Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain the steps for the solution Please explain the steps for the solution Problem 2-4 Calculating Taxes Timmy Tappan is single and had $186,000

Please explain the steps for the solution

Please explain the steps for the solution

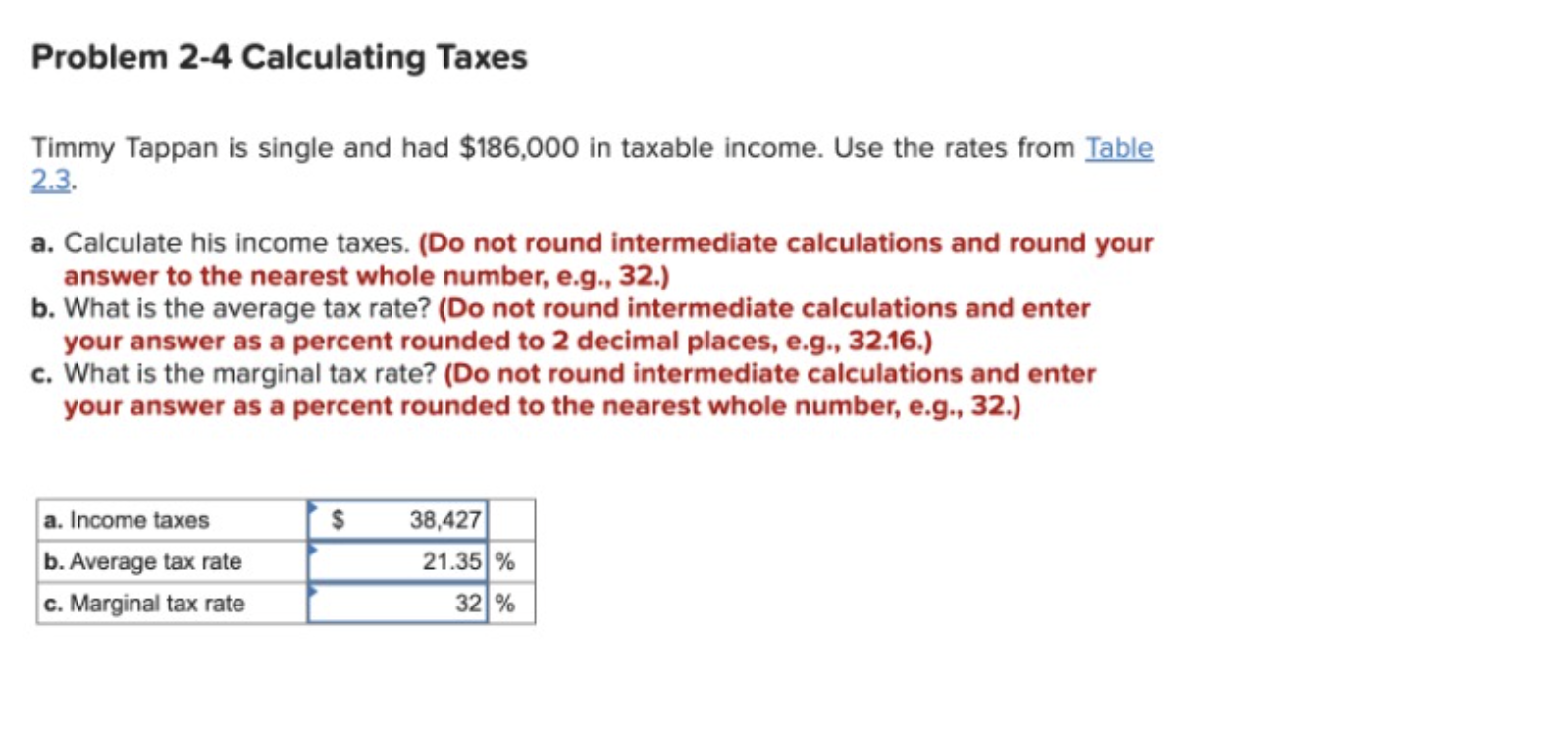

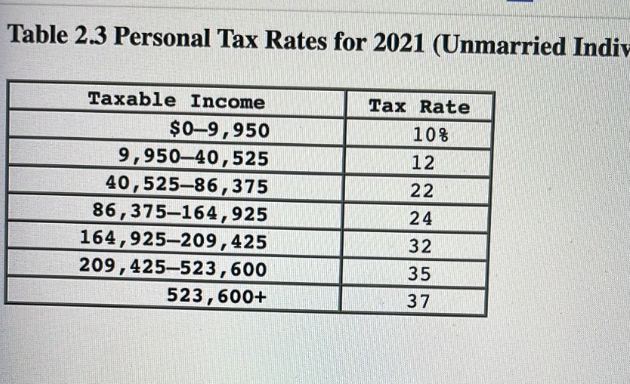

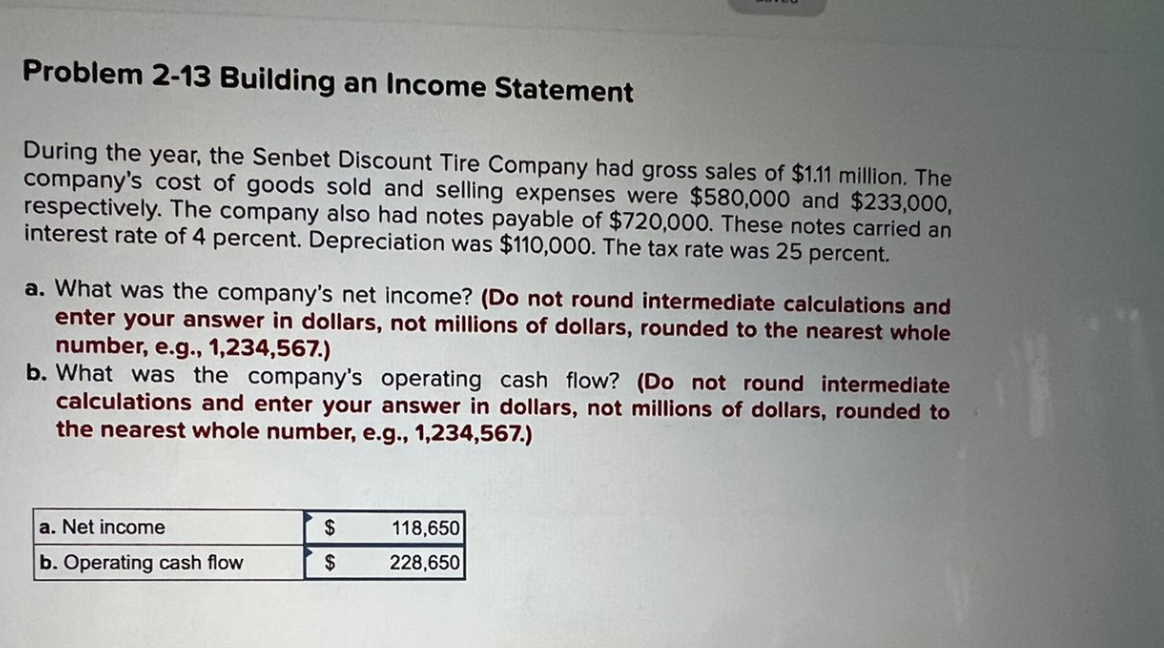

Problem 2-4 Calculating Taxes Timmy Tappan is single and had $186,000 in taxable income. Use the rates from Table 2.3. a. Calculate his income taxes. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the average tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the marginal tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to the nearest whole number, e.g., 32.) a. Income taxes b. Average tax rate c. Marginal tax rate $ 38,427 21.35% 32% Table 2.3 Personal Tax Rates for 2021 (Unmarried Indiv Taxable Income $0-9,950 9,950-40,525 40,525-86,375 86,375-164,925 164,925-209,425 209,425-523,600 523,600+ Tax Rate 10% 12 22 24 32 35 37 Problem 2-13 Building an Income Statement During the year, the Senbet Discount Tire Company had gross sales of $1.11 million. The company's cost of goods sold and selling expenses were $580,000 and $233,000, respectively. The company also had notes payable of $720,000. These notes carried an interest rate of 4 percent. Depreciation was $110,000. The tax rate was 25 percent. a. What was the company's net income? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What was the company's operating cash flow? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) a. Net income b. Operating cash flow $ $ 118,650 228,650Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started