Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Explain. Thank you You are given the following information about a securities market: There are three nondividend-paying stocks, X, Y, and Z. The current

Please Explain. Thank you

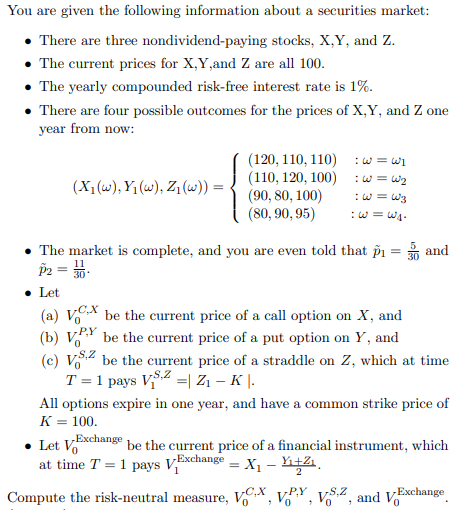

You are given the following information about a securities market: There are three nondividend-paying stocks, X, Y, and Z. The current prices for X,Y and Z are all 100. The yearly compounded risk-free interest rate is 1%. There are four possible outcomes for the prices of X, Y, and Zone year from now: (120, 110, 110) (110, 120, 100) :w=w2 (X1(w), Y. (w), 21(w)) = (90, 80, 100) (80,90,95) = : = : : = : The market is complete, and you are even told that i = and P2 = 30 11 Let - (a) V.C.* be the current price of a call option on X, and (b) V.PY be the current price of a put option on Y, and (e) v..be the current price of a straddle on Z, which at time T = 1 pays V$2 =| 21 - K|. All options expire in one year, and have a common strike price of K Exchange be the current price of a financial instrument, which at time T = 1 pays V.Exchange = X - Y12 Compute the risk-neutral measure, VCX, V.PY, V.8.2 and V.Exchange 100. Let Vo 9 You are given the following information about a securities market: There are three nondividend-paying stocks, X, Y, and Z. The current prices for X,Y and Z are all 100. The yearly compounded risk-free interest rate is 1%. There are four possible outcomes for the prices of X, Y, and Zone year from now: (120, 110, 110) (110, 120, 100) :w=w2 (X1(w), Y. (w), 21(w)) = (90, 80, 100) (80,90,95) = : = : : = : The market is complete, and you are even told that i = and P2 = 30 11 Let - (a) V.C.* be the current price of a call option on X, and (b) V.PY be the current price of a put option on Y, and (e) v..be the current price of a straddle on Z, which at time T = 1 pays V$2 =| 21 - K|. All options expire in one year, and have a common strike price of K Exchange be the current price of a financial instrument, which at time T = 1 pays V.Exchange = X - Y12 Compute the risk-neutral measure, VCX, V.PY, V.8.2 and V.Exchange 100. Let Vo 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started