Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain the answers if possible write the formulae 1 Working Capital Management (Session 1,2,3) (15 marks) (Submission in Excel only) Please find below the

Please explain the answers if possible write the formulae

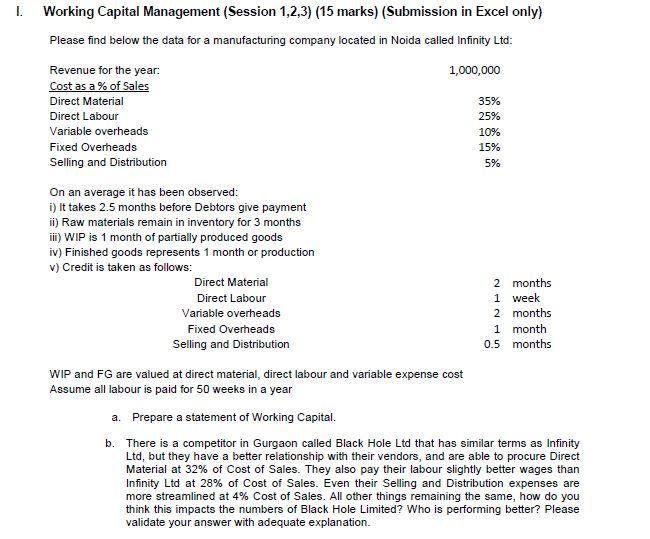

1 Working Capital Management (Session 1,2,3) (15 marks) (Submission in Excel only) Please find below the data for a manufacturing company located in Noida called Infinity Ltd: 1,000,000 Revenue for the year. Cost as a % of Sales Direct Material Direct Labour Variable overheads Fixed Overheads Selling and Distribution 35% 25% 10% 15% 5% On an average it has been observed: i) It takes 2.5 months before Debtors give payment ii) Raw materials remain in inventory for 3 months ii) WIP is 1 month of partially produced goods iv) Finished goods represents 1 month or production v) Credit is taken as follows: Direct Material 2 months Direct Labour 1 week Variable overheads 2 months Fixed Overheads 1 month Selling and Distribution 0.5 months WIP and FG are valued at direct material, direct labour and variable expense cost Assume all labour is paid for 50 weeks in a year a. Prepare a statement of Working Capital. b. There is a competitor in Gurgaon called Black Hole Ltd that has similar terms as Infinity Ltd, but they have a better relationship with their vendors, and are able to procure Direct Material at 32% of Cost of Sales. They also pay their labour slightly better wages than Infinity Ltd at 28% of Cost of Sales. Even their Selling and Distribution expenses are more streamlined at 4% Cost of Sales. All other things remaining the same, how do you think this impacts the numbers of Black Hole Limited? Who is performing better? Please validate your answer with adequate explanation. 1 Working Capital Management (Session 1,2,3) (15 marks) (Submission in Excel only) Please find below the data for a manufacturing company located in Noida called Infinity Ltd: 1,000,000 Revenue for the year. Cost as a % of Sales Direct Material Direct Labour Variable overheads Fixed Overheads Selling and Distribution 35% 25% 10% 15% 5% On an average it has been observed: i) It takes 2.5 months before Debtors give payment ii) Raw materials remain in inventory for 3 months ii) WIP is 1 month of partially produced goods iv) Finished goods represents 1 month or production v) Credit is taken as follows: Direct Material 2 months Direct Labour 1 week Variable overheads 2 months Fixed Overheads 1 month Selling and Distribution 0.5 months WIP and FG are valued at direct material, direct labour and variable expense cost Assume all labour is paid for 50 weeks in a year a. Prepare a statement of Working Capital. b. There is a competitor in Gurgaon called Black Hole Ltd that has similar terms as Infinity Ltd, but they have a better relationship with their vendors, and are able to procure Direct Material at 32% of Cost of Sales. They also pay their labour slightly better wages than Infinity Ltd at 28% of Cost of Sales. Even their Selling and Distribution expenses are more streamlined at 4% Cost of Sales. All other things remaining the same, how do you think this impacts the numbers of Black Hole Limited? Who is performing better? Please validate your answer with adequate explanationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started