Answered step by step

Verified Expert Solution

Question

1 Approved Answer

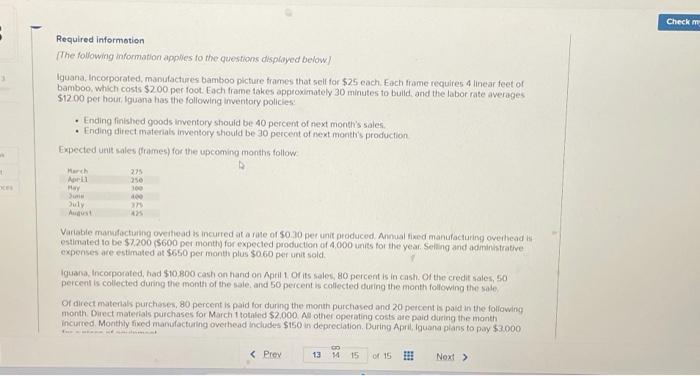

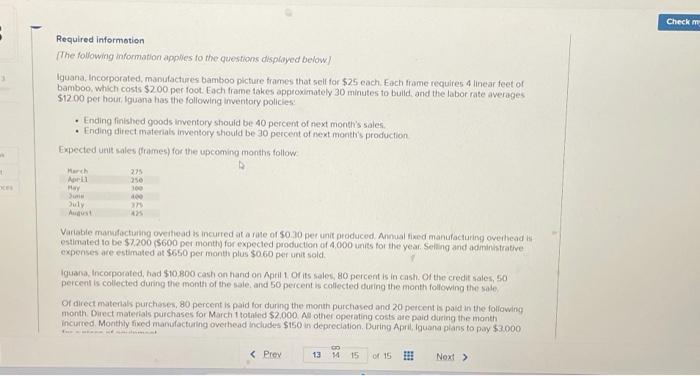

please explain the steps Required Informotion [The following informiation applies fo the questions displayed below] Iguana, Incosporated, manufactures bamboo plcture trames thot seif for $25

please explain the steps

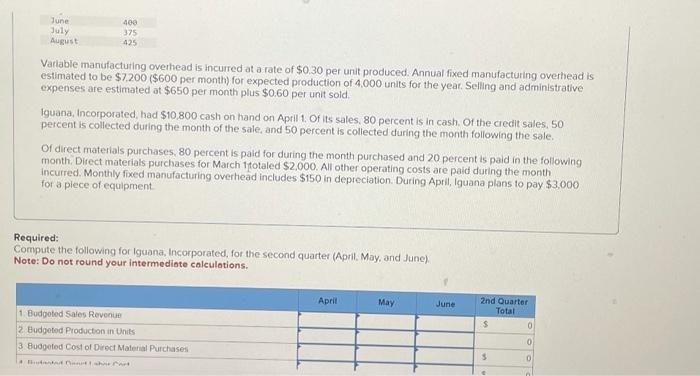

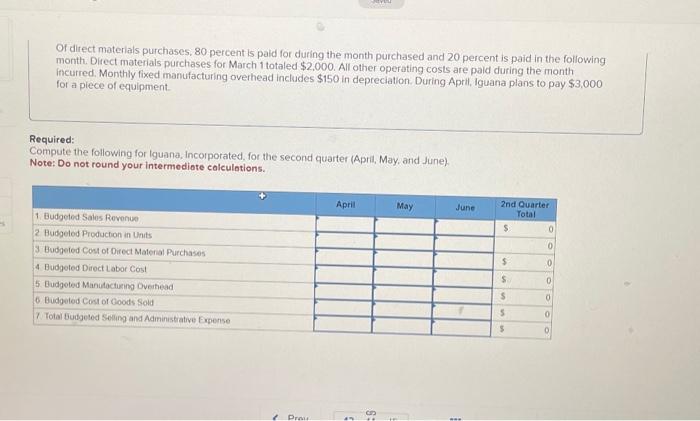

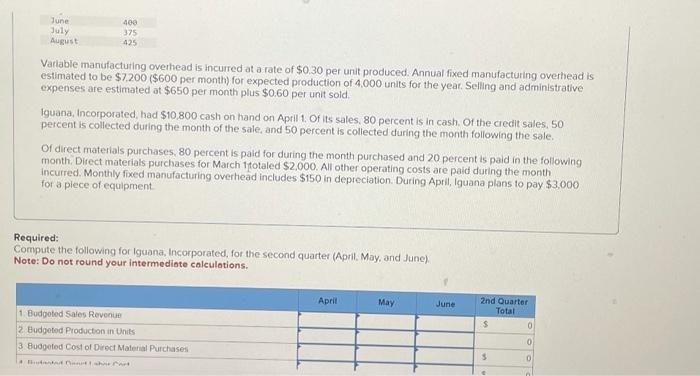

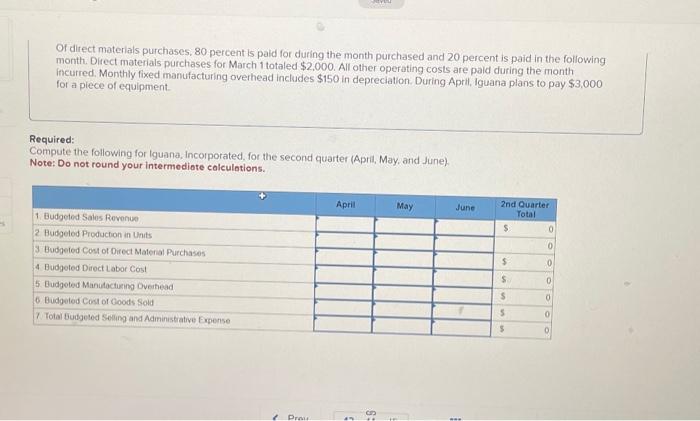

Required Informotion [The following informiation applies fo the questions displayed below] Iguana, Incosporated, manufactures bamboo plcture trames thot seif for $25 each. Each frame requires 4 linear feet of bamboo, which costs $200 per foot. Each frame takes approvimately 30 minutes to bulid, and the labor rate averages $1200 per hour lguana has the following inventory policies. - Ending finished goods imventory shouid be 40 percent of next montris sales. - Ending direct materiats inveatory should be 30 percent of next montr's production Expected unit sales (frames) for the upcoming months follow Variable mangfocturang oweitiead is incurred at a rase of 50.70 per unit aroduced. Annual fixed manufacturing oveihead is. estimated to be $7,200 (\$600 per monthy for expecled production of 4,000 units fot the year. Selling and adminhistrative expenses are estimated at $650 per manti plus $060 per unit sold. Iguana. Incocporated, had $10.800 cash on hand on A pril 1 Or its sales, 80 percert is in cash. Or the credit sales, 50 percent is collected during the month of the sale. and 50 percent is collected during the month following the soles Ot direct materals purchises, 80 percent is paid tor during the month porchased and 20 percent is pold in the foliowine month. Direct materials purchases for March 1 totaled $2.000. Al other operating costs ate paid dieing the month incurred. Monthty fixed ramagactuiling ovethead includes $150 in depreclation. During April, Iquana plans to pay $3.000 Varlable manufactuting overhead is incurred at a rate of $0.30 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ( $600 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.60 per unit sold Iguana, Incorporated, had $10,800 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50 percent is collected duting the month of the sale, and 50 percent is collected during the month following the sale. Of direct materials purchases. 80 percent is paid for during the month purchased and 20 percent is paid in the following month. Direct materials purchases for March 1 totaled $2,000. All other operating costs are paid during the month incurred. Monthly foxed manufacturing overhead includes $150 in depreciation. During April, Iguana plans to pay $3,000 for a plece of equipment. Required: Compute the following for Iguana, Incorporated, for the second quarter (April, May, and June) Note: Do not round your intermediote calculations. Of direct materlals purchases, 80 percent is paid for during the month purchased and 20 percent is paid in the following month. Direct materials purchases for March 1 totaled $2,000. All other operating costs are paid during the month incurred. Monthly fixed manufacturing overhead includes $150 in depreciation. During April, Iguana plans to pay $3,000 for a piece of equipment. Required: Compute the following for lguana, incorporated, for the second quarter (April, May, and June) Note: Do not round your intermediote calculotions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started