Please explain step by step how do I do these calculations, Circled in

Please explain step by step how do I do these calculations, Circled in

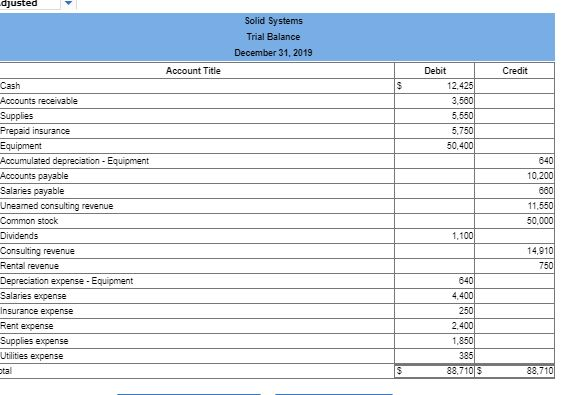

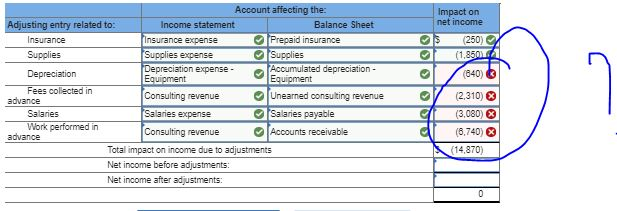

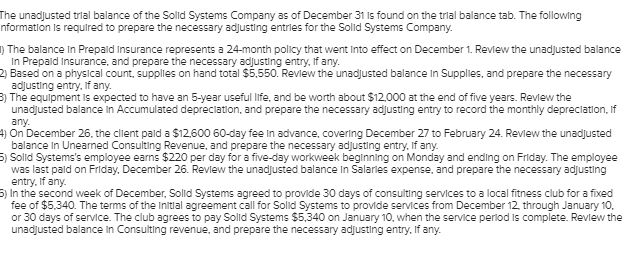

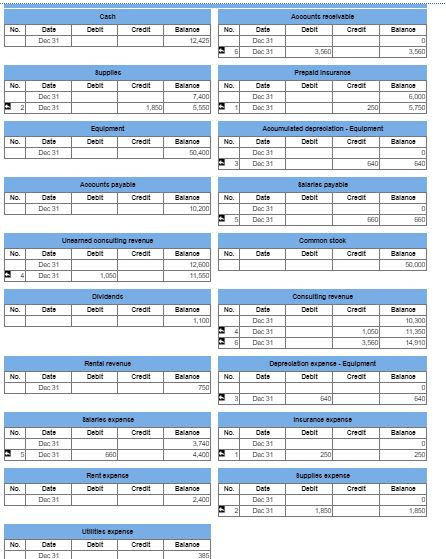

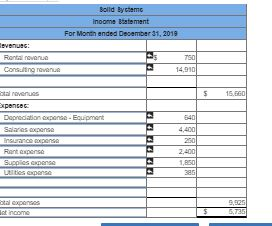

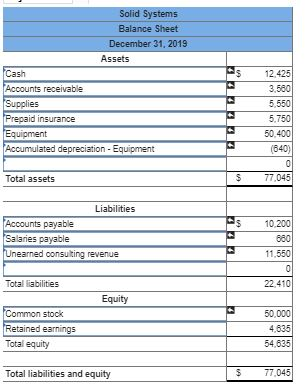

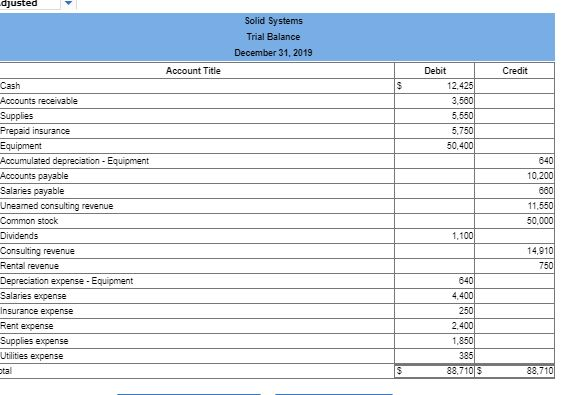

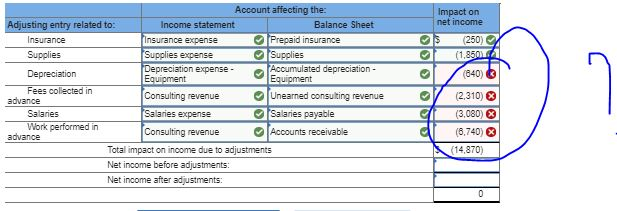

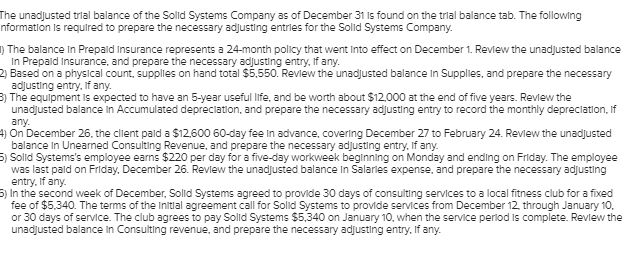

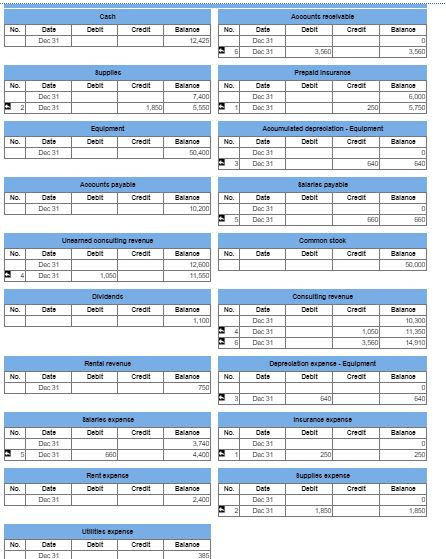

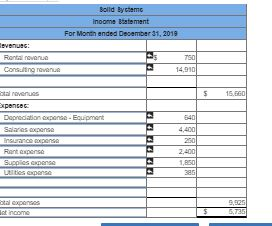

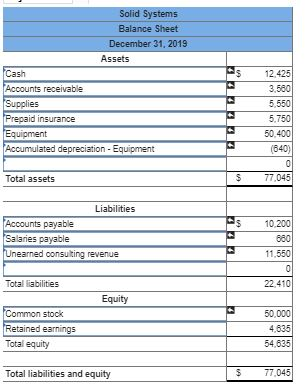

The unadjusted trlal balance of the Solld Systems Company as of December 31 is found on the trial balance tab. The following nformation Is required to prepare the necessary adjusting entries for the Solid Systems Company. ) The balance In Prepaid Insurance represents a 24-month policy that went Into effect on December 1. Review the unadjusted balance In Prepaid Insurance, and prepare the necessary adjusting entry, If any. 2) Based on a physical count, supples on hand total $5,550. Revlew the unadjusted balance In Supplies, and prepare the necessary adjusting entry., If any. 8) The equlpment is expected to have an 5-year useful life, and be worth about $12,000 at the end of five years. Review the unadjusted balance in Accumulated depreclation, and prepare the necessary adjusting entry to record the monthly depreciation, If any 4) On December 26, the client paid a $12,600 60-day fee In advance, covering December 27 to February 24. Review the unadjusted balance In Unearned Consulting Revenue, and prepare the necessary adjusting entry, If any. ) Solld Systems's employee earns $220 per day for a five-day workweek beginning on Monday and ending on Friday. The employee was last pald on Friday, December 26. Revlew the unadjusted balance In Salaries expense, and prepare the necessary adjusting entry. If any 5) In the second week of December, Solld Systems agreed to provide 30 days of consulting services to a local fitness club for a fixed fee of $5,340. The terms of the Initlal agreement call for Sold Systems to provide services from December 12, through January 10, or 30 days of service. The club agrees to pay Solld Systems $5,340 on January 10, when the service perlod is complete. Revlew the unadjusted balance in Consulting revenue, and prepare the necessary adjusting entry. If any. Cath Appounts reonivabie Credit Baanos No Dater Debit Balanoe No. Date Deb Credit Dec31 12.425 Dec 31 Dec31 3.560 3,560 Bupplies Prepald Insuranos Dater Credit No Date Balanoa No. Debt Eaanoe Debit Credit Doc 31 7.400 Dec 31 6,000 5,750 2 5.050 Dac 31 1,850 Dec31 250 Acoumulated depreolstion-Equlpment Equipment Dater Debt Credit Baano No Date Debit Balanoe No. Credit 50400 Dec 31 Dec 31 Dec31 640 Apoounts payabie 8alaniec payabler Date Debt Credit No Date Balanoe No. Baanoe Debit Credit Dec 31 Dec 31 10.200 Dec31 Unearned oonculting revenue Common stook Credit No Date Debit Balanoe No. Dater Debt Eaanoe Credit Dec 31 12,600 50,000 Dec 31 1,030 11,50 Dividends Consulting revenue No. Credit No Dater Balanos Date Debt Eaanoe Debit Credit 1,100 Dec 31 10.300 Doc 31 11.350 1,050 Dec 31 3.560 14.910 Depreolaton expence-Equlpments Rantal revenuer Debt Credit No. Date Eaanos NC Dater Debit Credit Balanoe Dec 31 T50 Dec 31 640 640 Baaries expanter insuranoe expenss Depit Eaanoe No. Date Credit NC Dater Debit Credit Eaanoe 3,740 Dec 3 Dec 31 4,400 1 250 Doc 31 660 Dac 31 Rentexpene aupplies expencer Debit Credit No Eaanoe Ng. Dater Balanoe Dater Debit Credit Dec 31 2400 Dec 31 2 Dac 31 1,850 ublities expense Depit Credit Eaanoe No. Dater Dec 3t Bolld Byctame inoome Btatement For Month ended December 31, 2019 devenuac Rantal novanua Consutng ravanue T50 14,910 tal ravenuas Expensec: Dapnediation xpensa-Equipment Salares axpense Encurance axpense Rant axpense Supplies apense Lltes expense 15,60 640 4400 20 2400 1,850 385 otal expanses st income 9,525 5,735 Solid Systems Balance Sheet December 31, 2019 Assets Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation-Equipment 12,425 3,580 5,550 5,750 50,400 (640) 0 77,045 Total assets Liabilities Accounts payable Salaries payable Unearned consulting revenue 10,200 680 11,550 0 22,410 Total liabilities Equity 50,000 Common stock Retained earnings Total equity 4635 54,635 77,045 Total liabilities and equity djusted Solid Systems Trial Balance December 31, 2019 Account Title Debit Credit 12,425 Cash Accounts receivable 3,580 5,550 5,750 Supplies Prepaid insurance Equipment 50,400 640 Accumulated depreciation - Equipment Accounts payable Salaries payable Uneamed consulting revenue 10.200 880 11,550 Common stock 50,000 1,100 Dividends Consulting revenue 14,910 750 Rental revenue Depreciation expense-Equipment 640 Salaries expense 4.400 250 Insurance expense Rent expense Supplies expense 2,400 1,850 Utilities expense 385 88,710 S 88,710 otal Account affecting the: Impact on net income Adjusting entry related to: Income statement Balance Sheet Prepaid insurance Supplies Accumulated depreciation- Equipment (250) Insurance expense Insurance Supplies expense (1,850) Supplies Depreciation expense- Equipment Depreciation (840) Fees collected in advance Consulting revenue Unearned consulting revenue (2,310) Salaries expense Salaries payable Salaries (3,080) performed in Consulting revenue Accounts receivable (5,740) advance Total impact on income due to adjustments (14,870) Net income before adjustments Net income after adjustments 0

Please explain step by step how do I do these calculations, Circled in

Please explain step by step how do I do these calculations, Circled in