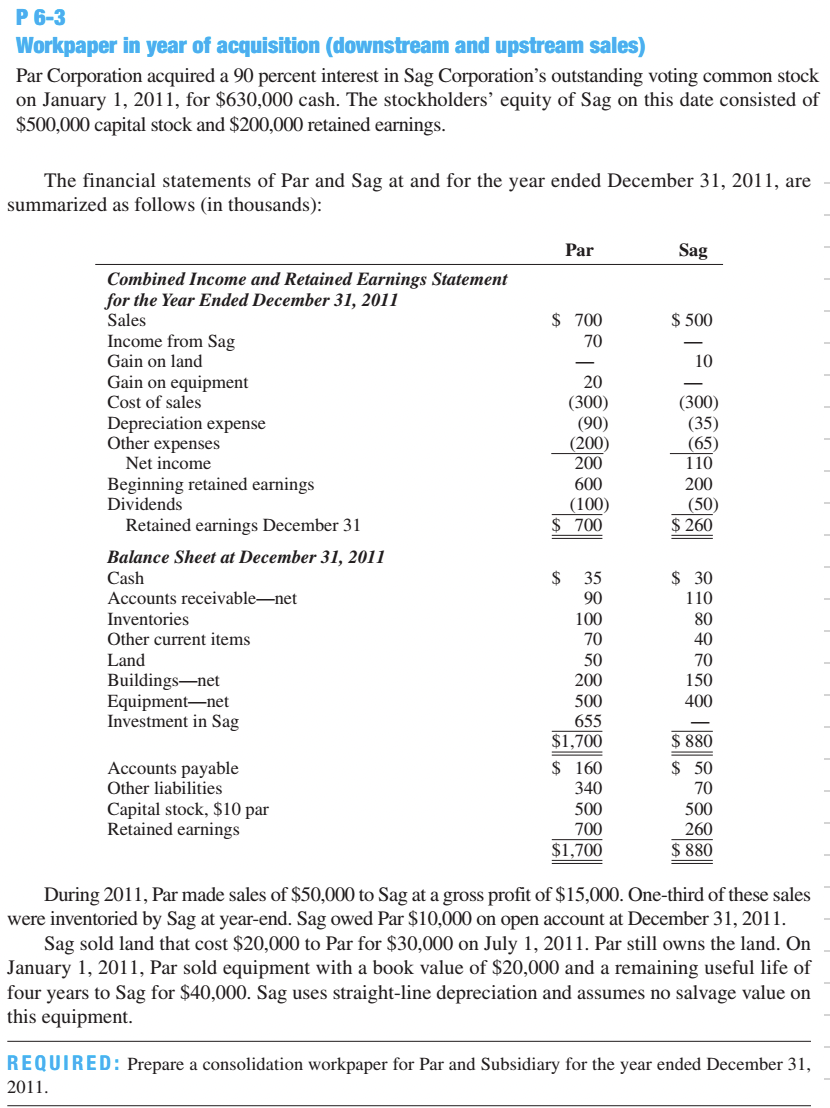

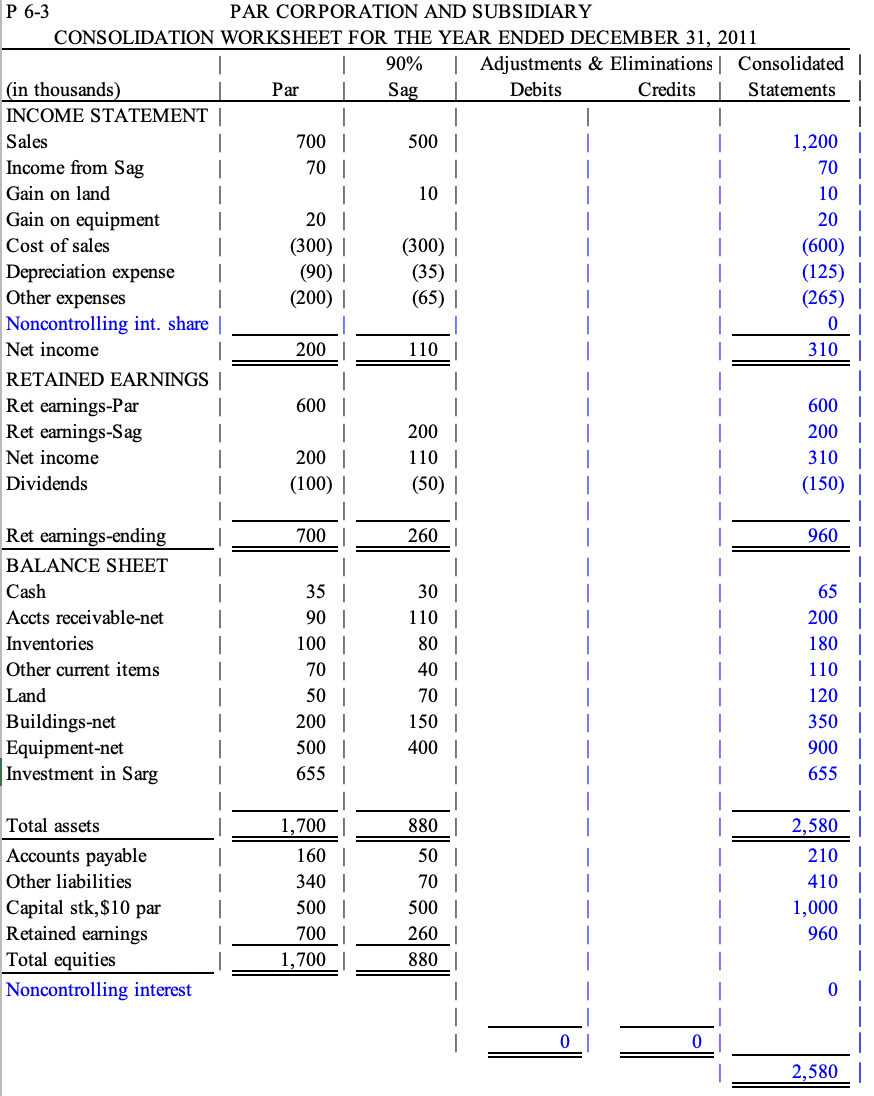

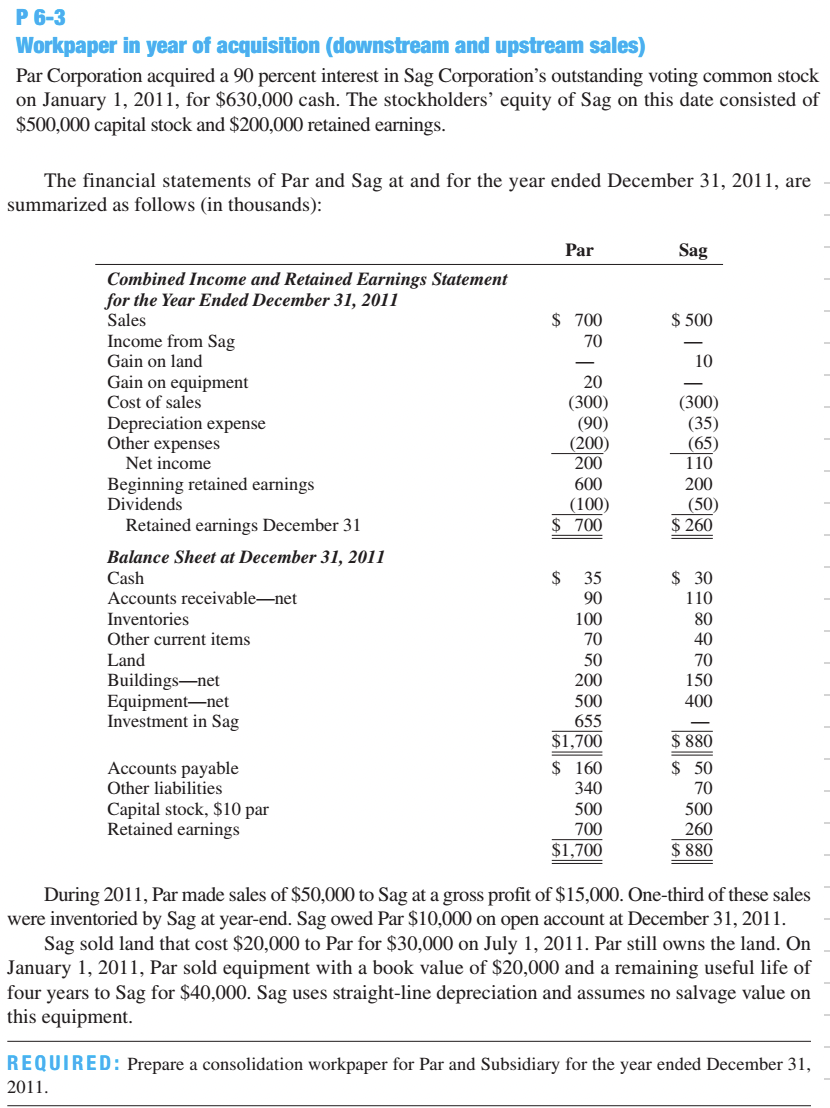

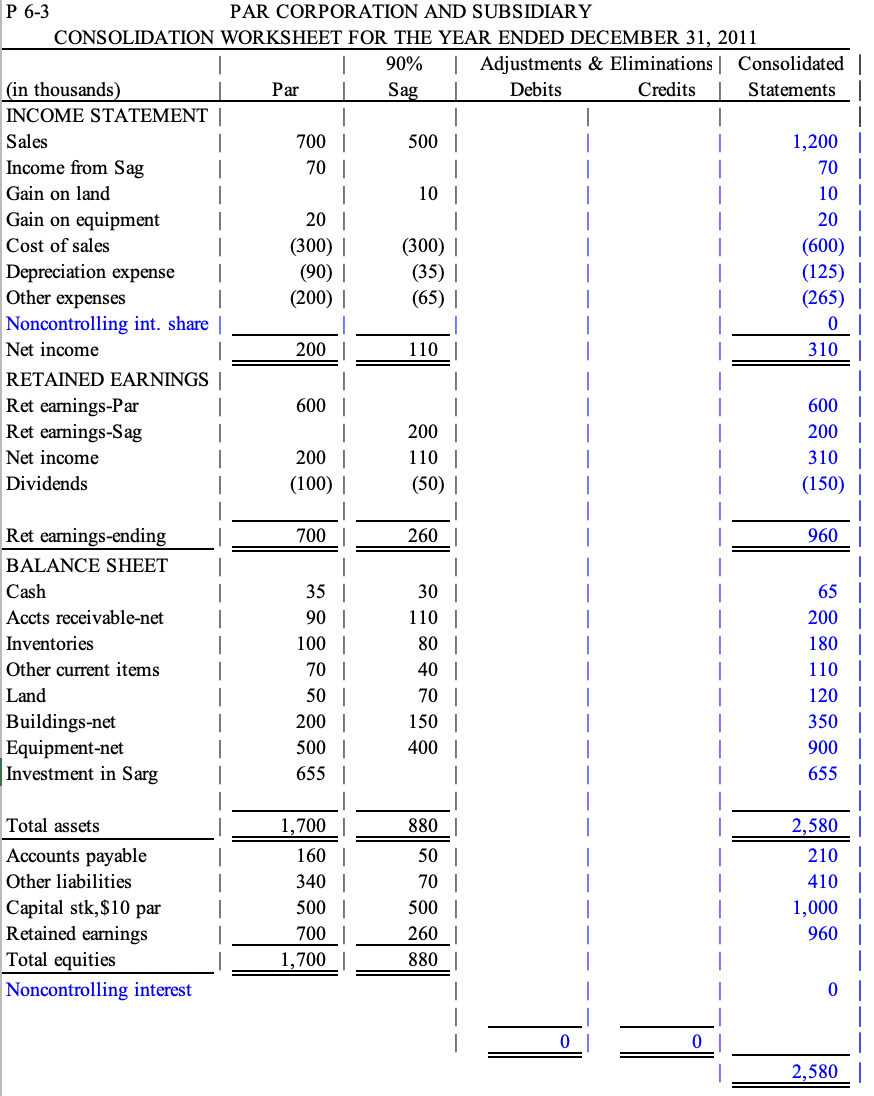

P 6-3 Workpaper in year of acquisition (downstream and upstream sales) Par Corporation acquired a 90 percent interest in Sag Corporation's outstanding voting common stock on January 1, 2011, for $630,000 cash. The stockholders' equity of Sag on this date consisted of $500,000 capital stock and $200,000 retained earnings. The financial statements of Par and Sag at and for the year ended December 31, 2011, are summarized as follows (in thousands): Par Sag $ 500 $ 700 70 10 20 (300) (90) Combined Income and Retained Earnings Statement for the Year Ended December 31, 2011 Sales Income from Sag Gain on land Gain on equipment Cost of sales Depreciation expense Other expenses Net income Beginning retained earnings Dividends Retained earnings December 31 Balance Sheet at December 31, 2011 Cash Accounts receivable-net Inventories Other current items (200) 200 600 (100) $ 700 (300) (35) (65) 110 200 (50) $ 260 $ 30 110 80 40 70 150 Land Buildings-net Equipment-net Investment in Sag 400 $ 35 90 100 70 50 200 500 655 $1,700 $ 160 340 500 700 $1,700 Accounts payable Other liabilities Capital stock, $10 par Retained earnings $ 880 $ 50 70 500 260 $ 880 During 2011, Par made sales of $50,000 to Sag at a gross profit of $15,000. One-third of these sales were inventoried by Sag at year-end. Sag owed Par $10,000 on open account at December 31, 2011. Sag sold land that cost $20,000 to Par for $30,000 on July 1, 2011. Par still owns the land. On January 1, 2011, Par sold equipment with a book value of $20,000 and a remaining useful life of four years to Sag for $40,000. Sag uses straight-line depreciation and assumes no salvage value on this equipment. REQUIRED: Prepare a consolidation workpaper for Par and Subsidiary for the year ended December 31, 2011. P 6-3 PAR CORPORATION AND SUBSIDIARY CONSOLIDATION WORKSHEET FOR THE YEAR ENDED DECEMBER 31, 2011 90% Adjustments & Eliminations Consolidated (in thousands) Par Sag Debits Credits Statements INCOME STATEMENT | Sales 700 500 1,200 Income from Sag 70 70 | Gain on land 101 10 | Gain on equipment 20 20 Cost of sales (300) | (300) | (600) Depreciation expense (90) (35) (125) | Other expenses (200) (65) (265) Noncontrolling int. share 0 Net income 200 110 310 RETAINED EARNINGS Ret earnings-Par 600 600 Ret earnings-Sag 200 200 Net income 200 1101 310 Dividends (100) (50)| (150) 700 260 960 Ret earnings-ending BALANCE SHEET Cash Accts receivable-net Inventories Other current items Land Buildings-net Equipment-net Investment in Sarg 35 90 100 70 50 200 500 655 30 1101 80 401 70 150 400 65 | 2001 180 110 | 120 | 3501 900 655 880 Total assets Accounts payable Other liabilities Capital stk, $10 par Retained earnings Total equities Noncontrolling interest 1,700 160 340 500 700 1,700 50 701 500 260 880 2,580 210 4101 1,000 960 0 0 0 2,580