please explain with explanantion .

please answer both parts and b part answer that are labelled are not right please give new answers for b part also . thanks

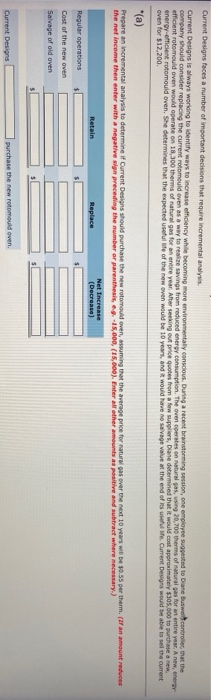

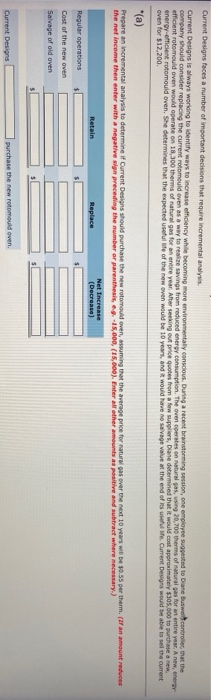

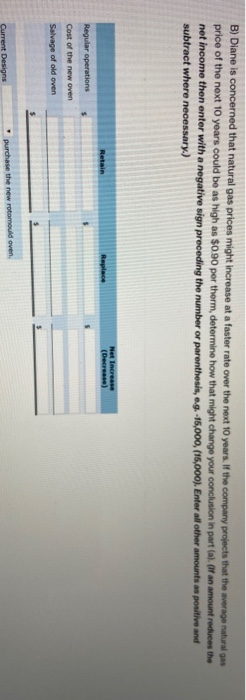

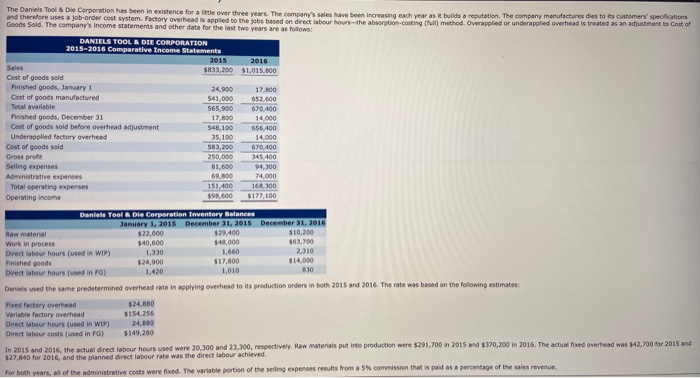

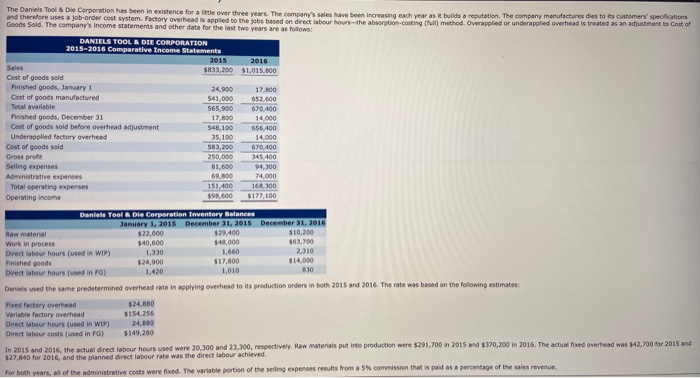

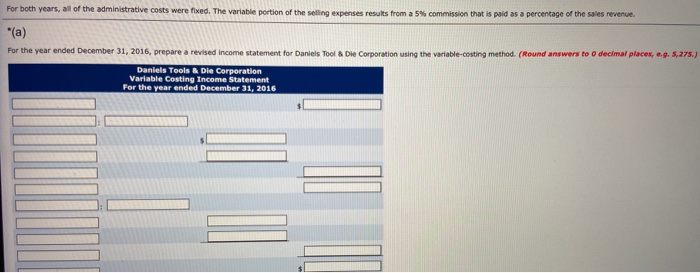

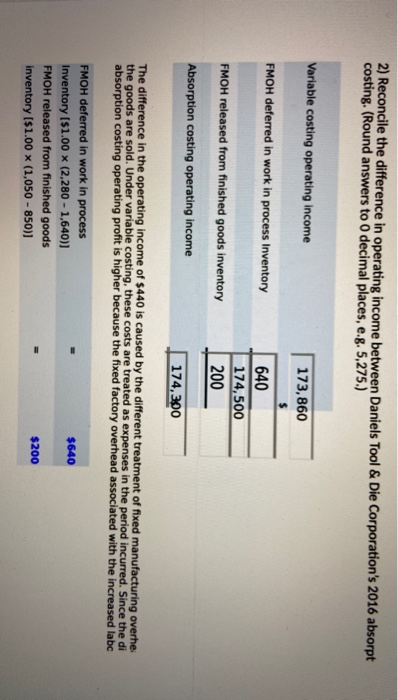

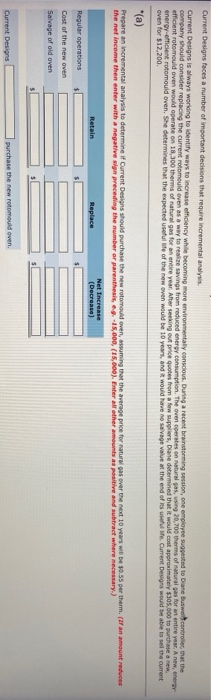

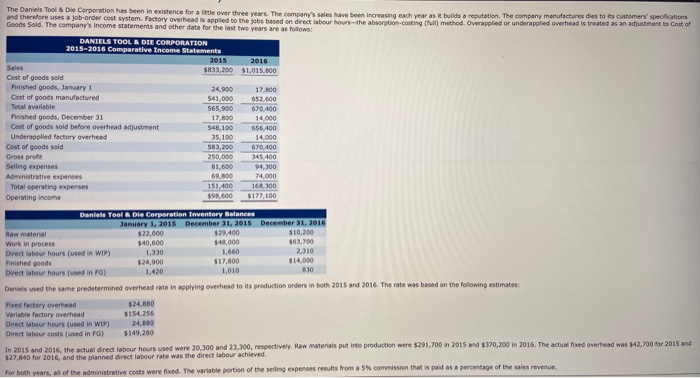

Current Designs faces a number of important decisions that require incremental analysis Current Designs is always working to identify ways to increase efficiency while becoming more environmentally conscious. During a recent brainstorming session, one employee suggested to Diane buwwe controller that the company should consider replacing the current rotomould oven as a way to realize savings from reduced energy consumption. The oven operates on natural gas, using 20,700 therms of natural gas for an entire year. A new, energy efficient rotomould over would operate on 18,300 therms of natural gas for an entire year. After seeking out pre quotes from a few suppliers, Diane determined that it would cost approximately $305,000 to purchase a new energeticentrotomould oven. She determines that the expected useful life of the new even would be 10 years, and it would have no savage value at the end of its use. Current Designs would be able to sell the current oven for $12,200 Prepare an incremental analysis to determine if Current Designs should purchase the new rotomould over, assuming that the average price for natural gas over the next 10 years will be $0.55 pertherm. (If an amount reduces the net income then enter with a negative sin preceding the number or parenthesis, . 15,000, (15,000).Enter all other aments as positive and subtract where necessary.) Net Increase Retain Replace (Decrease) Regular operations Cost of the new oven Salvage of old oven Current Designs purchase the new rotomould oven B) Diane is concerned that natural gas prices might increase at a faster rate over the next 10 years. If the company projects that the average natural gas price of the next 10 years could be as high as $0.90 per therm, determine how that might change your conclusion in part (al. Of an amount reduces the net income then enter with a negative sign preceding the number or parenthesis, ag. 15,000, (15,000). Enter all other amounts as positive and subtract where necessary.) Net Increase (Decrease) Retain Replace Regular operations Cost of the new oven Salvage of old oven Current Designs purchase the new rotomould oven 2016 The Daniels Tool & Die Corporation has been in existence for a little over three years. The company's sales have been increasing each year as it builds a reputation. The company manufactures dies to its customers' specifications and therefore uses a job-order cost system. Factory overhead is applied to the jobs based on direct labour hours-the absorption costing (M) method. Overapplied or underapplied overhead is treated as an adjustment to cost of Goods Sold. The company's income statements and other data for the last two years are as follows: DANIELS TOOL A DIE CORPORATION 2015-2016 Comparative Income Statements 2015 $833,200 $1,015,800 Cost of goods sold Finished goods, January 1 24,900 17,800 Cost of goods manufactured 541,000 652.600 Total available 565,900 670.400 Finished goods, December 31 14,000 Cost of goods sold before overhead adjustment 548,100 656,400 Underapplied factory overhead 35.100 14.000 Cost of goods sold 583,200 670,400 Gross profit 250,000 345.400 Selling expenses 81,600 94,300 Administrative expenses 69.000 74.000 Total operating expenses 151,400 168,300 Operating income 398,600 $177,100 17.800 Daniele Tool & Die Corporation Inventory Balances January 1, 2015 December 31, 2015 December 31, 2016 Raw material 122,000 $29,400 $10,200 Work in process $40,600 $48,000 $63,700 Direct labour hours (used in WIP) 1.330 1,660 2,310 Finished goods $24,900 $17,800 $14.000 Direct labour hours (used in FO) 1,420 1,010 830 Daniels used the same predetermined overhead rate in applying overhead to its production orders in both 2015 and 2016. The rate was based on the following estimates: Fixed factory overhead $24.860 Variable factory overhead $154,256 Direct labour hours (used in WIP) 24,689 Direct labour costs (used in FG) $149,280 In 2015 and 2016, the actual direct labour hours used were 20.300 and 23,300, respectively, Raw materials put into production were $291,700 in 2015 and $370,200 in 2016. The actual fixed overhead was $42.700 for 2015 and $27,840 for 2016, and the planned direct labour rate was the direct labour achieved For both years, all of the administrative costs were fixed. The variable portion of the selling expenses results from a 5% commission that is paid as a percentage of the sales revenue For both years, all of the administrative costs were fixed. The variable portion of the selling expenses results from a 5% commission that is paid as a percentage of the sales revenue. *(a) For the year ended December 31, 2016, prepare a revised income statement for Daniels Tool & Die Corporation using the variable-costing method. (Round answers to decimal places, e.g. 5,275.) Daniels Tools & Die Corporation Variable Costing Income Statement For the year ended December 31, 2016 2) Reconcile the difference in operating income between Daniels Tool & Die Corporation's 2016 absorpt costing. (Round answers to 0 decimal places, e.g. 5,275.) Variable costing operating income FMOH deferred in work in process Inventory 173,860 $ 640 174,500 200 FMOH released from finished goods inventory Absorption costing operating income 174,300 The difference in the operating income of $440 is caused by the different treatment of fixed manufacturing overhe the goods are sold. Under variable costing, these costs are treated as expenses in the period incurred. Since the di absorption costing operating profit is higher because the fixed factory overhead associated with the increased labc $640 FMOH deferred in work in process Inventory ($1.00 (2,280 - 1,640)] FMOH released from finished goods inventory ($1.00 (1,050 - 850)] $200