Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain the question 3and4, how to calculate ? Case 1 At December 31, 2020, Hanoi Ltd. has equipment with a cost of VND26,000,000, and

please explain the question 3and4, how to calculate ?

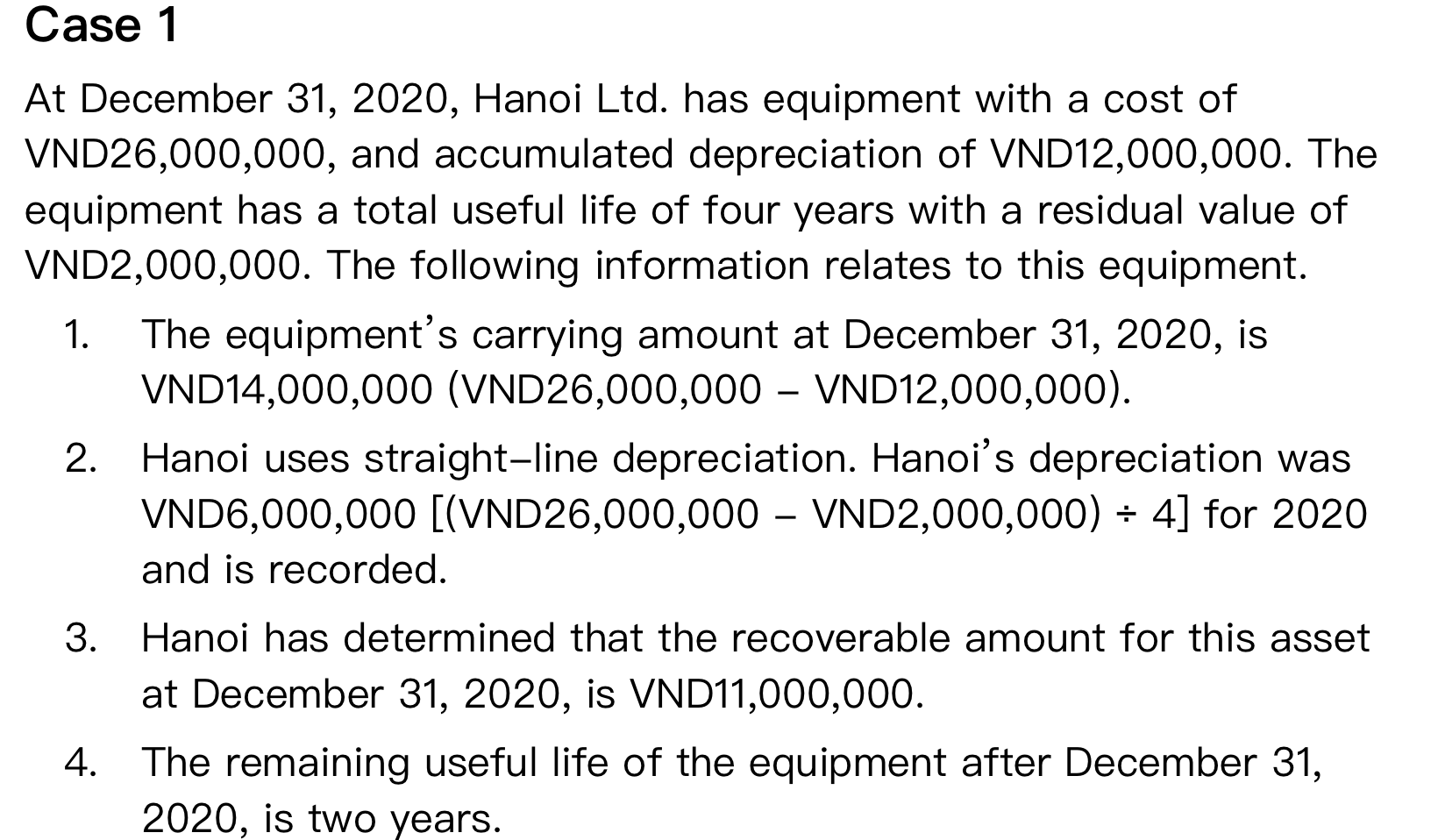

Case 1 At December 31, 2020, Hanoi Ltd. has equipment with a cost of VND26,000,000, and accumulated depreciation of VND 12,000,000. The equipment has a total useful life of four years with a residual value of VND2,000,000. The following information relates to this equipment. 1. The equipment's carrying amount at December 31, 2020, is VND 14,000,000 (VND26,000,000 VND12,000,000). 2. Hanoi uses straight-line depreciation. Hanoi's depreciation was VND6,000,000 [(VND26,000,000 - VND2,000,000) = 4] for 2020 and is recorded. 3. Hanoi has determined that the recoverable amount for this asset at December 31, 2020, is VND11,000,000. 4. The remaining useful life of the equipment after December 31, 2020, is two yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started