Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain why. Thanks! Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21,

Please explain why. Thanks!

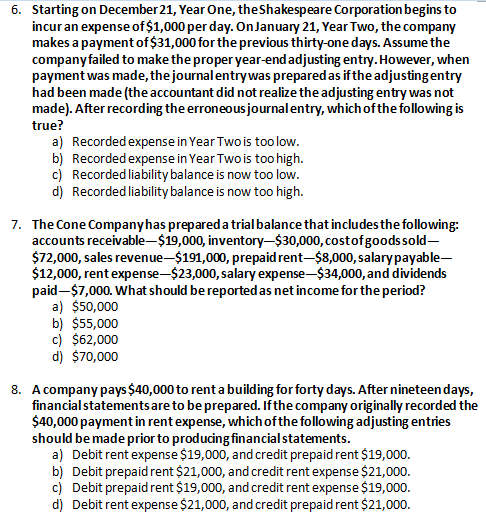

Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000 for the previous thirty-one days. Assume the company failed to make the proper year-end adjusting entry. However, when payment was made, the journal entry was prepared as if the adjusting entry had been made (the accountant did not realize the adjusting entry was not made). After recording the erroneous journal entry, which of the following is true? Recorded expense in Year Two is too low. Recorded expense in Year Two is too high. Recorded liability balance is now too low. Recorded liability balance is now too high. The Cone Company has prepared a trial balance that includes the following: accounts receivable -$19,000, inventory-$30,000, cost of goods sold- $72,000, sales revenue-$191,000, prepaid rent-$8,000, salary payable- $12,000, rent expense-$23,000, salary expense-$34,000, and dividends paid-$7,000. What should be reported as net income for the period? $50,000 $55,000 $62,000 $70,000 A company pays $40,000 to rent a building for forty days. After nineteen days, financial statements are to be prepared. If the company originally recorded the $40,000 payment in rent expense, which of the following adjusting entries should be made prior to producing financial statements. Debit rent expense $19,000, and credit prepaid rent $19,000. Debit prepaid rent $21,000, and credit rent expense $21,000. Debit prepaid rent $19,000, and credit rent expense $19,000. Debit rent expense $21,000, and credit prepaid rent $21,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started