Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE EXPLAIN WHY THEY START WITH THE LAST 8 YEARS FIRST? I'm confused on the equation of PV = $101,967.59 / [1 + (.10 /

PLEASE EXPLAIN WHY THEY START WITH THE LAST 8 YEARS FIRST? I'm confused on the equation of "PV = $101,967.59 / [1 + (.10 / 12)]84 = $50,782.69

PLEASE EXPLAIN WHY THEY START WITH THE LAST 8 YEARS FIRST? I'm confused on the equation of "PV = $101,967.59 / [1 + (.10 / 12)]84 = $50,782.69

also please hand draw a timeline for the entire equation step by step (not using excel please). I'm looking for a detailed explanation to explain the entire process.

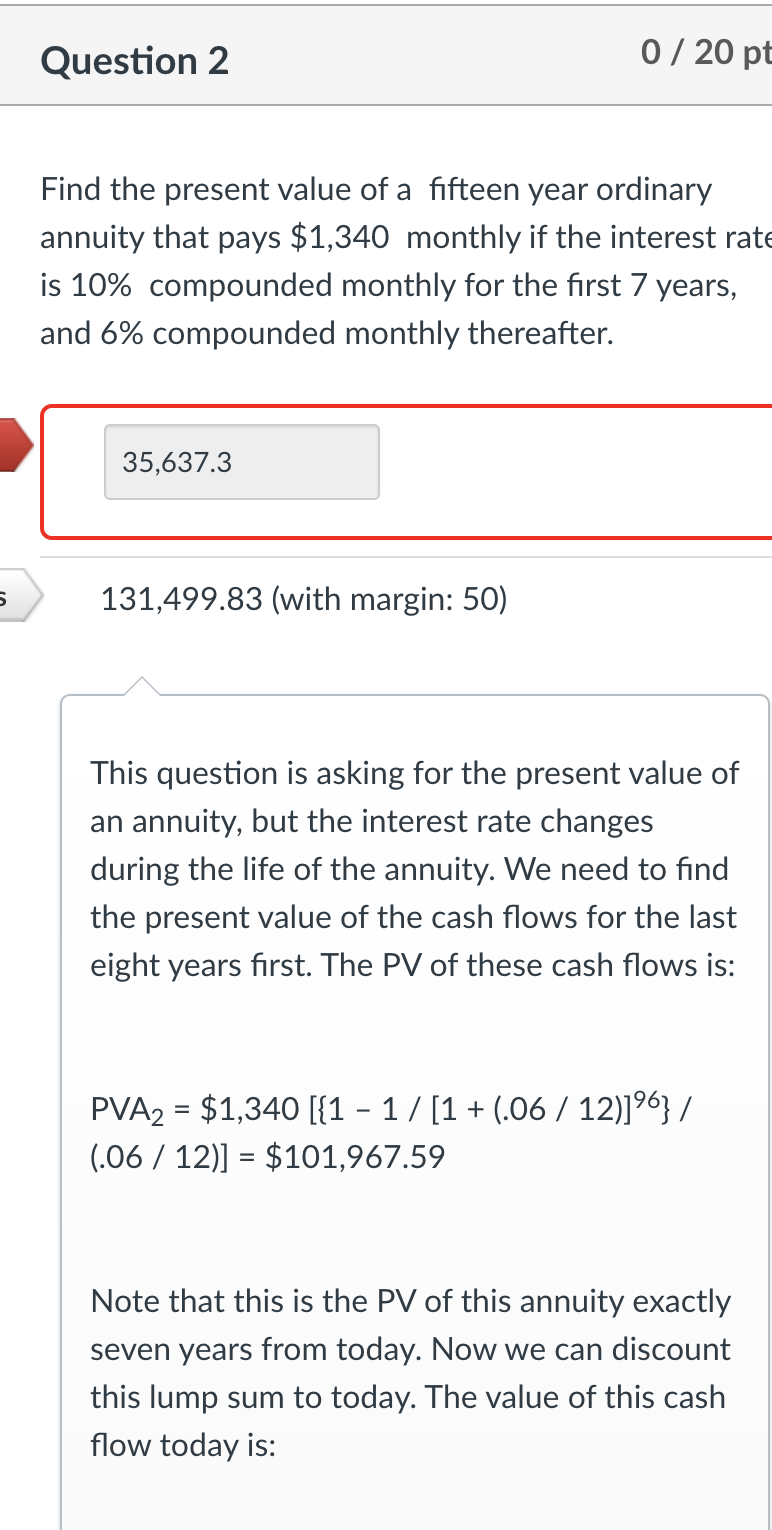

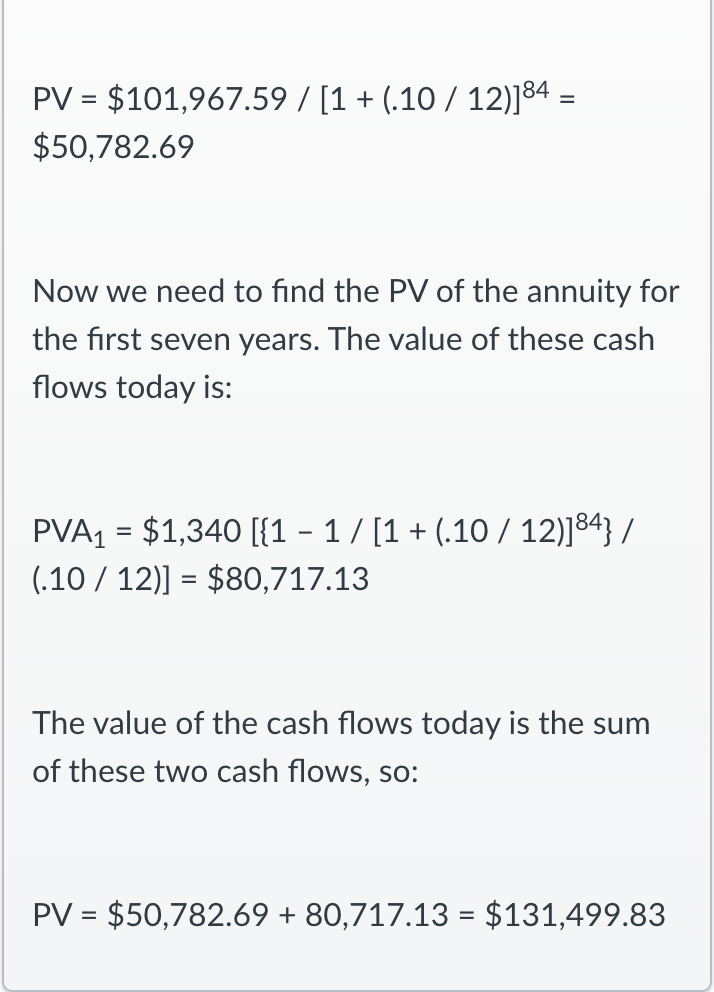

Question 2 0 / 20 pt Find the present value of a fifteen year ordinary annuity that pays $1,340 monthly if the interest rate is 10% compounded monthly for the first 7 years, and 6% compounded monthly thereafter. 35,637.3 131,499.83 (with margin: 50) This question is asking for the present value of an annuity, but the interest rate changes during the life of the annuity. We need to find the present value of the cash flows for the last eight years first. The PV of these cash flows is: PVA2 = $1,340 [{1 - 1/[1 + 0.06 / 12)]6}/ (.06 / 12)] = $101,967.59 Note that this is the PV of this annuity exactly seven years from today. Now we can discount this lump sum to today. The value of this cash flow today is: = PV = $101,967.59 / [1 + (.10 / 12)]84 - $50,782.69 Now we need to find the PV of the annuity for the first seven years. The value of these cash flows today is: PVA1 = $1,340 [{1 - 1/[1 + (.10 / 12)]84} / (.10 / 12)] = $80,717.13 The value of the cash flows today is the sum of these two cash flows, so: PV = $50,782.69 + 80,717.13 = $131,499.83Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started