Answered step by step

Verified Expert Solution

Question

1 Approved Answer

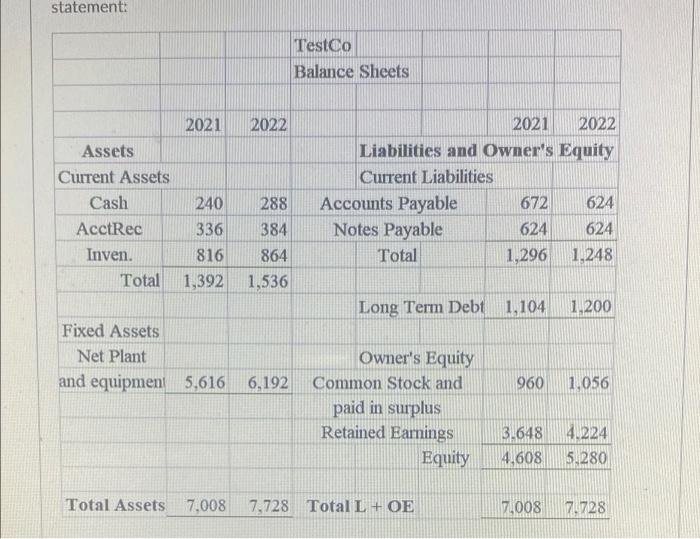

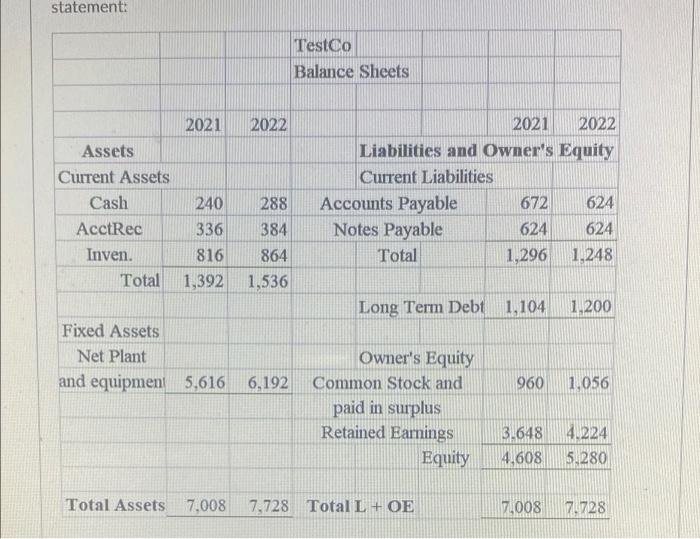

please explain the answer and the formula use for it statement: TestCo Balance Sheets 2021 2022 2021 2022 Liabilities and Owner's Equity Current Liabilities Accounts

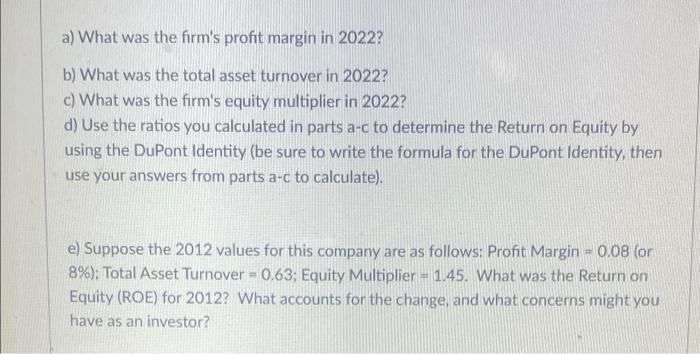

please explain the answer and the formula use for it

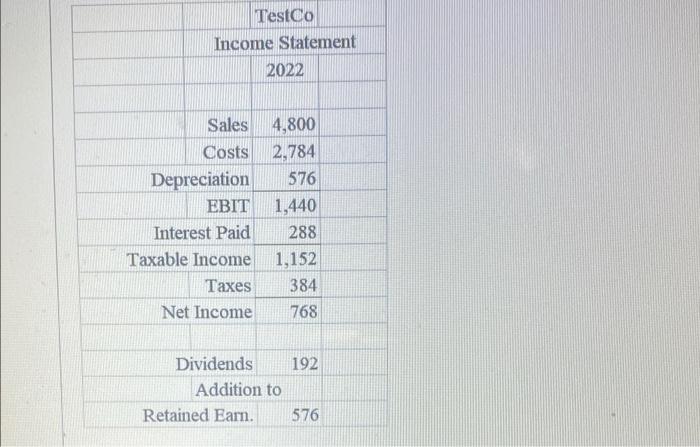

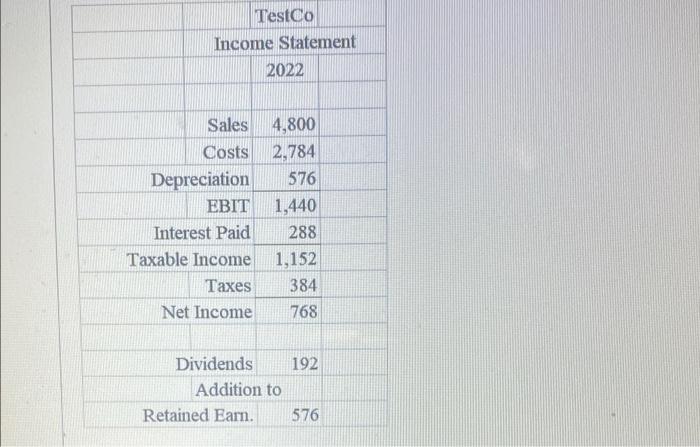

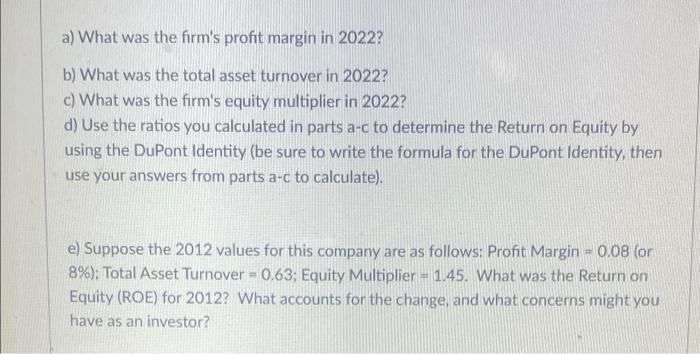

statement: TestCo Balance Sheets 2021 2022 2021 2022 Liabilities and Owner's Equity Current Liabilities Accounts Payable 672 624 Notes Payable 624 624 Total 1,296 1,248 240 Assets Current Assets Cash AcctRec Inven. Total 288 336 816 1,392 384 864 1,536 Long Term Debt 1,104 1,200 Fixed Assets Net Plant and equipmen 5,616 6,192 960 1.056 Owner's Equity Common Stock and paid in surplus Retained Earnings Equity 3.648 4.608 40224 5.280 Total Assets 7,008 7,728 Total L + OE 17,008 7728 TestCo Income Statement 2022 Sales 4,800 Costs 2,784 Depreciation 576 EBIT 1,440 Interest Paid 288 Taxable Income 1,152 Taxes 384 Net Income 768 192 Dividends Addition to Retained Eam. 576 a) What was the firm's profit margin in 2022? b) What was the total asset turnover in 2022? c) What was the firm's equity multiplier in 2022? d) Use the ratios you calculated in parts a-c to determine the Return on Equity by using the DuPont Identity (be sure to write the formula for the DuPont Identity, then use your answers from parts a-c to calculate). e) Suppose the 2012 values for this company are as follows: Profit Margin - 0.08 (or 8%): Total Asset Turnover = 0.63: Equity Multiplier = 1.45. What was the Return on Equity (ROE) for 2012? What accounts for the change, and what concerns might you have as an investor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started