cummins, CIM

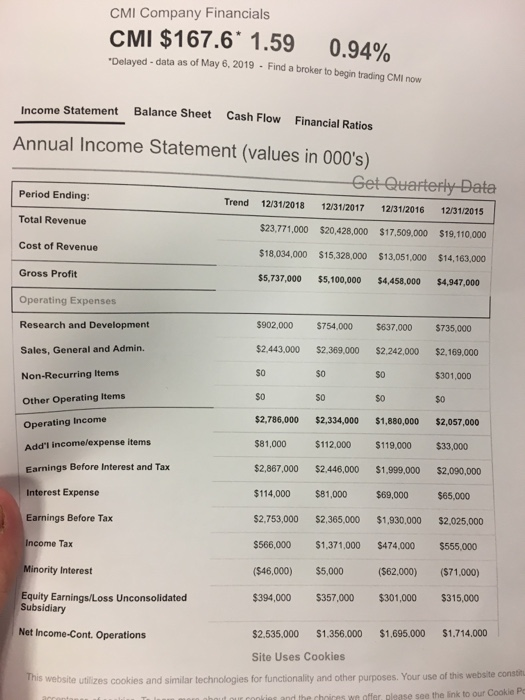

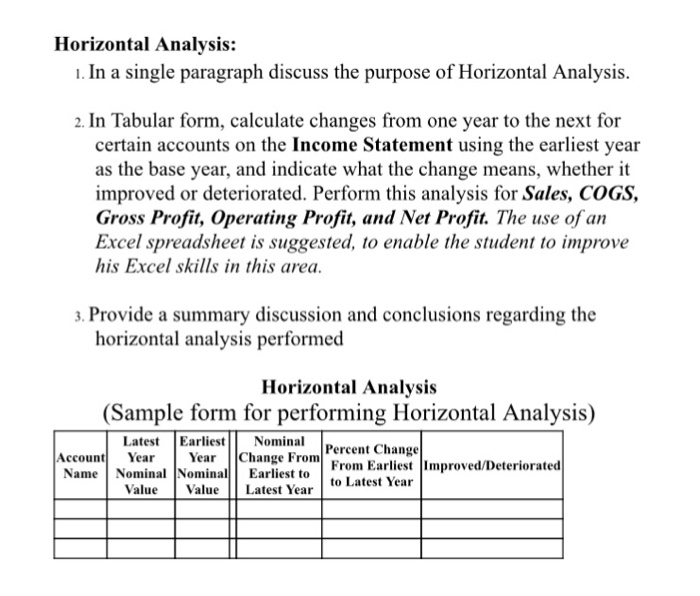

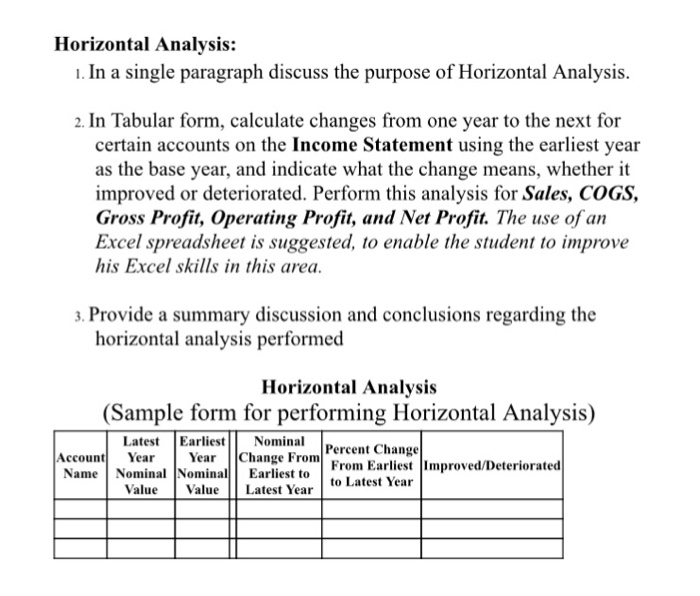

Horizontal Analysis: 1. In a single paragraph discuss the purpose of Horizontal Analysis. 2. In Tabular form, calculate changes from one year to the next for certain accounts on the Income Statement using the earliest year improved or deteriorated. Perform this analysis for Sales, COGS, Gross Profit, Operating Profit, and Net Profit. The use of an Excel spreadsheet is suggested, to enable the student to improve his Excel skills in this area. . Provide a summary discussion and conclusions regarding the horizontal analysis performed Horizontal Analysis (Sample form for performing Horizontal Analysis) Latest ElstNomina Percent Change ccount YYear Change From F Name Nominal Nomina Earliest to From Earliest Improved/Deteriorated to Latest Year ValueValueLatest Year CMI Company Financials CMI $167.6*1.59 0.94% data as of May 6, 2019 Find a broker to begin trading CMI now Income Statement Balance Sheet Cash Flow Financial Ratios Annual Income Statement (values in 000's) Period Ending: Total Revenue Cost of Revenue Gross Profit Operating Expenses Research and Development Sales, General and Admin. Non-Recurring Items Other Operating Items Operating Income Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015 $23,771,000 $20,428,000 $17.509,000 $19,110,000 $18,034,000 $15,328,000 $13,051,000 $14,163,000 5,737,000 $5,100,000 $4,458,000 $4,947,000 $902,000 $754,000 $637.000 $735,000 $2,443,000 $2,369,000 $2.242,000 $2,169.000 SO So so $301,000 So $2,786,000 $2,334,000 $1,880,000 $2,057,000 $81,000 $112,000 $119,000 $33,000 $2,867,000 $2.446,000 $1,999,000 $2,090,000 $114,000 $81,000 $69,000 $65,000 $2,753,000 $2,365,000 $1,930,000 $2.025,000 $566,000 $1,371,000 $474,000 $555,000 ($46,000) $5,000 (62.000) (71,000) $394,000 $357,000 $301,000 $315,000 SO S0 $0 Add'I incomelexpense items Earnings Before Interest and Tax Interest Expense Earnings Before Tax Income Tax Minority Interest Equity Earnings/Loss Unconsolidated Subsidiary Net Income-Cont. Operations $2.535.000 $1.356.000 $1,695.000 $1.714.000 Site Uses Cookies Ihis website utilizes cookies and similar technologies for functionality and other purposes. Your use of this website consth wn offer, please see the link to our Cookie P

cummins, CIM

cummins, CIM