Answered step by step

Verified Expert Solution

Question

1 Approved Answer

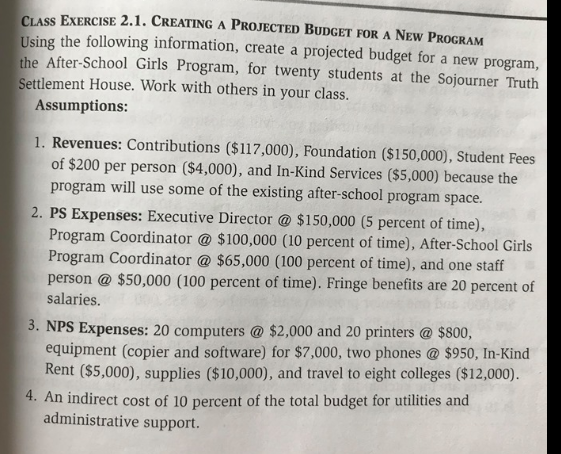

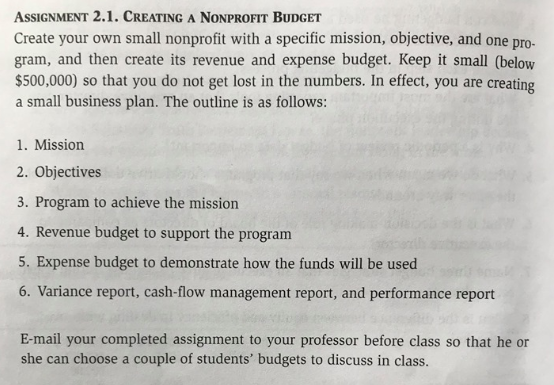

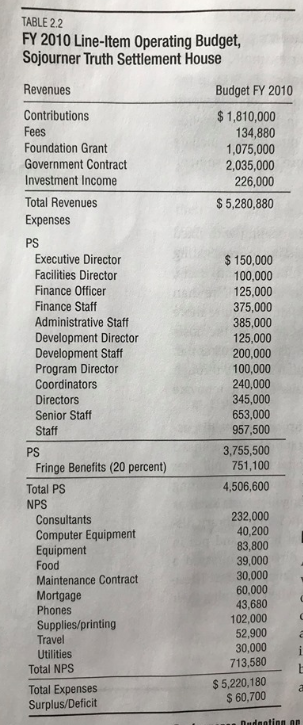

Please explain the answer. Thank you. unes EXERCISE 2.1. CREATING A PROJECTED BUDGET FOR A NEW PROGRAM Using the following information, create a projected budget

Please explain the answer. Thank you.

unes EXERCISE 2.1. CREATING A PROJECTED BUDGET FOR A NEW PROGRAM Using the following information, create a projected budget for a new program, the After-School Girls Program, for twenty students at the Sojourner Truth Settlement House. Work with others in your class. Assumptions: 1. Revenues: Contributions ($117,000), Foundation ($150,000), Student Fees of $200 per person ($4,000), and In-Kind Services ($5,000) because the program will use some of the existing after-school program space. 2. PS Expenses: Executive Director @ $150,000 (5 percent of time), Program Coordinator @ $100,000 (10 percent of time), After-School Girls Program Coordinator @ $65,000 (100 percent of time), and one staff person @ $50,000 (100 percent of time). Fringe benefits are 20 percent of salaries. 3. NPS Expenses: 20 computers @ $2,000 and 20 printers @ $800, equipment (copier and software) for $7,000, two phones @ $950, In-Kind Rent ($5,000), supplies ($10,000), and travel to eight colleges ($12,000). 4. An indirect cost of 10 percent of the total budget for utilities and administrative support. ASSIGNMENT 2.1. CREATING A NONPROFIT BUDGET Create your own small nonprofit with a specific mission, objective, and one pro. gram, and then create its revenue and expense budget. Keep it small (below $500,000) so that you do not get lost in the numbers. In effect, you are creating a small business plan. The outline is as follows: 1. Mission 2. Objectives 3. Program to achieve the mission 4. Revenue budget to support the program 5. Expense budget to demonstrate how the funds will be used 6. Variance report, cash-flow management report, and performance report E-mail your completed assignment to your professor before class so that he or she can choose a couple of students' budgets to discuss in class. TABLE 2.2 FY 2010 Line-Item Operating Budget, Sojourner Truth Settlement House Revenues Budget FY 2010 $ 1,810,000 134,880 1,075,000 2,035,000 226,000 $ 5,280,880 Contributions Fees Foundation Grant Government Contract Investment Income Total Revenues Expenses PS Executive Director Facilities Director Finance Officer Finance Staff Administrative Staff Development Director Development Staff Program Director Coordinators Directors Senior Staff Staff $ 150,000 100,000 125,000 375,000 385,000 125,000 200,000 100,000 240,000 345,000 653,000 957,500 3,755,500 751,100 4,506,600 PS Fringe Benefits (20 percent) Total PS NPS Consultants Computer Equipment Equipment Food Maintenance Contract Mortgage Phones Supplies/printing Travel Utilities Total NPS Total Expenses Surplus/Deficit 232,000 40,200 83,800 39,000 30,000 60,000 43,680 102,000 52,900 30,000 713,580 $ 5,220,180 $ 60,700 Dadatinnon unes EXERCISE 2.1. CREATING A PROJECTED BUDGET FOR A NEW PROGRAM Using the following information, create a projected budget for a new program, the After-School Girls Program, for twenty students at the Sojourner Truth Settlement House. Work with others in your class. Assumptions: 1. Revenues: Contributions ($117,000), Foundation ($150,000), Student Fees of $200 per person ($4,000), and In-Kind Services ($5,000) because the program will use some of the existing after-school program space. 2. PS Expenses: Executive Director @ $150,000 (5 percent of time), Program Coordinator @ $100,000 (10 percent of time), After-School Girls Program Coordinator @ $65,000 (100 percent of time), and one staff person @ $50,000 (100 percent of time). Fringe benefits are 20 percent of salaries. 3. NPS Expenses: 20 computers @ $2,000 and 20 printers @ $800, equipment (copier and software) for $7,000, two phones @ $950, In-Kind Rent ($5,000), supplies ($10,000), and travel to eight colleges ($12,000). 4. An indirect cost of 10 percent of the total budget for utilities and administrative support. ASSIGNMENT 2.1. CREATING A NONPROFIT BUDGET Create your own small nonprofit with a specific mission, objective, and one pro. gram, and then create its revenue and expense budget. Keep it small (below $500,000) so that you do not get lost in the numbers. In effect, you are creating a small business plan. The outline is as follows: 1. Mission 2. Objectives 3. Program to achieve the mission 4. Revenue budget to support the program 5. Expense budget to demonstrate how the funds will be used 6. Variance report, cash-flow management report, and performance report E-mail your completed assignment to your professor before class so that he or she can choose a couple of students' budgets to discuss in class. TABLE 2.2 FY 2010 Line-Item Operating Budget, Sojourner Truth Settlement House Revenues Budget FY 2010 $ 1,810,000 134,880 1,075,000 2,035,000 226,000 $ 5,280,880 Contributions Fees Foundation Grant Government Contract Investment Income Total Revenues Expenses PS Executive Director Facilities Director Finance Officer Finance Staff Administrative Staff Development Director Development Staff Program Director Coordinators Directors Senior Staff Staff $ 150,000 100,000 125,000 375,000 385,000 125,000 200,000 100,000 240,000 345,000 653,000 957,500 3,755,500 751,100 4,506,600 PS Fringe Benefits (20 percent) Total PS NPS Consultants Computer Equipment Equipment Food Maintenance Contract Mortgage Phones Supplies/printing Travel Utilities Total NPS Total Expenses Surplus/Deficit 232,000 40,200 83,800 39,000 30,000 60,000 43,680 102,000 52,900 30,000 713,580 $ 5,220,180 $ 60,700 DadatinnonStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started