

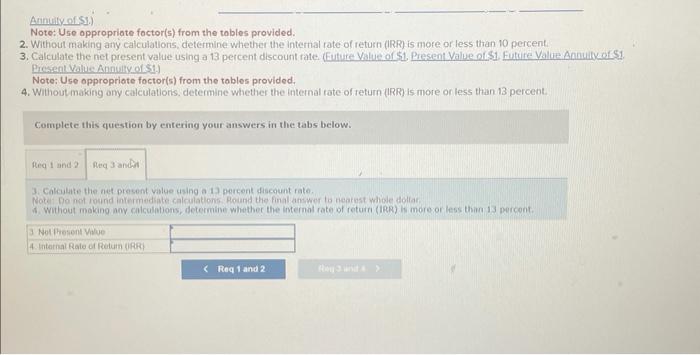

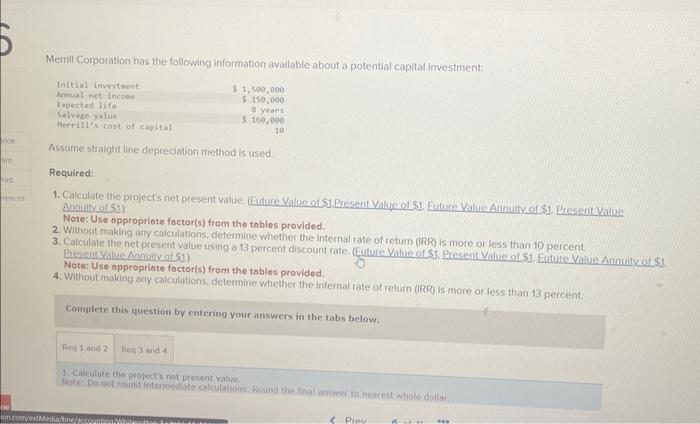

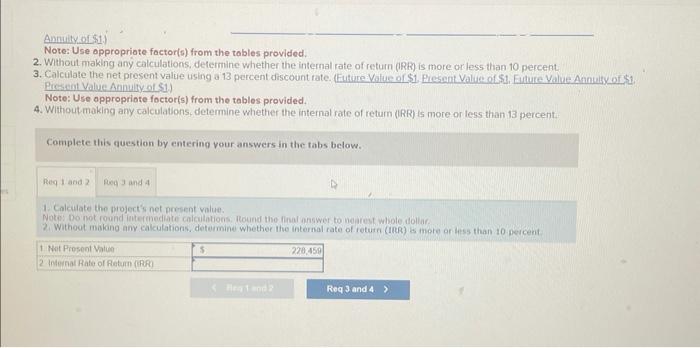

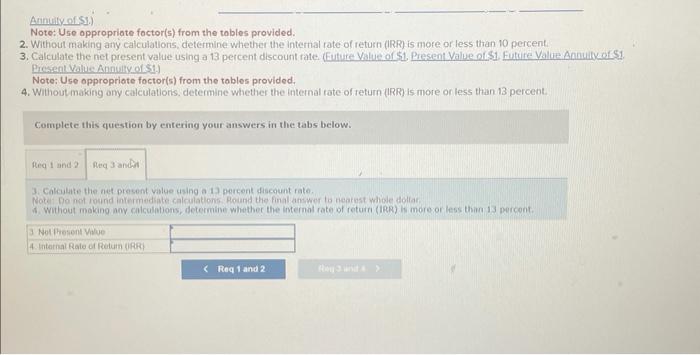

Memill Corporation has the following information avallable about a potential capital investment: Assume straight ine depreciation method is used. Required: 1. Calculate the project's net present value. Euture Value at S1. Precent Value of S1, Euture Value Annuity af S1. Present Value Arnuityofs S11) Note: Use appropriate factor(s) from the tobles provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. 3. Calculate the net present value using a 13 percent discount rate. (Guture Value of S1, Present Value ol.S1. Eutuce Value Annuity of S1. Note: Use oppropriate foctor(s) from the tobles provided. 4. Without making any calculations, determine whether the internal tate of return (IRR) is more or less than 13 percent: Complete this question by entering your answers in the tabs below. 1. Calculate the orofect's net present value. Fote- Da moUround interoodiate calculationk. Rounis the lioul msswer to neorest whole dallar Anmity of :1) Note: Use oppropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (iRk) is more or less than 10 percent: 3. Calculate the net present value using a 13 percent discount rate. (Euture Value of $1. Present Value of S1, Eulure Value Annuify of St. Picsent Value Annultyot $1. Note: Use oppropriote foctor(s) from the tables provided. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 13 percent. Complete this question by entering your answers in the tabs below. 1. Calculate the project's net porsent value: Note: Do inot round interepedate colailations. Ilound the linal onswer to nearest whole dollar. 2. Withoot malano any cakculations, determine whether the internal rate of feturn (irs) \& more ar iess than 10 peicent Note: Use oppropriate foctor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. 3. Calculate the net present value using a 13 percent discount rate (Euture Value of 51 , Present Value af \$1, Future Value Aanulife of S1. PresentValue Anniltyof 51 .) Note: Use oppropriate foctor(s) from the tables provided. 4. Without making ony calculations, determine whether the internal rate of teturn (IRR) is more or less than 13 percent. Complete this question by entering your answers in the tabs below. 3. Cakilite the net present vilue using a 13 percent diacount rate. Note Do not rocund intermediate calculations Plound the final amwer to neatost whiode dolar 4. Without moking aoy calculations, determine whether the internal rate of return (IRR) h more or less than i3 percont. Memill Corporation has the following information avallable about a potential capital investment: Assume straight ine depreciation method is used. Required: 1. Calculate the project's net present value. Euture Value at S1. Precent Value of S1, Euture Value Annuity af S1. Present Value Arnuityofs S11) Note: Use appropriate factor(s) from the tobles provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. 3. Calculate the net present value using a 13 percent discount rate. (Guture Value of S1, Present Value ol.S1. Eutuce Value Annuity of S1. Note: Use oppropriate foctor(s) from the tobles provided. 4. Without making any calculations, determine whether the internal tate of return (IRR) is more or less than 13 percent: Complete this question by entering your answers in the tabs below. 1. Calculate the orofect's net present value. Fote- Da moUround interoodiate calculationk. Rounis the lioul msswer to neorest whole dallar Anmity of :1) Note: Use oppropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (iRk) is more or less than 10 percent: 3. Calculate the net present value using a 13 percent discount rate. (Euture Value of $1. Present Value of S1, Eulure Value Annuify of St. Picsent Value Annultyot $1. Note: Use oppropriote foctor(s) from the tables provided. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 13 percent. Complete this question by entering your answers in the tabs below. 1. Calculate the project's net porsent value: Note: Do inot round interepedate colailations. Ilound the linal onswer to nearest whole dollar. 2. Withoot malano any cakculations, determine whether the internal rate of feturn (irs) \& more ar iess than 10 peicent Note: Use oppropriate foctor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. 3. Calculate the net present value using a 13 percent discount rate (Euture Value of 51 , Present Value af \$1, Future Value Aanulife of S1. PresentValue Anniltyof 51 .) Note: Use oppropriate foctor(s) from the tables provided. 4. Without making ony calculations, determine whether the internal rate of teturn (IRR) is more or less than 13 percent. Complete this question by entering your answers in the tabs below. 3. Cakilite the net present vilue using a 13 percent diacount rate. Note Do not rocund intermediate calculations Plound the final amwer to neatost whiode dolar 4. Without moking aoy calculations, determine whether the internal rate of return (IRR) h more or less than i3 percont