Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain Texas-Q Company produces and sells barbeque grills. Texas-Q sells three models: a small portable gas grill, a larger stationary gas grill, and the

please explain

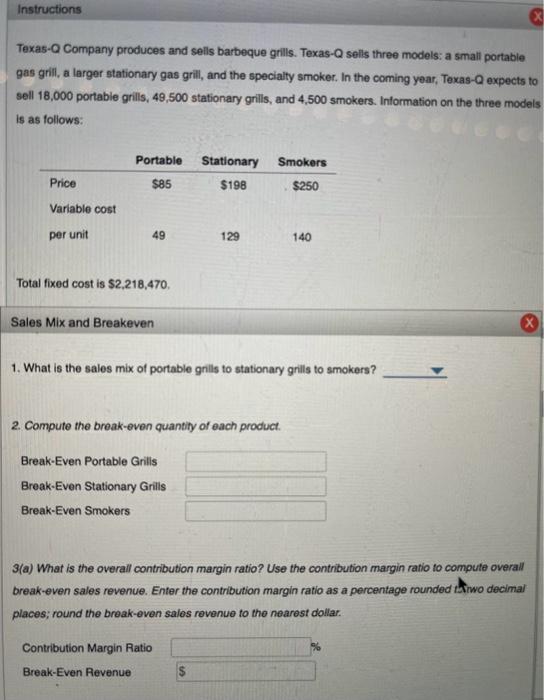

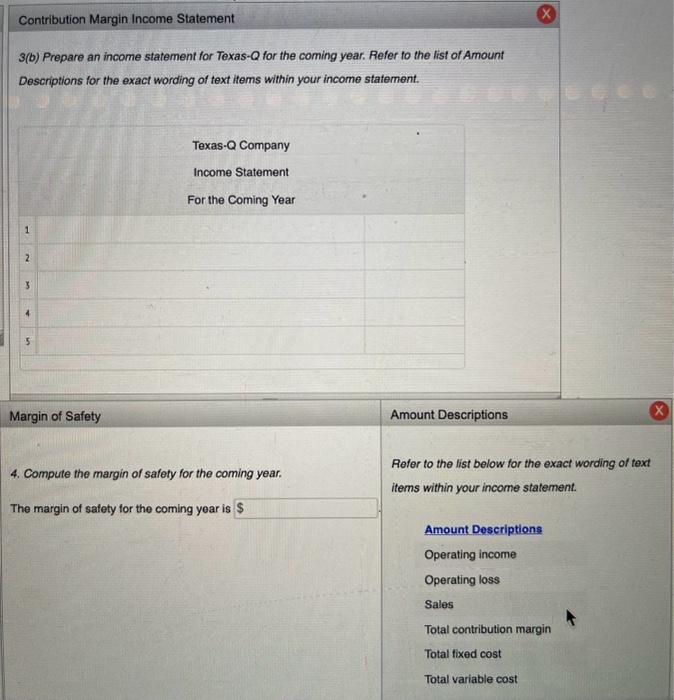

Texas-Q Company produces and sells barbeque grills. Texas-Q sells three models: a small portable gas grill, a larger stationary gas grill, and the specialty smoker. In the coming year, Texas-Q expects to sell 18,000 portable grills, 49,500 stationary grills, and 4,500 smokers. Information on the three models is as follows: Total fixed cost is $2,218,470. Sales Mix and Breakeven 1. What is the sales mix of portable grills to stationary grills to smokers? 2. Compute the break-even quantily of each product. 3(a) What is the overall contribution margin ratio? Use the contribution margin ratio to compute overall break-even sales revenue. Enter the contribution margin ratio as a percentage rounded thiwo decimal places; round the break-even sales revenue to the nearest dollar. 3(b) Prepare an income statement for Texas- Q for the coming year. Refer to the list of Amount Descriptions for the exact wording of text items within your income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started