Please explain what is difference between these two questions

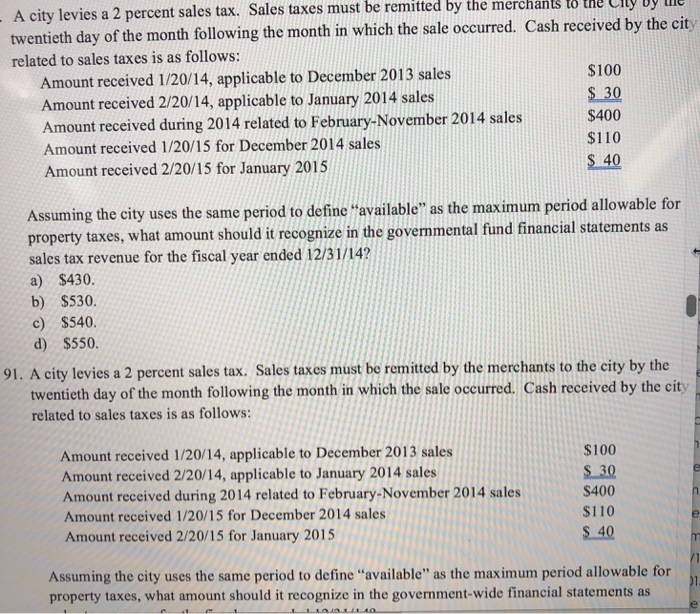

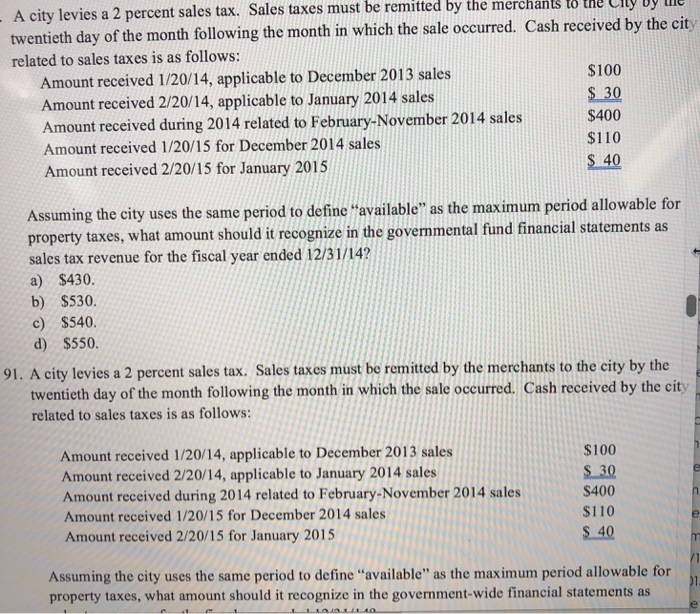

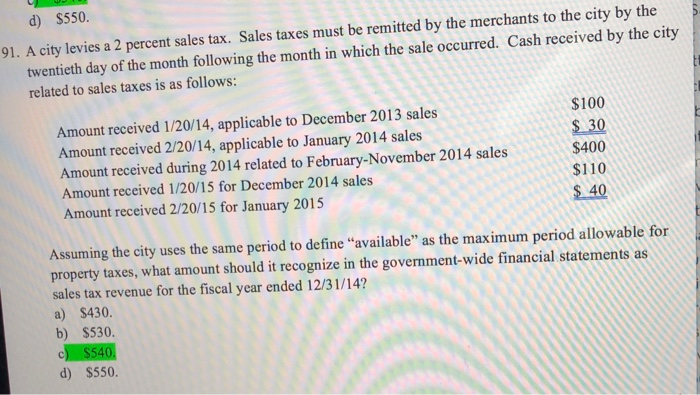

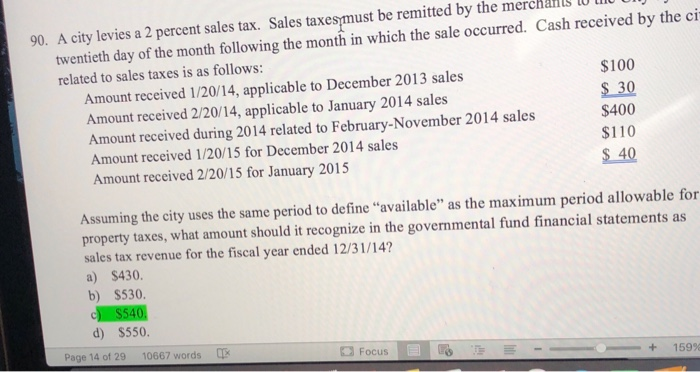

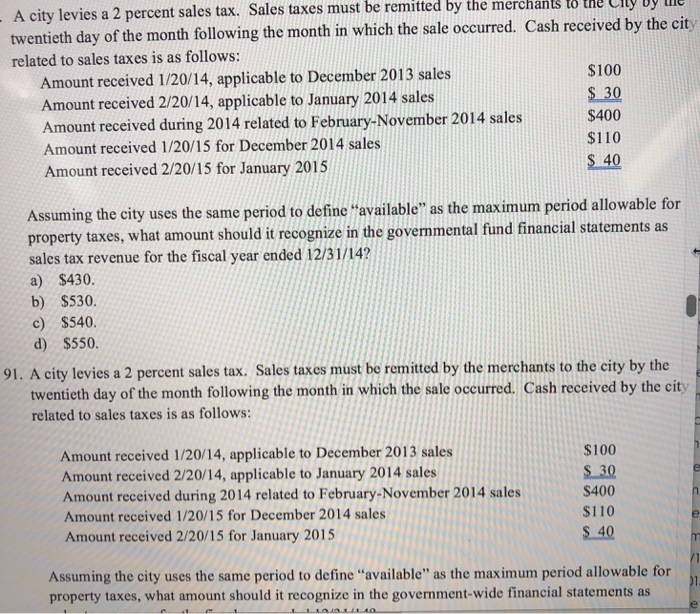

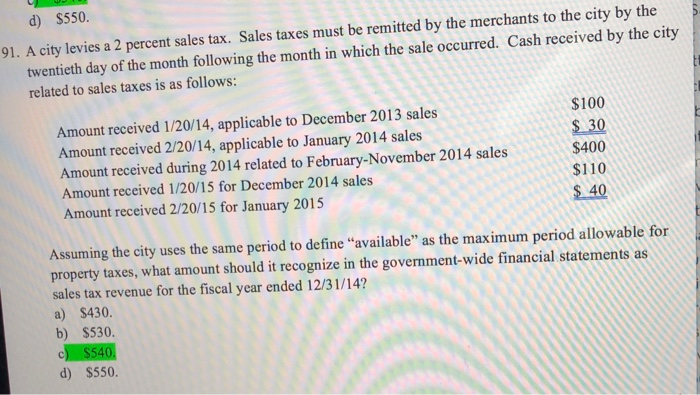

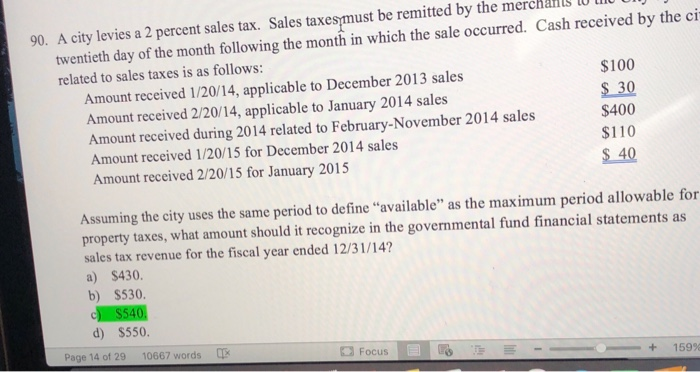

A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to t twentieth day of the month following the month in which the sale occurred. Cash received by the cit related to sales taxes is as follows: be remitted by the merchants to the CILy y e Amount received 1/20/14, applicable to December 2013 sales $100 S 30 $400 $110 S 40 Amount received 2/20/14, applicable to January 2014 sales Amount received during 2014 related to February-November 2014 sales Amount received 1/20/15 for December 2014 sales Amount received 2/20/15 for January 2015 g the city uses the same period to define "available" as the maximum period allowable for Assumin property taxes, what amount should it recognize in the govemmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/14? a) $430. b) $530. c) $540. d) S550 91. A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to the city by the twentieth day of the month following the month in which the sale occurred. Cash received by the city related to sales taxes is as follows: Amount received 1/20/14, applicable to December 2013 sales Amount received 2/20/14, applicable to January 2014 sales Amount received during 2014 related to February-November 2014 sales Amount received 1/20/15 for December 2014 sales Amount received 2/20/15 for January 2015 $100 S 30 $400 $110 S 40 Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as d) S550. 91. A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to the city by the twentieth day of the month following the month in which the sale occurred. Cash received by the city related to sales taxes is as follows: Amount received 1/20/14, applicable to December 2013 sales Amount received 2/20/14, applicable to January 2014 sales Amount received during 2014 related to February-November 2014 sales Amount received 1/20/15 for December 2014 sales Amount received 2/20/15 for January 2015 $100 $ 30 $400 $110 $ 40 Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/14? a) $430. b) $530. $540 d) $550