Answered step by step

Verified Expert Solution

Question

1 Approved Answer

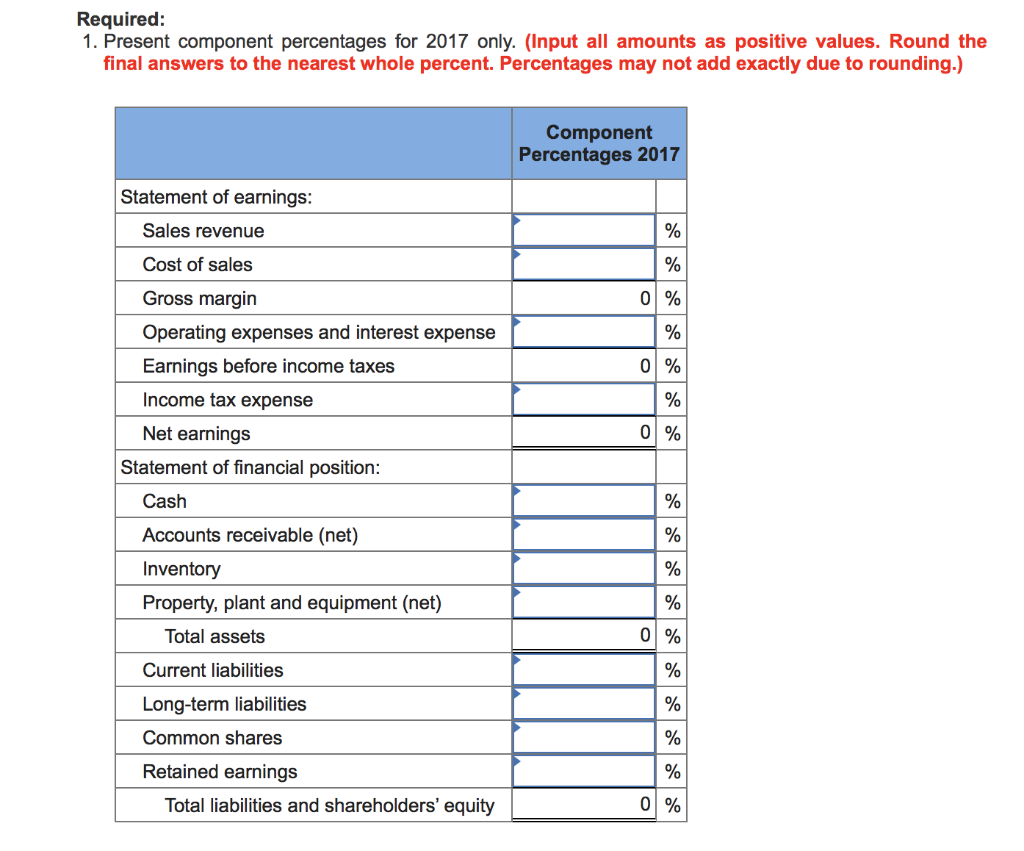

please explain Required: 1. Present component percentages for 2017 only. (Input all amounts as positive values. Round the final answers to the nearest whole percent.

please explain

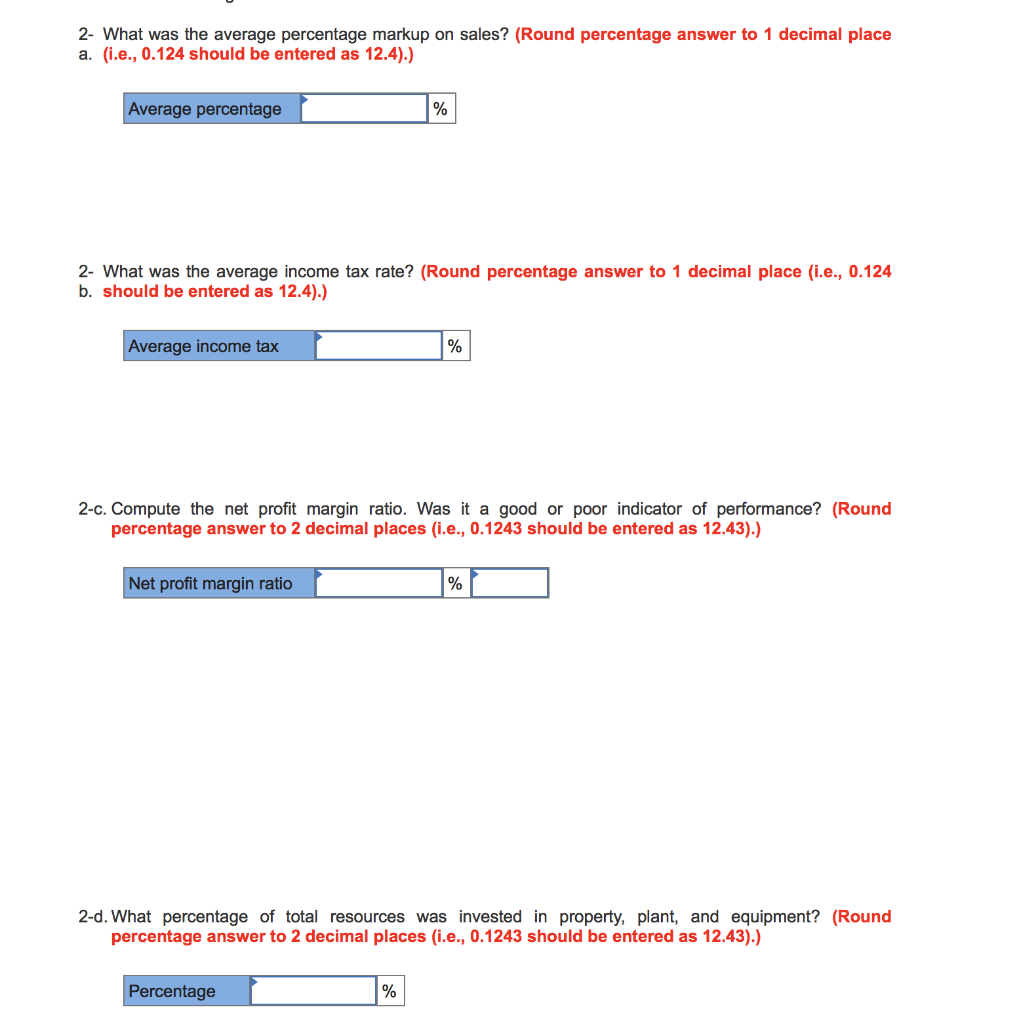

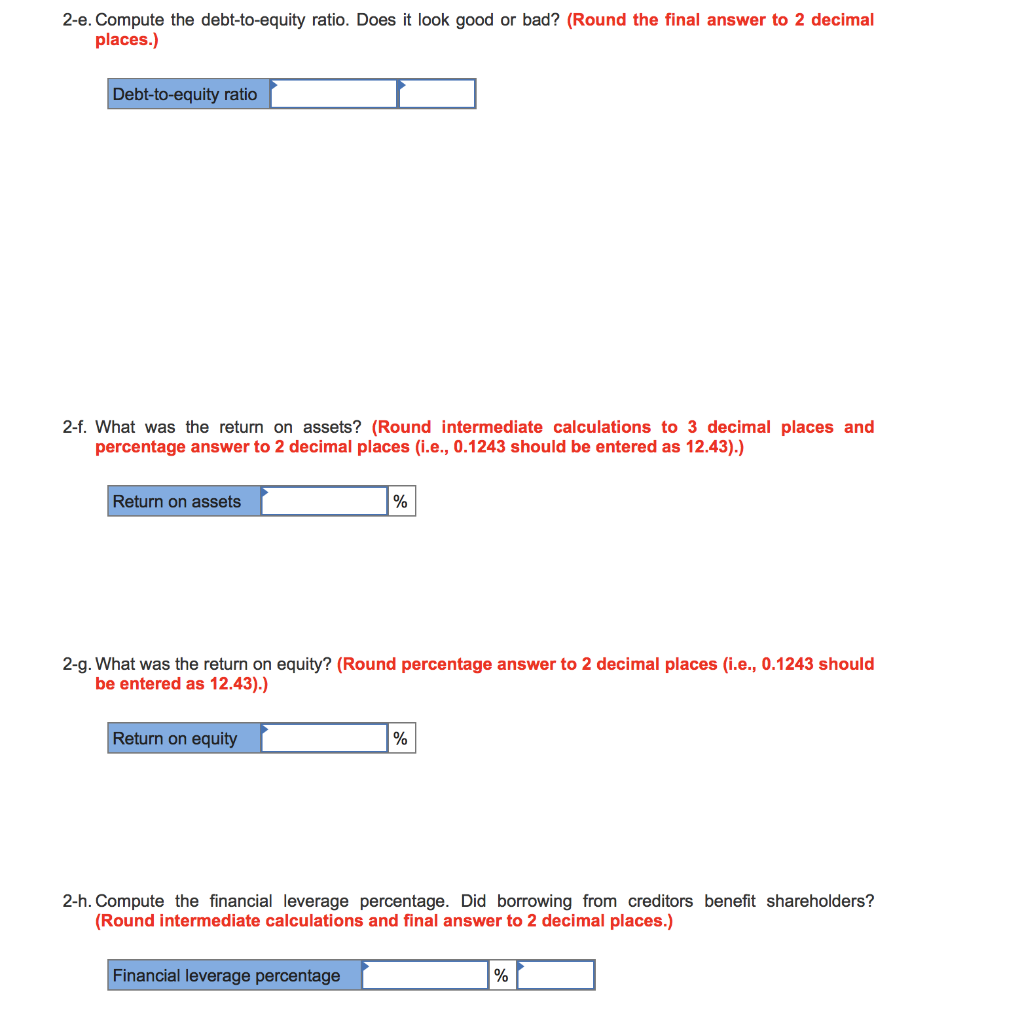

Required: 1. Present component percentages for 2017 only. (Input all amounts as positive values. Round the final answers to the nearest whole percent. Percentages may not add exactly due to rounding.) Component Percentages 2017 Statement of earnings: Sales revenue % % 0 % % 0 % % 0 % Cost of sales Gross margin Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings Statement of financial position: Cash Accounts receivable (net) Inventory Property, plant and equipment (net) Total assets % % % % 0 % Current liabilities % Long-term liabilities % Common shares % % Retained earnings Total liabilities and shareholders' equity 0 % 2- What was the average percentage markup on sales? (Round percentage answer to 1 decimal place a. (i.e., 0.124 should be entered as 12.4).) Average percentage % 2- What was the average income tax rate? (Round percentage answer to 1 decimal place (i.e., 0.124 b. should be entered as 12.4).) Average income tax % 2-c. Compute the net profit margin ratio. Was it a good or poor indicator of performance? (Round percentage answer to 2 decimal places (i.e., 0.1243 should be entered as 12.43).) Net profit margin ratio % 2-d. What percentage of total resources was invested in property, plant, and equipment? (Round percentage answer to 2 decimal places (i.e., 0.1243 should be entered as 12.43).) Percentage % 2-e. Compute the debt-to-equity ratio. Does it look good or bad? (Round the final answer to 2 decimal places.) Debt-to-equity ratio 2-f. What was the return on assets? (Round intermediate calculations to 3 decimal places and percentage answer to 2 decimal places (i.e., 0.1243 should be entered as 12.43).) Return on assets % 2-g. What was the return on equity? (Round percentage answer to 2 decimal places (i.e., 0.1243 should be entered as 12.43).) Return on equity % 2-h. Compute the financial leverage percentage. Did borrowing from creditors benefit shareholders? (Round intermediate calculations and final answer to 2 decimal places.) Financial leverage percentage %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started