please explain the calculations briefly

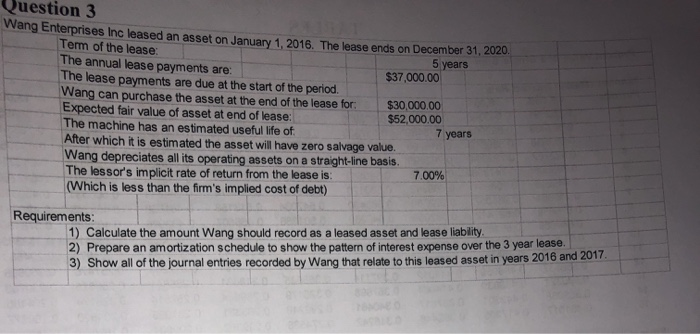

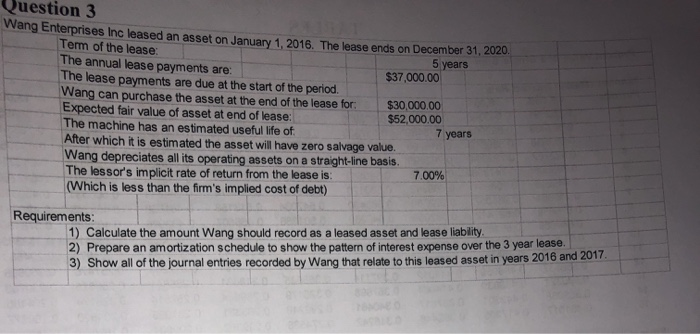

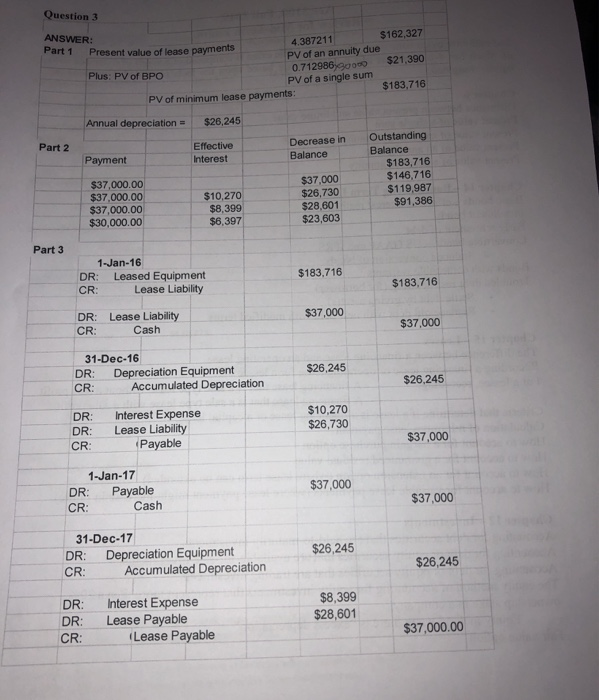

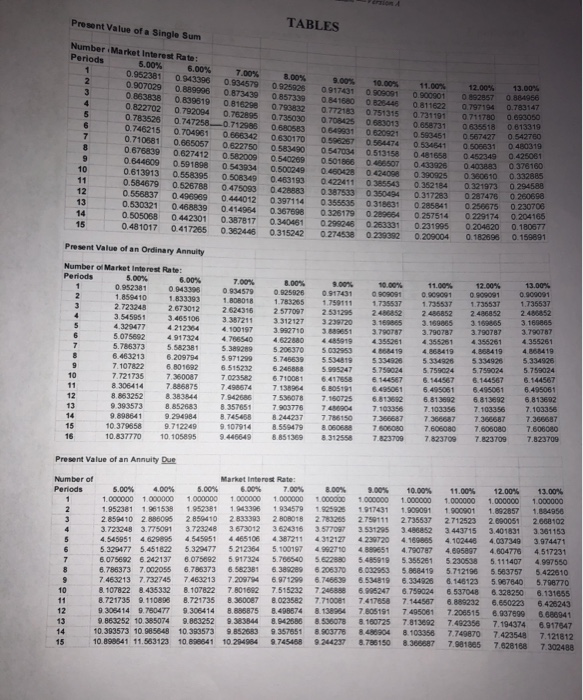

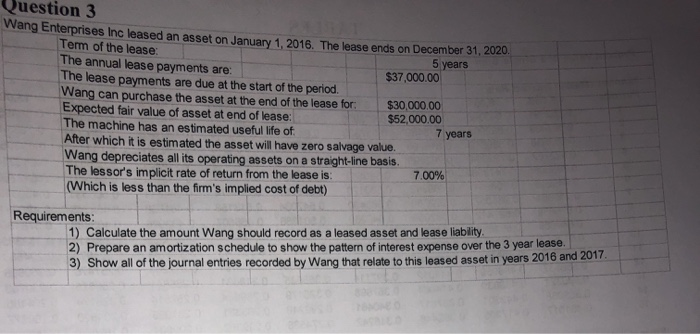

Question 3 Wang Enterprises Inc leased an asset on January 1, 2016. The lease ends on December 31, 2020. Term of the lease: 5 years The annual lease payments are: $37,000.00 The lease payments are due at the start of the period. Wang can purchase the asset at the end of the lease for $30,000.00 Expected fair value of asset at end of lease: $52,000.00 The machine has an estimated useful life of 7 years After which it is estimated the asset will have zero salvage value. Wang depreciates all its operating assets on a straight-line basis. The lessor's implicit rate of return from the lease is: 7.00% ( Which is less than the firm's implied cost of debt) Requirements: 1) Calculate the amount Wang should record as a leased asset and lease liability 2) Prepare an amortization schedule to show the pattern of interest expense over the 3 year lease. 3) Show all of the journal entries recorded by Wana that relate to this leased asset in years 2016 and 2 Question 3 ANSWER: 4.387211 $162,327 Part 1 Present value of lease payments PV of an annuity due $21,390 Plus: PV of BPO 0.712986 000 PV of a single sum $183,716 PV of minimum lease payments: Annual depreciation = $26,245 Part 2 Outstanding Decrease in Effective Payment Balance Interest Balance $183,716 $37,000.00 $37,000 $146,716 $37,000.00 $10,270 $26,730 $119.987 $37,000.00 $8,399 $28,601 $91,386 $30,000.00 $6,397 $23,603 Part 3 1-Jan-16 DR: Leased Equipment CR: Lease Liability $183,716 $183,716 $37,000 DR: Lease Liability CR: Cash $37.000 31-Dec-16 DR: Depreciation Equipment CR: Accumulated Depreciation $26,245 $26,245 DR: DR: CR: Interest Expense Lease Liability Payable $10,270 $26,730 $37,000 1-Jan-17 DR: Payable CR: Cash $37,000 $37,000 31-Dec-17 DR: Depreciation Equipment CR: Accumulated Depreciation $26,245 $26,245 DR: $8,399 $28,601 Interest Expense Lease Payable (Lease Payable DR: CR: $37,000.00 Present Value of a Single Sum TABLES Number Market Interest Rate : Periods 5.00% .00 70% 0 952381 043306 0945709292 on 10 12.00 13.00 917491 0909091 0900901 07029 0.889996 0882857 0884956 087343 00 0.900801 0857290 0 0863838 8116 0797184 080819 081624 0.78374 7982 772183 0822702 0751315 0731191 0.711780 0.690050 0792004 0 5 0735030 TOMS 063013 0658731 0 835518 0.783526 0813319 0.747258 71295 00583 06400010820921 0503451 0567427 0 542780 0.746215 0.704961 0666342 0630170 SET 055404 0534541 05006310 40319 0.710581 0 665057 0892750 5 0 0547034 0513158 0.481658 04349 0425061 0676839 0627412 52000 540 090166 SOT 0.000 04ARS 0378100 06448090591209 03934 050 04098 0.390925 0380510 0 332885 0613913 0.5680950 5349 483199 02411 035543 0.352184 0321973 0 294588 0.584679 0.525788 0475093 0.428883 387533 0350434 0.317283 0287476 0260698 0 556837 049899 0444012 397114 035 0318831 0 285841 0256575 0.230706 0.530321 0.468839 0414054 0367699 0326179 020654 0.257514 0229174 0.204165 0 505068 0.442301 0.387817 0.340431 0299240263331 0.231995 0204620 0.180677 0.481017 0.417265 0.362446 0.315242 0274538 0230302 0.2090040 182806 0.160891 Present Value of an ordinary Annuity 3777 Number of Market Interest Rate Periods 00 00 092381 0.943305 1.850410 1.833093 2.723248 2673012 3 545051 3.465106 4320477 42124 5 075692 4 917324 5.786373 5.582381 6.401213 6.209794 7 107822 6 801692 7.721735 7350087 8305414 7885875 8. 52 8.383544 13 3573 1852583 941 9200384 10 378 9.71229 10 837770 10.105895 7 ons 8.0 % 0034579 0.925326 091761 18018 1.783285 19111 262016 2.577097 3387211 3312127 3239720 4.100197 3092710 351 478540 4.622880445019 5389289 5.20637050323 5971290 5.745539 5534819 65152326 246688 5.995247 70352 5 710081 5.41758 7.48574 7 138954 805191 7002686 7535078 7 57651 7903775 T 04 7 8244237 107914 8550479 9605549 8851369 435091 4868419 5334928 5.759024 6 1657 8.65051 5832 710356 7366687 7505080 7.823709 11.00% 13.00 900001 COD091 1 735537 173553T 1.735537 242 246852 3 S 3169065 3.160865 3.790787 3790787 4355251 4355261 4.355261 4.868419 48684194 MM19 5334925 5334926 5334926 S750094 5750024 5.759024 14457 8144567 6.144587 505061841851 5.495051 58132 5.813692 7.103356 7.103256 73555877366687 760607 6060 7.60608 78237097.823709 7.823709 7.356687 16 Present Value of an Annuity Due Number of Market Interest Rate: Periods 5.00 4.00% 5.00% 60% 70% 9.00% 10.00% 11.00% 12.00% 13.00% 1 000000 1000000 1000000 1000000 1000000 1000000 1000000 1000000 100000 OOCOCO 1OOOOOO 1952381 1661558 19523811 3306 19345791925 1917431 1900091 900001 1992 1995 2504102 096 2856410 2833383 208018 27325 2750111 27355 2 71223 2090051 200102 3720433775091 372368 3673012362016 3577097 3531295 3 85 3443715 3491891 331153 545051 4629995 4545051 465106 387211 1212742307204 10 4 102 4037349 3974471 5320477 54518225329477 5212364 5.100197 4992710480651 4.790787 4 605097 4004778 4517231 60752 82421378075092 5017324 5.7065405.692805485019 5.355251 5230538 5.111407 4997550 6.788373 7002056 6.7883736582381 63890896205370 6032053 868419 5712106 5563757 5.472810 7.462213 7.73274574632137 209704697129967666385348196.334926 1481235967840 5.706770 A 107822 8.435332 8.107822 7801692 7.515232 7245888 6.906247 6.759024 6537048 6 328250 8.131855 8.721735 110898 8.721735 8 380087 8023582 7.710001 7417658 7.144567 0232 8.850223 5.426243 9308414 9780477 9305414 8886875 8.490674 138954 7805151 7.495081 7 206515 8.9978998 4 1 9 252 10 3850749.883252 9383844 8.942686 85360738160725 7.813892 7492358 7194374 77 10 390573 105 10390573 98239357851 773 904 0 7 10.896541 11 563123 10 898841 10 204054 974 920 8711508366687 70818657828188 7304